On the way to resolvability — SRB 2022 priorities

Sebastiano Laviola, board member and director of resolution policy and cooperation at the Single Resolution Board (SRB), laid out its priorities for 2022, which aim at ensuring banks’ full compliance with the Expectations for Banks (EfB), by the end of 2023.

In 2021, the banks were asked to identify key entities, drivers and quantum of liquidity and funding needs in resolution. In 2022, the banks will be asked to identify the sources of liquidity and collateral necessary to cover funding needs in resolution.

Banks will also be requested to demonstrate the capabilities of their Management Information Systems to produce the necessary data for bail-in valuation and execution, building further on the work undertaken in 2021.

A new focus for the SRB in 2022 will be to assess banks’ work on separability and reorganisation after bail-in.

“Separability is particularly important for resolution cases where you have a partial asset sale as part of the resolution strategy,” said Laviola, “but also for banks with an open-bank bail-in, because they have to work on credible reorganisation measures and demonstrate capability to support the restoration of the bank’s long term viability post bail-in. It is very likely that in a reorganisation plan, after the bail-in, you will have to spin-off some assets and sell some legal entities, and therefore, again, an asset transfer system needs to be in place.”

Depending on the use of a partial transfer tool as either preferred (“Plan A”) or variant (“Plan B”) resolution strategy, the SRB expects either an advanced separability analysis report (SAR) (and a transfer playbook), or a preliminary SAR.

The SRB will also enhance the MREL policy for resolution strategies involving transfer tools.

“Today, if you use a transfer strategy and certain balance sheet indicators indicate a certain degree of marketability of the separated part, there is essentially a reduction in the MREL requirement,” said Laviola. “However, we would like to better link the recapitalisation amount of MREL to the overall assessment of resolvability.”

MREL policy: modifications on NCWO calculation and discretionary bail-in exclusions

In respect of MREL more generally, after the overhaul of the policy determined by the introduction of the banking package (CRR-CRD-SRMR-BRRD), the general framework is now relatively clear and stable.

The SRB will reflect more elements in the assessment of the “no creditor worse off” (NCWO) risk, in particular the methodology will take into account that in the run-up to resolution banks’ balance sheets do not remain stable but change; in addition, the SRB aims instead at introducing in the methodology the potential impact of discretionary exclusions of classes of liabilities from bail-in (discretionary exclusions are decided by the SRB with a view towards preserving financial stability (or for other reasons) and can potentially include corporate and retail deposits, retail-held debt in securities format, etc).

“It is clear that when you approach the point of resolution, normally the balance sheet doesn’t stay constant, it develops, and therefore we have to anticipate — to the extent possible — what type of balance sheet we might face when the bank is coming close to the Point of Non-Viability (PONV) and how this impacts the NCWO calculation,” said Laviola.

“The other part is the potential impact of the discretionary exclusions. We all know that in the hierarchy of the liabilities it is possible for the resolution authority, for a number of reasons, to discretionarily exclude some liabilities. Of course, this means that other liabilities pay more, or there has to be compensation ex post from the resolution fund, and this may impact the NCWO calculation. So, what are these discretionary exclusions? What are the constraints? What is the impact?”

He said an update to the SRB MREL policy reflecting the evolution of the bank’s balance sheet in the run-up to resolution and NCWO calculations will likely be introduced in 2022, and changes relating to discretionary exclusions may be introduced in 2023.

M-MDA applies, but is different to classic MDA

Laviola then took the opportunity to discuss the MREL Maximum Distributable Amount (M-MDA), highlighting that — in contrast to prudential MDA — the M-MDA regime is not automatic, but subject to a discretionary decision of the resolution authority, following specific procedural steps and assessment criteria.

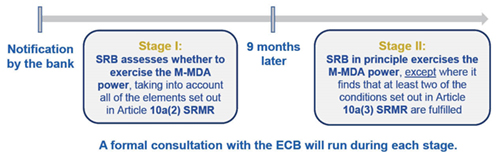

Where the combined buffer requirement considered on top of the MREL requirement is breached — or expected to be — banks should notify the SRB immediately and then, in stage one, provide the SRB with monthly information while it assesses the criteria in Article 10a(2), in consultation with the ECB, whether to impose a M-MDA restriction. If the breach continues, nine months later, under stage two, the M-MDA is, in principle, applied — unless, Laviola noted, at least two of five exceptional conditions set out in Article 10a(3) SRMR are fulfilled.

“For example, if there is general financial turmoil, so that the reason why the bank cannot issue is not idiosyncratic to the bank but a generalised condition,” he said. “Another condition is that exercising the powers would lead to negative spill-over effects in other parts of the banking sector, meaning there could be a financial stability impact.”

How will the SRB assess whether to impose M-MDA?

Source: Single Resolution Board

Permissions regime: banks make limited use of the General Prior Permission

The SRB Permissions regime for early reductions of MREL-eligible liabilities (e.g. calls, repurchases, etc) has been refined, with changes valid from 1 January 2022, and at CACIB’s event Laviola said that, according to a preliminary assessment, more than 40 applications for General Prior Permission (GPP) to reduce eligible liabilities instruments by a predetermined amount for a specific period had been received.

Following the publication by the EBA of its final report on the draft RTS on own funds and eligible liabilities in May 2021, the European Commission was expected to publish a delegated regulation by the end of 2021. Since the publication has been delayed and this is now expected around the middle of 2022, the SRB has updated the provisions of its transitional regime to reflect the final report on the draft EBA RTS. Banks were thereby requested to apply for General Prior Permissions until 1 October 2021, so that they could be effective on 1 January 2022 and remain in place when the delegated regulation will come into force, unless it contains substantial changes from the draft RTS.

According to the legislative framework, banks are requested to respect a margin above the MREL requirement after deducting the GPP predetermined amount, and according to the draft RTS, the predetermined amount cannot exceed 10% of the total amount of outstanding eligible liabilities.

“This represents normally a substantial amount,” said Laviola, “and in fact, the banks have not used the full envelope; rather, half of it, except for a few cases.”

In addition to being able to call, redeem, repay or repurchase eligible liabilities under a GPP, banks can also request ad hoc permissions to redeem specific instruments, in accordance with Art.78a CRR.

Final MREL shortfall reduced by €23bn in a year, to €40bn

The average final 2024 MREL overall target is 26% of total risk-weighted assets (RWAs) including the CBR, and the average subordination target 17.6%, while the average MREL and subordination binding intermediate targets, effective 1 January 2022, are 25.2% and 17.5%, respectively. According to the SRB’s MREL dashboard, as of June 2021, the aggregate shortfall of 77 banks versus their binding intermediate targets (including the CBR) was €5bn — “not very big,” according to Laviola — with 20 banks in shortfall. The overall shortfall versus final 2024 MREL targets meanwhile fell by 37% (around €23bn) with respect to the previous year, to about €40bn.

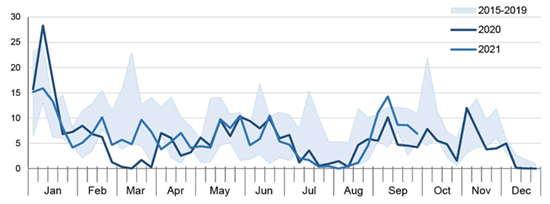

Laviola said banks had been helped by “very buoyant” market conditions and very low rates.

“Therefore, we expect almost all banks to respect the binding intermediate target,” he added.

Weekly euro-banks’ issuances (EUR bn)

(Weeks start on Wednesday and end on Tuesday)

Source: Dealogic, ECB calculations

Is senior preferred debt a funding or MREL instrument? It is always bail-in-able, but bigger banks have more subordinated liabilities

Laviola then addressed a question from the audience on whether senior preferred debt can be seen as a funding instrument, or whether it is always a bail-in-able and MREL-eligible instrument. He began by making a clear distinction between senior preferred debt in securitised format (bonds, certificates, etc) and pari passu debt in non-securitised format, such as deposits, operational liabilities, etc. Laviola reminded the audience that when BRRD 1 was introduced, it preceded the TLAC term-sheet and that, outside of own funds instruments, senior preferred debt constituted the majority of bail-in-able resources of the banking system.

In the wake of statutory preparations for the banking system to meet TLAC, the European legislator introduced senior non-preferred (SNP) debt. This is a good innovation as it ranks below liabilities that are, or can, be excluded from bail-in and therefore helps in addressing the NCWO issue. However, SNP comes at an extra cost given its enhanced loss absorbency.

Laviola then made the link to the liabilities structure and hierarchy of banks’ liabilities that is the critical determining factor for which types of liability are subject to bail-in and which get excluded. And the liabilities structure of a bank is closely linked to its size and international reach.

- On one side, large international banks tend to have all types of liabilities on their balance sheet and therefore resolution, in CACIB’s understanding, may be carried out by using largely own funds and SNP debt.

- At the other end of the spectrum, there may be banks which have a balance sheet size of below €30bn and may still be earmarked for resolution, in which case also a full MREL requirement will apply. However, such banks tend to have predominantly only capital and deposits. In such cases, senior unsecured debt that such banks may raise will serve predominantly for MREL purposes.

Are deposits and debt sold to retail really bail-in-able? Legislation says, yes, with caveats

This then prompted a question as to whether MREL-eligible deposits and debt sold to retail and SME investors is really bail-in-able or should the market assume that it will be subject to discretionary exclusion from bail-in? Laviola first reminded the audience that according to the legislation such liabilities are bail-in-able. However, there are certain caveats:

- The first caveat is the discretionary exclusion itself, which is decided by the resolution authority. However, in order for the resolution authority to decide, it needs full information on the liabilities side of the bank as to instruments and their exact ranking — this would then enable the resolution authority, when drafting the resolution scheme, to decide which liabilities cover losses and in what order. This is then complemented by an analysis as to the depletion in the run-up to resolution and financial stability and confidence effects of the bail-in of certain debt types.

- The second caveat is that the regulation provides certain restrictions as to what type of retail investor can be considered as a “bail-in-able” counterparty: the retail investor must have a well-diversified financial portfolio of a certain size, must be documented as well-versed in financial matters, and must be able to invest in material minimum sizes [CACIB: this serves to ensure that a natural person investor can actually afford the loss due to bail-in without having to face financial ruin].

CMDI review can substantially enhance resolvability, but needs deposit ranking and DGS reform

Beyond the current legislation, Laviola then stated that the bail-in-ability of certain deposits and debts sold to retail/SME clients is one of the core debates on the Crisis Management & Deposit Insurance (CMDI) legislative review (covering the BRRD and DGSD and their interactions).

Clearly, there may be issues as to the resolvability of banks at the low end of the size scale that are earmarked for resolution (the “middle class” banks: too large for liquidation and “too small” for resolution) — these issues relate to whether there is a sufficient amount of liabilities that can be truly bailed in without triggering considerable adverse effects. In this case, the SRB’s position on solving this issue consists of introducing up to four elements:

- Introduce a general depositor preference in the EU, meaning that large corporate deposits rank senior to senior preferred debt uniformly throughout the EU rather than the current mixed situation — such a ranking would largely resolve the NCWO issue created in situations where certain pari passu debts are excluded from bail-in in a resolution, but would be included in the insolvency waterfall of a hypothetical liquidation.

- Abolish the super-preference for DGS as per current legislation and let all deposits rank pari passu.

- What is “super-preference” of DGS and role in resolution? Outside of secured debt and certain liabilities that may be preferred by law, such as the liquidation expenses, employees’ salaries, etc, DGSs subrogating to the rights of covered depositors have the most senior liability ranking and rank above SME and large corporate deposits, making their potential contribution in a resolution scenario rather difficult and limited.

- This would contribute to enhancing the Least Cost test that limits DGS’s intervention in resolutions to the maximum final loss the DGS would suffer in a liquidation of the bank (which is today rather limited, given the DGS super-preference in liquidation, after having reimbursed covered deposits).

- Harmonise the criteria for the Least Cost Test throughout the EU.

- In this context, the introduction of a European Deposit Insurance Scheme (EDIS) would be a game-changer.

With such a scheme in place, upon entry into resolution the DGS could intervene once the bank’s own funds and “side effect free” bail-in-able debt are consumed and there remains a shortfall to be covered until the achievement of the liquidation or resolution plan target.

The DGS could be further supported through SRF contributions once the 8% TLOF threshold is met, whilst the introduction of EDIS would mean that there would be no danger that national DGS’s can run out of resources.

Finally, DGS intervention is fully compatible with the BRRD, as it does not represent public money, but contributions from the banking industry.

MREL calibration and transparency: here for TLAC, MREL to come in 2024

At the end of the CACIB event, the question of MREL calibration and transparency was addressed — the legislation and its own MREL methodology provide the SRB with various options to customise the MREL quantum to resolution plans, with the result that the final MREL may be different from the MREL determined on the basis of the default MREL formula. At the same time, there is no compulsory standardised disclosure on MREL, which means there is a rather mixed picture in terms of bottom-up MREL transparency. The whole situation may be rather frustrating for investors.

Here, Laviola reminded the audience firstly that TLAC disclosure is already mandatory and has to be disclosed in a pre-determined format, whereas MREL disclosure will become mandatory from the 1 January 2024 date from which the final MREL has to be met.

Laviola clarified some of the general adjustments to MREL that the SRB undertakes:

- Pillar 2 adjustments are mostly limited to the banks with higher Pillar 2, as here it can be assumed that many of the potential losses in the run-up to resolution will be covered by the Pillar 2 setting — hence, a lower Pillar 2 can be justified in the recapitalisation amount element of MREL under certain conditions, and depending on the riskiness profile of the bank post-resolution. But this adjustment is not material.

- The adjustment for transfer strategies is much more important as it impacts the RWA amount used to calibrate the recapitalisation amount and market confidence charge. Here, the SRB uses currently a corridor of 15%-25% of assets calibrated based on balance sheet characteristics capturing the overall marketability of the entity. The adjustment estimates the lower perimeter and recapitalisation needs of the entity post-resolution.

Turning then to the disclosure of individual MRELs and its components, there is a trade-off to be made in the run-up to the final MREL target in 2024, with potentially market sensitive information that may adversely impact legitimate interests of the impacted bank.

Laviola sees this matter as also linked to the disclosure of resolution plans or elements thereof.

The disclosure of resolution plans that exists in the US and is about to be introduced in the UK cannot be compared to the situation in the EU. If one looks at the US, the banks are required to produce their own resolution plans under Title I of the Dodd Frank Act — these are the plans that are partially disclosed. Under Title II of the same act, the FDIC as US resolution authority may draw up its own resolution plan and it is free to deviate from the bank’s resolution plan. Resolution plans in the EU are prepared by the SRB and therefore are more similar to Title II plans in the US that are not disclosed.

The SRB clearly acknowledges the positive effects of more transparency: one of the ways in which the SRB considers enhancing disclosure is the yearly publication of resolvability heatmaps — overviews of the progress of the European banking system towards achieving resolvability in anonymised format. Such disclosure is expected in the near future.

The publication of the heatmap would allow each bank to position itself, and all stakeholders to understand how the system is progressing towards full resolvability of each risk profile and dimension.