The message behind Mario Draghi’s parting package will be as important going forward as the measures themselves, argues Crédit Agricole CIB Eurozone economist Louis Harreau. Here, he analyses their impact on bond markets, ...

ECB: The Handover of Power

From CACIB

The European Banking Authority’s Q4 2018 Risk Dashboard, published on 29 March, showed 2018 to have been a difficult year for capital generation for the European banking system as a whole, as evidenced by the decreasing ...

European banks: Headwinds limit capital build in 2018, more to come

From CACIB

Analysis by Crédit Agricole CIB shows that the varied methodologies used by insurance companies to calculate financial leverage ratios make significant differences to the ratios they communicate. However, Michael Benyaya ...

Insurers’ financial leverage ratios: Well adjusted?

From CACIB

Michael Benyaya, DCM solutions, Crédit Agricole CIB, highlights key factors for insurers considering whether RT1 issuance is appropriate, as well as rating agency approaches to the instrument and differences to bank ...

Rationale for issuing RT1

From CACIB

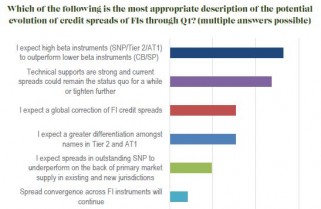

The buyside is positioning for sustained strength in subordinated bank bonds in the New Year, according to an investor survey by Crédit Agricole CIB syndicate, with few clouds on the horizon. New German and Italian ...

CACIB investor survey: Game on for FIG in 2018!

From CACIB

Disclosure by insurance companies has improved in the run-up to the implementation date of Solvency II, but the complexities of the new European capital framework coupled with investors’ expectations means that there is ...

Solvency II Disclosure: Raising the Bar

From CACIB

The Financial Stability Board (FSB) and Basel Committee on Banking Supervision released the final term sheet for TLAC (total loss-absorbing capacity) on 9 November ahead of its adoption at the G20 meeting in Turkey. This was ...

TLAC term sheet: Finally finalised

From CACIB

The European Parliament’s recent acceptance of key Commission proposals provides further clarity over the EU’s new financial landscape. Jonathan Blondeau, DCM, capital structuring & liability management at Crédit ...

BRRD & SRM: Where do we stand?

From CACIB

In November 2013, the Trilogue agreement on the Omnibus II Directive was welcomed by the market as it clearly paves the way for the implementation of Solvency II in 2016. By Michael Benyaya of Crédit Agricole ...

Solvency II: Back on track, but hurdles remain

From CACIB