Insurers’ financial leverage ratios: Well adjusted?

Analysis by Crédit Agricole CIB shows that the varied methodologies used by insurance companies to calculate financial leverage ratios make significant differences to the ratios they communicate. However, Michael Benyaya and Szymon Wypiorczyk, DCM solutions, CACIB, suggests methodologies could converge.

Among the key credit metrics monitored by insurance sector stakeholders, the financial leverage ratio retains a prominent position. The ratio is supposed to be a fairly simple measure to evaluate a company’s debt levels in relative terms with a straightforward and intuitive formula.

Yet the communication and methodology, including adjustments, used by insurance companies to calculate their financial leverage can vary significantly.

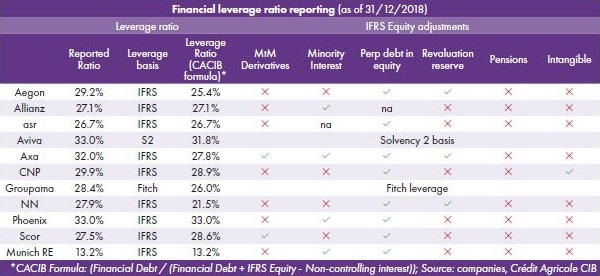

Based on the full-year 2018 results, CACIB has analysed the different methodologies and disclosures of 11 European insurance companies to underline the different approaches. The table below shows an overview of the results.

For purposes of comparison, we have also calculated a financial leverage ratio using a basic formula:

Financial Debt / (Financial Debt + IFRS Equity – Non-controlling interest)

where the financial debt also includes perpetual instruments accounted for as equity under IFRS. Given the adjustments described below, the disclosed ratios of some insurers differ significantly from this CACIB methodology.

In the European landscape, the majority of companies rely on IFRS metrics to calculate the financial leverage ratio, but Aviva now discloses a financial leverage based on the Solvency 2 framework. Rating agencies’ metrics are also commonly used, either as the unique reference (Groupama) or together with the IFRS ratio (CNP, asr, Phoenix). It is worth noting that S&P’s financial leverage ratio currently lacks transparency (as it is based on the S&P insurance capital model), but S&P has in a request for comment proposed changing its financial ratio definition to move to an IFRS basis. This should improve comparability over time.

As highlighted in the table below, the IFRS financial leverage is adjusted by various items:

Some insurers exclude revaluation reserves from their equity. This adjustment has a meaningful impact on the ratio (Aegon, Axa and NN).

Some insurers adjust their equity for the mark-to-market derivatives position (Axa, Scor) and intangible items (only CNP).

Aegon simplified its definition of the financial leverage ratio and no longer adjusts its equity for the remeasurement of defined benefits plans (pensions, IAS19). This is in line with peers.

In a few years, IFRS17 (postponed to 2022) will likely impact the IFRS equity position of insurance companies, which will in turn affect the leverage position.

By this time, Solvency 2 will probably be even more established in the financial communication of insurance companies. Aviva’s disclosures highlight, in our view, the increasing weight of the framework in the management of the balance-sheet, and it would not be surprising if other insurance companies were to follow on the heels of Aviva in the coming years.