Crédit Agricole braved a downbeat tone in the US dollar primary market on Monday and was rewarded with a $6bn book that allowed it to price its largest deal in the currency since 2014 and all but conclude the French ...

CASA gets $6bn book for $1.75bn SNP return

News in brief

The US dollar market proved attractive for Yankee and US banks alike in the opening weeks of the year, with FIG issuance far exceeding supply in euros and funding levels proving more competitive across the capital structure. ...

Dollar market goes from strength to strength despite USTs sell-off

News in brief

Abanca opened the euro subordinated space for 2021 with its second AT1 on 7 January, a €375m perpeutal non-call 5.5 trade that attracted over 200 accounts and achieved pricing inside fair value. Alberto de Francisco ...

‘Remarkable’ result buoys early bird Abanca

News in brief

Rabobank sold its first green senior non-preferred bond on 22 October, a €750m seven year priced some 3bp through fair value, with the deal’s impressive outcome attributed largely to its green nature. The Dutch ...

Rabobank green SNP debut impresses on price

News in brief

Italian banks have begun taking advantage of senior non-preferred (SNP) debt to help meet rating and regulatory targets as they continue their post-crisis recovery. Wider credit market volatility rather than an inconclusive ...

Italy: SNP buttresses banks’ restoration of ratios

News in brief

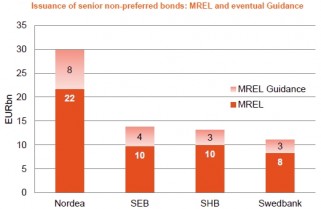

Sweden’s final MREL framework means the country’s banks again face stiffer requirements than elsewhere, prompting a latest clash with the regulatory authorities. The next step is the creation of instruments to meet the ...

Sweden: The MREL smoke clears

News in brief

UniCredit on 26 May sold its first Tier 2 issue since October 2013, a Eu750m 10.5 year non-call 5.5 transaction, after buying back Eu414m equivalent of old-style Tier 1 and Lower Tier 2 euro and sterling bonds. Here, Waleed ...

Buy-back buoys Eu750m UniCredit Tier 2 return

Market, News in brief

Aviva reopened the European market for not only insurance company subordinated debt but more generally financial institutions sub debt after a six week hiatus on 28 May with a dual tranche Eu900m and £400m Tier 2 offering ...

Aviva ends sub drought, peers hit window

News in brief

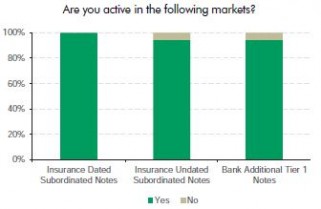

Crédit Agricole CIB DCM Solutions conducted an investor survey on Solvency II Tier 1 hybrid instruments in January and we are pleased to present the results here. ...