Nordic banks are among the best positioned in Europe to ride out the uncertainties facing the banking sector in 2023, according to Crédit Agricole CIB bank analysts Gwenaëlle Lereste and Pascal Decque, highlighting the ...

Nordic Bank Day: Safe haven picks for 2023

From CACIB

While GSS bonds have hitherto represented a way for issuers and investors to engage on sustainability, ESG is being integrated more broadly and deeply into their strategies. Regulatory initiatives are furthering this move, ...

CACIB’s 2nd ESG Bank Day: Greening the business model

From CACIB

Pre-funding by banks and a pick-up in insurance issuance, as well as developments in the ESG space and liability management, could see the prospects for financial institutions activity improve in the second half of the year, ...

Positioning for H2

From CACIB

The US may be taper-whispering, but the European Central Bank cannot return to its pre-pandemic level of bond buying until at least the end of 2022, even if the recovery continues, argues Crédit Agricole CIB Eurozone ...

Too soon to talk about ECB tapering

From CACIB

Persistent signs of a burgeoning US recovery over the summer could lead to the FOMC signalling its tapering strategy as early as the August Jackson Hole central bank symposium or the September policy meeting, according to ...

Managed taper anticipated from September, wider EUR/USD XCCY

From CACIB

Among the fundamental characteristics intuitively attributed to a hybrid instrument, a correlation with related equity performance is one of the most oft-cited. But while a strong correlation with share prices may appear ...

Demystifying equity and AT1 correlation

From CACIB

The ECB’s comprehensive and diversified response to the Covid-19 crisis has proven effective in providing relief in the sovereign, corporate and banking spheres, and the central bank appears ready to act further, says ...

ECB tools effective, but Eurozone differences must be addressed

From CACIB

After a surprising 2019, what does the year ahead hold in store for euro credit markets, notably bank debt? Vincent Hoarau, head of FI syndicate at Crédit Agricole CIB, suggests that geopolitical developments hold risks for ...

Complacency a key risk to primary in 2020

From CACIB

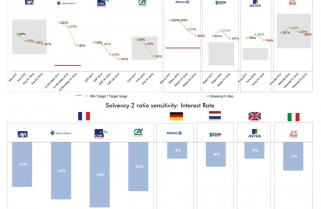

The half year and Q3 2019 results of European insurance companies again (after the 2016 episode) revealed the volatile nature of the Solvency 2 framework. Several companies reported a sharp drop in the S2 margin and the ...