Primary defies concerns as investors lap up FI supply, driving spreads and NIPs tighter

Going into the final week of January, the primary market for financial institutions issuance is still buoyant, undeterred by rich valuations and the potential for repricing, as ample liquidity and the big picture of rates falling drive investors into new issues, creating ongoing attractive opportunities for issuers. Neil Day reports, with insights from Crédit Agricole CIB syndicate and trading.

You can download a pdf version of this article in the full BIHC Briefing alongside further coverage.

Concerns that the primary market might struggle to absorb heavy financial institutions supply in the new year have proven unfounded, with a host of issuers able to take out size on the back of multiple times subscribed order books without having to pay punitive new issue premiums.

Despite valuations remaining on some measures stretched and the exuberant pricing in of rate cuts, the market has only experienced minor stumbles since the start of 2024.

“Since the beginning of the year, investors have been happily deploying cash,” said Vincent Hoarau, head of FIG syndicate at Crédit Agricole CIB. “They want to lock in high coupons before they evaporate and it feels like the entire buy-side community wants to stay fully invested until something breaks.

“We have seen some phenomenal, arguably ridiculous, order books, demonstrating the very deep market for credit products. It’s primetime for bonds, from two year FRNs to AT1.”

The primary market hit the ground running on Tuesday, 2 January at the start of an almost full week. Some €7.75bn of unsecured FIG supply hit the market across the capital stack, supplemented by €3.75bn of covered bonds, to take day one overall financial institutions issuance to €11.5bn from eight issuers and 11 tranches — with the success of the reopening reflected by aggregate demand above €21bn.

Deals ranged from a €3.75bn triple-tranche senior preferred issue for Spain’s Santander incorporating a four non-call three tranche, to a €1.25bn perpetual non-call 6.2 Additional Tier 1 for Crédit Agricole SA.

Seeking first-mover advantage — as it did in January 2023 — the French bank pre-empted potential competing supply from other core European issuers with an announcement at 8am Hong Kong time. Sole led by Crédit Agricole CIB, the AT1 was priced at 6.5% after tightening of 25bp from initial price thoughts, with fair value seen at around 6.15%, and sized at €1.25bn against a €2.5bn-plus book good at re-offer. The reset margin was 420.7bp, versus 444bp for the issuer’s 7.25% AT1 with a one year shorter maturity issued on 3 January last year.

“The market performed well in the prior weeks, making valuations particularly attractive for issuers, hence CASA’s willingness to be first out there,” said Hoarau at Crédit Agricole CIB. “The concession was reasonable, but coupons collapsed alongside underlying rates in December, and sub/AT1 volumes are set to increase in 2024 versus 2023, so given the pricing parameters — a coupon inside 7% and reset close to the critical mark of 400bp — it was not a big surprise to see a lower level of oversubscription.

“Nonetheless, the issuer could reiterate what it achieved last year and print €1.25bn whilst ensuring a good performance in the secondary market and attracting new accounts.”

Despite the market suffering a wobble as early as the second trading day of the year — as rate cut expectations were modestly reined in — Spain’s CaixaBank the next day achieved a solid outcome with a €750m perpetual non-call 6.5 AT1 that was tightened from IPTs of 7.75% to 7.5% on the back of some €1.55bn of demand, while buying back up to €750m of a 6.75% AT1 callable in June. And the second week of the year proved accommodating to AT1s for BPER Banca of Italy and Banco Comercial Português, who achieved strong outcomes on €500m 8.375% and €400m 8.125% perpetual non-call 5.5 issues, respectively.

Insurers Allianz and Axa experienced similar success with Tier 2 and RT1 issues, respectively, in the opening fortnight (see separate article), while a step up the bank capital stack, Tier 2 saw its share of hits in the busiest start to the year for the instrument in several years. Lloyds and BFCM opened Tier 2 issuance on 2 January, with the UK bank selling a €500m 10.25 non-call 5.25 issue on the back of some €2.4bn of orders that allowed it to tighten pricing some 30bp to a re-offer spread of mid-swaps plus 205bp — inside UK Tier 2s printed in the past two years.

“Thanks to the scarcity element surrounding the offering — with Lloyds having no relevant outstanding benchmarks in euros — the issuer paid only 5bp-10bp of NIP, compared with 10bp-15bp in the senior space the same day,” noted Hoarau at joint bookrunner Crédit Agricole CIB.

Banque Fédérative du Crédit Mutuel (BFCM) meanwhile attracted a peak €3.45bn of orders to a 10 year bullet Tier 2, allowing the French issuer to size the transaction at €1.5bn and tighten pricing 25bp to 195bp, implying a NIP of 10bp-15bp. The outcome suggested that market depth for the long-dated bullet format was greater than for callable issues.

Duration on trend

The attribution of the level of demand to the duration of the trade reflected a key ingredient in much of the year’s more successful supply.

The trend was clearly evident in the senior preferred segment from day one, when the 10 year bullet tranche of Santander’s triple-tranche senior preferred deal (joint led by Crédit Agricole CIB) enjoyed more demand than four non-call three and six non-call five pieces, the €2.6bn book allowing for 5bp more of tightening (to a re-offer of mid-swaps plus 130bp), a 5bp lower NIP (10bp) and a larger, €1.5bn size than the €1.25bn and €1bn shorter tranches.

Over the following fortnight, BBVA, BFCM and Crédit Agricole showed senior preferred issuance in the 10 year part of the curve to remain a sweet spot in the primary market, finding strong demand for their offerings, allowing them to price with modest NIPs and enjoy secondary market performance. BPCE went even further, attracting some €4bn of orders to a 12 year senior preferred issue on 16 January, allowing it to tighten 30bp to 130bp and a NIP of around 12.5bp.

Investors’ enthusiasm for duration was reaffirmed by a €1bn 10.5 year for Rabobank yesterday (Monday), albeit in senior non-preferred format. The Dutch bank went out with IPTs of the 150bp area and after revising guidance to 115bp-120bp, will price in range, on the back of more than €6bn of demand, achieved a re-offer spread of 115bp — flat to inside fair value.

“The phenomenal order book and spread are further evidence of the strong bid for duration, and preference for bullet format,” said Hoarau (pictured below) at joint bookrunner Crédit Agricole CIB. “The deal’s high scarcity value also played positively into demand, with the issuer having limited SNP funding needs in 2024.

“Despite the tightening and pricing, it should trade well and fuel the inversion of the credit curve at long end.”

Rabobank’s successful trade came after HoldCo and senior non-preferred had proven the more vulnerable to market fluctuations in the opening weeks of the year.

Notably, on the second day of primary market activity, NIPs as high as the 20s paid on a handful of HoldCo/SNP tranches were elevated relative to other formats, while in the first week of the year non-preferred underperformed preferred and, marginally, Tier 2 in the secondary market. However, this did not stop names such as ABN Amro, Commerzbank, Belfius and UniCredit following up with successful SNP trades at premiums as the single-digits, and in the Belgian’s case as good as no NIP for its €500m five year thanks to an almost six times subscribed book.

Waiting for the trigger

In spite of the brisk and constructive opening, January supply has not reached the peak that had been widely expected, according to William Rabicano, director, credit trading at Crédit Agricole CIB.

“The market has held up very well,” he said. “The wave of supply was well flagged at the back end of last year, with something similar to the record amounts of January 2023 expected, but while we have had what I would call a decent amount of supply, the deluge has not materalised.

“It’s also been pretty well spread across the capital structure. And given that positioning at the start of the year was probably light to underweight, both from clients and the street, it’s been quite easily absorbed.”

Supply underwhelming has only supported execution of deals that have hit the market, with new issue premiums quickly normalising towards what might be expected in a more average month for supply, noted Rabicano (pictured below), and spreads rallying, meaning that issuers have not had to pay up to issue.

“Technicals overall remain very firm,” he added. “It still feels like clients are very much cash rich, which has been reflected in the book sizes and cover ratios on most of the deals so far this year, both for top and second tier names. And on the secondary side, we consistently see better buying for choice across the platform — even on an optically weak day for macro like last Wednesday, it was three to one better buying, and spreads held in very well.

“Cash rich clients are still waiting for and wanting more issuance, but that may now struggle to materialise in the next couple of weeks, with issuers starting to go into blackout. So all the technicals do point towards a big squeeze in both credit indices and cash if we do get that sort of final signal confirming rates are going where we expect.”

This is despite some observers cautioning that the market may already be getting ahead of itself, as it did at the close of 2023 (see separate article). In the meantime, the market appears content to look through such a scenario, judging by year-to-date activity, placing more emphasis on the “if” rather than the “when” of rate cuts.

“The forthcoming weeks will show the real shape of the US economy and we will carefully watch any revision of NFP or GDP-related statistics,” said Hoarau. “For the time being, it’s all about excess liquidity — it prevails across all segments of the financial markets and it is pushing up valuations.

“Everyone is convinced that the tightening cycle is a thing of the past. FOMO has been observed so many times in the primary market, enabling FIG issuers to take both size and price.”

And even a further repricing of the rate curve on reflation fears might not be enough to trigger profit-taking, he suggests.

“There is little upside for real money accounts to sell long bonds with high coupons,” said Hoarau. “Investors would rather buy protection and deploy cash further at better Bund entry levels.

“Then, a significant inflow of funds from money-market holdings into bonds could further fuel the ‘primetime for bonds’ narrative and encourage investors to move further up in the duration spectrum. Short term, a serious macro or credit event would be necessary to justify a reset of spreads at higher levels, so we should expect the unexpected.”

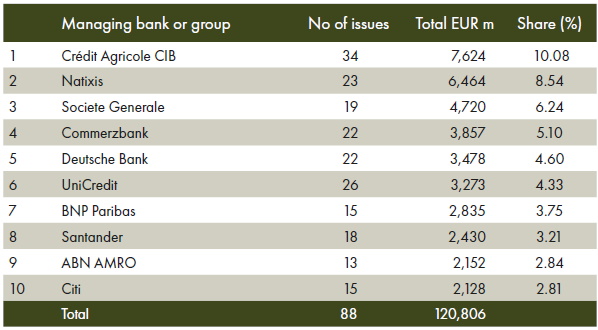

Bookrunners all euro investment grade financials issuance

01/01/2024-22/01/2024

Source: Bloomberg, Bond Radar, Crédit Agricole CIB