TLAC term sheet: Finally finalised

The Financial Stability Board (FSB) and Basel Committee on Banking Supervision released the final term sheet for TLAC (total loss-absorbing capacity) on 9 November ahead of its adoption at the G20 meeting in Turkey. This was largely unchanged from a version leaked in August and subsequent pointers. Here, Crédit Agricole CIB’s capital solutions team highlight selected items of interest from the final text.

Due to the graphic-heavy nature of this feature, you may wish to download it as a pdf to read, which you can do by clicking here.

Role of Senior Unsecured Instruments

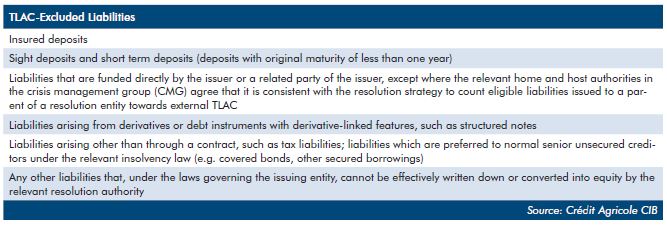

A list of TLAC-excluded liabilities is included in the FSB TLAC term sheet. It is broad enough to include the liabilities excluded by the local statutory framework, so it should absorb the Bank Recovery & Resolution Directive (BRRD) in the EU. However, liabilities arising from derivatives are explicitly excluded from TLAC, while they can, under certain assumptions, be subject to write-down and conversion powers under Art. 49 of the BRRD.

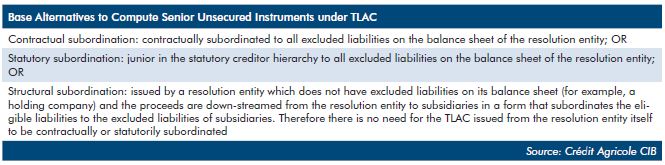

Senior unsecured instruments can be included in the TLAC computation under one of the following three alternatives

The final TLAC Term Sheet includes two waivers for a pari passu ranking of excluded liabilities alongside TLAC-eligible liabilities (i.e. exemptions from the subordination requirement for TLAC-eligible liabilities) (TLAC term sheet Section 11):

- Primarily aimed at resolution entities without structural subordination: Excluded liabilities can rank pari passu with TLAC-eligible liabilities up to a maximum of 2.5% of RWA’s where the TLAC min. requirement is set at 16% (increasing to 3.5% of RWA when the RWA min. requirement increases to 18% of RWA in 2022)

- Primarily aimed at resolution entities with structural subordination: Excluded liabilities can rank pari passu with TLAC-eligible liabilities up to a maximum of 5% of the resolution entity’s eligible external TLAC (this allows for a minimum amount of tax and derivative liabilities necessary to run the balance sheet of e.g. a non-operational HoldCo)

Only one of the two exemptions may be used. Another constraint is that the usage of one of these exceptions must not give rise to material risk of successful legal challenge or valid compensation claims.

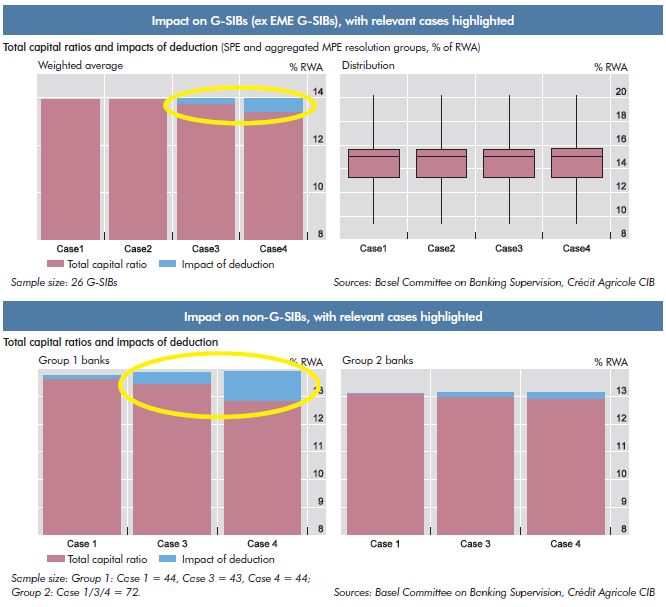

Points of Interest on the TLAC Needs as per Basel Committee QIS

The following Basel Committee table summarises the aggregate shortfalls (RWA buffers considered) by case, including and excluding emerging market G-SIBs, and the potential impact of the 2.5% exemptions. The shortfalls are calculated as the larger of the RWAs requirement or the 2×3% leverage requirement at each G-SIB level.

- Case 1: only includes TLAC instruments meeting all criteria of the final TLAC term sheet, including the subordination requirement.

- Case 2: same as Case 1, but with additional requirements on Tier 2 capital as per Basel III.

- Case 3: same as Case 1, but includes senior unsecured debt issued by resolution entities.

- Case 4: same as Case 3, plus structured debt and senior unsecured issued by non-resolution entities.

- Overall, significant needs identified, providing potential support for German/Italian law style approaches within the Single Supervisory Mechanism (SSM) area.

- However, potentially unlevel playing field for e.g. UK and Swiss banks, which must fill their TLAC buffers through eligible HoldCo issuance.

NEW ELEMENT: Basel Committee Consultation Paper on TLAC Holdings by Banks

Alongside the final TLAC documentation package, the Basel Committee published a consultative document titled “TLAC Holdings”. The paper is open for consultation until 12 February 2016.

The Basel Committee proposes that banks treat TLAC-eligible debt holdings, (i.e. in addition to qualifying reg. cap. Instruments, other TLAC-eligible instruments, such as potential Tier 3 debt, fully qualifying senior debt (e.g. German bank senior post 2017)) as they currently treat Tier 2 debt holdings, i.e. net (long minus short positions, subject to conditions of Basel III paras. 80 and 84). TLAC holdings are:

- If the investor bank holds less than 10% of the common shares of the bank invested in: below a Basel III threshold, the net TLAC holdings are risk-weighted and any excess above the Basel III threshold is fully deducted against Tier 2 capital;

- If the investor bank holds more than 10% of the common shares of the bank invested in: the net TLAC holdings fully deducted against Tier 2 capital;

- To the extent that Tier 2 capital is insufficient to fully absorb the deductions, any excess deduction is applied first against AT1 capital and then against CET1 capital.

Of note, also TLAC liabilities ranking pari passu with Excluded Liabilities are included in the Tier 2 deduction (when original maturity > 1 year). The Basel Committee proposes this approach in order to create a level-playing field between G-SIBs (who will have TLAC liabilities other than reg. cap. Instruments) and non-G-SIBs (who are unlikely to have TLAC liabilities other than reg. cap. Instruments). Thus, the usual correspondence approach for deductions (e.g. Tier 2 vs. Tier 2) is abandoned.

Impact on Trading and Liquidity

In its proposal, the Basel Committee states that “one of the aims of the Basel III deduction threshold is to permit a limited level of activity, such as market-making, to occur without banks being subject to a deduction”. Thus, the Basel Committee appears potentially cognizant of the negative impacts that the proposed Tier 2 deduction approach could have on secondary trading levels and market liquidity. Hence, as part of the consultation process, the Basel Committee is seeking feedback on “whether any adjustment to the existing threshold, set at 10% of a bank’s own common equity, is warranted”.

We anticipate banks with market-making operations and other debt market stakeholders to focus significantly on this issue in the coming months.

Basel Committee Consultation Paper on TLAC Holdings – Quantitative Impact

Below is a summary of the essential impacts found by the Basel Committee on the proposed Tier 2 deduction approach. We note that this Basel Committee QIS seems to ignore existing deductions against Tier 2, which is a drawback of the analysis, in our view.

- The overall impact of TLAC deductions against Tier 2 for G-SIBs appears limited

- However, the Basel Committee states that the impact can be significant for some individual G-SIBs

- The impact is much more pronounced on non-G-SIB banks

- The relevant Group is Group 1, i.e. internationally active banks with CET1 of more than Eu3bn

- As a result of a shortage of Tier 2 to absorb the required deductions, around one-third of the Group 1 banks, ie 44 banks, have to deduct part of their TLAC liabilities from AT1 and almost half of the 44 banks have to deduct part of them from AT1 and CET1 in Case 4 – the CET1 ratio is reduced on average by 1 percentage point.

Proposed TLAC Deduction Approach: Areas of Concern

The proposed deduction approach applies to “internationally active banks” – the scope of application of the proposed regime must be clarified. Will the proposed application also extend to DSIBs and hence to MREL-eligible liabilities in the EU?

Considerations on likely impact

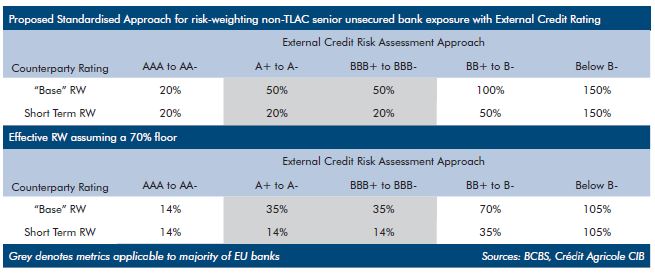

- As per Basel Committee QIS, the proposed approach seems to result in significant deductions only for a minority of G-SIBs and comparable banks, though it can’t be ignored

- Thus, the risk weightings below the 10% threshold appear to be the binding constraint (though a bank must look at all its senior unsecured bank exposures, incl. look-through approach on index exposure when determining whether it is above 10% of own funds)

- In this context, the proposed revisions to the risk weighting of senior unsecured and subordinated debt bank exposure appear key. The impact must be looked at on an aggregated basis across the banking and the trading book

Proposed Banking Book Risk-Weighting Approach

- Even assuming a softening of the proposed approach and application of a generous floor for IRB risk weights based on 70% of SA risk weights, the impact may be such that in certain jurisdictions the applied risk weights for senior bank debt exposure increase significantly

- Moreover, subordinated debt is proposed to be risk-weighted at 150% across the board

- Given the new role of senior unsecured debt to specifically fulfill MREL/TLAC purposes in certain jurisdictions, it cannot be excluded that the Basel Committee may in time define new harsher risk weights for lower-ranked senior unsecured debt in the future

Proposed Revision to Trading Book exposure through the Fundamental Review of the Trading Book (FRTB)

More clarity on the potential impact of the FRTB should come from the anticipated publication of a nearly final paper by BCBS on the subject in the coming weeks.

The impact on the trading book may result in higher risk weights due to two reasons:

Value at Risk (VaR) and Stressed VaR (SVaR):

- Horizon extension to 10 days: potentially higher risk weights due to the lengthening of the horizon for the VaR/SVaR calculation

- Bail-in-able senior debt should exhibit ceteris paribus higher volatility than non-bail-inable senior debt -> VaR/SVaR should be higher, thus higher risk weights

Non-modellable risk factors (NMRF)

- Whilst point of non-viability (PONV), although not a precisely defined event, can be modelled on proxy parameters such as CET1 ratio with a good degree of confidence, the decision of the resolution authority to bail in senior unsecured debt may be a NMRF. In the latest QIS on FRTB, NMRFs were one of the biggest contributors to higher risk weights

Central Bank Eligibility of bail-in-able/lower-ranked senior unsecured debt

The jury as to whether lower-ranked senior unsecured debt (relative to Excluded Liabilities) is Central Bank-eligible is still out and can be answered ultimately only by the Central Banks. Technical factors such as structured senior unsecured debt being higher-ranked, e.g. in the German law, may influence the decision towards exclusion of Central Bank repo eligibility. Central Bank repo eligibility is a key factor in the private repo market: without Central Bank repo eligibility, private market repo eligibility may severely decline. This may further reduce liquidity and tradability of the product.

Bringing it all together…

- Potentially higher risk weights across banking and trading book and loss of repo eligibility are potential factors common to all banks and may restrict the ability of banks to invest in the product (with the exception of specific bank sectors benefiting from more lenient risk weight treatment).

- Higher risk weights may also impact insurers as another key constituent of the investor community.

- Secondary trading of the product may become hampered to a degree that is not commensurate with the size of the asset class and the liquidity it needs.