Insurers’ results reveal S2 headwinds, more to come

The half year and Q3 2019 results of European insurance companies again (after the 2016 episode) revealed the volatile nature of the Solvency 2 framework. Several companies reported a sharp drop in the S2 margin and the solvency situation has likely worsened since then. Michael Benyaya and Szymon Wypiorczyk in Crédit Agricole CIB’s DCM Solutions team highlight here some of the recent trends and potential implications of the persistence of the low/negative interest rate environment.

● Half year 2019 results showed that the market environment and the low interest rates exerted meaningful pressure on the solvency position of insurance companies. For example, duration gaps in France and exposures to mortgage spreads in the Netherlands appear indeed extremely painful through the S2 lenses. As expected, the drop in interest rates during Q3 has weakened S2 margins, in particular life insurers’.

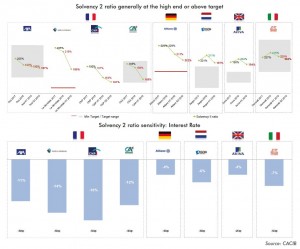

● Yet the S2 margins still remain relatively strong and generally well positioned in the target ranges (see chart below). Insurers are therefore unlikely to launch cash calls on the equity markets. However, as further pressure is expected (as shown below by the sensitivity to interest rates), revisions to the S2 targets cannot be ruled out in the short to medium term.

● Financial flexibility in terms of S2 capital headroom is strong across the sector. This has allowed companies to tap the debt capital markets to boost the solvency position (see preceding article). In this context, the deleveraging trend has probably come to an end and financial leverage ratios will probably increase again.

● However, the use of subordinated debt has to be viewed as a temporary fix. The adaptation of business models and/or the regulatory framework will be needed to ensure the long term resilience of the sector. In France, several companies have already announced that the access to the general account will be restricted and crediting rates will decrease sharply. There are also some discussions on technical adjustments in the S2 framework of the treatment of specific provisions (e.g. Provision pour risque d’exigibilité in France) that could have a positive impact.

● In terms of regulation, the debate around the 2020 review of the S2 Directive will be fierce, in particular regarding negative interest rates in the standard formula and the volatility adjustment.

Please click on chart to enlarge.