The European Banking Authority, European Central Bank and Single Resolution Board shared insights into their latest work and priorities in a Crédit Agricole CIB web conference ahead of the new year. Neil Day reports their ...

The 2023 Regulatory Angle: EBA, ECB & SRB on their supervisory priorities

Regulation & ratings

Crédit Agricole CIB hosted a web conference on the theme “European banks: the regulatory angle” in December 2021, with delegates hearing from ECB supervisory board member Edouard Fernandez-Bollo, Sebastiano Laviola, ...

European banks — the regulatory angle: EBA, ECB & SRB on supervisory priorities

Regulation & ratings

Sebastiano Laviola, board member and director of resolution policy and cooperation at the Single Resolution Board (SRB), laid out its priorities for 2022, which aim at ensuring banks’ full compliance with the Expectations ...

On the way to resolvability — SRB 2022 priorities

Regulation & ratings

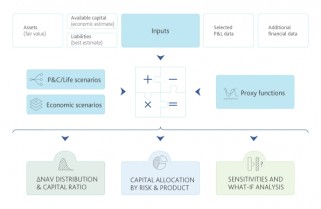

A new Moody’s Capital Tool (MCT) has been introduced to inform a risk-based analysis of the capital adequacy of property and casualty (P&C) and life insurers. Although no ratings will be changed, the tool is expected ...

P&C and Life Insurers: Moody’s Capital Tool

Regulation & ratings

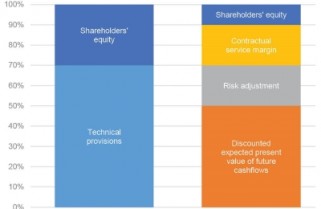

All sides of the market have to grapple with how the introduction of IFRS 17 will affect insurance companies’ business performance and credit dynamics ahead of its introduction in 2023. Here, Crédit Agricole CIB’s DCM ...

IFRS 17: Anticipating the ‘disruptive’ new standard

Regulation & ratings

Fitch’s ratings of Tier 2 debt could be cut by one notch under proposed new rating criteria released in a report on 15 November, although AT1 instruments could be lifted one notch. ...

Tier 2 under threat from Fitch draft, AT1 set for boost

Regulation & ratings

Proposals for the next iteration of CRR/CRD and BRRD have been unveiled just as negotiations over Basel III revisions reach a critical stage and an unknown new administration arrives in the US. The EU moves augur well for ...

Take two

Regulation & ratings

The European Banking Authority (EBA) offered relief to the Additional Tier 1 (AT1) market on 1 July when it announced that stress test-related Pillar 2 requirements need not be included in MDA calculations, thereby easing ...