Sweden: The MREL smoke clears

Sweden’s final MREL framework means the country’s banks again face stiffer requirements than elsewhere, prompting a latest clash with the regulatory authorities. The next step is the creation of instruments to meet the expected individual requirements, even if early targets should be met comfortably. Neil Day reports.

The Swedish National Debt Office (Riksgälden) revealed its MREL framework on 23 February and, not for the first time, the countries’ financial authorities found themselves in opposition to the banking industry over the “gold-plating” of regulations.

“Our view is that the Swedish MREL requirements are very strict compared both to TLAC and to the requirements that will be the case for other banks in the EU,” Johan Hansing (pictured), chief economist at the Swedish Bankers’ Association (Bankföreningen), told Bank+Insurance Hybrid Capital.

However, in a joint report for the government, Riksgälden and Finansinspektionen (FI, the Swedish FSA) on 11 May, the authorities declared the design of Swedish regulations appropriate. They defended the MREL requirements, saying they are stricter than the minimum requirements set out in EU law due to the country’s large and highly interconnected banking sector as well as its considerable dependence on market funding.

“The report shows that Sweden has a well-functioning regulatory framework that reduces the risk of financial crises,” concluded Finansinspektionen director general Erik Thedéen and Debt Office director general Hans Lindblad.

They further argued that European Commission proposals to amend banking regulation could significantly alter discretions for national authorities, and in Sweden’s case have a “primarily negative” overall economic effect.

The disagreement over the MREL requirements had been brewing since more than a year ago, with the Debt Office having published its proposals in April 2016.

Analysts point out that the final version of the MREL framework is less burdensome than that originally outlined. Swedbank analysts, for example, note that one of the two elements that make up MREL, the recapitalisation amount (RCA) — the other being the loss absorption amount (LAA) — is lower because the November 2016 EC proposals stipulate that the combined buffer requirement (CBR) should be deducted from the RCA, rather than the RCA equalling the total capital requirement, as the Debt Office had believed should be the case, with macroprudential elements of the Pillar 2 requirement also excluded.

The EC nevertheless also proposed that resolution authorities can also introduce Pillar 2 guidance, although — unlike the formal MREL — this would not be a hard trigger of resolution or restrictions on coupon payments.

“The SNDO decided to wait until the EC proposals are adopted into EU law before taking a stance on eventual MREL guidance,” said Swedbank’s analysts. “However, in its MREL memorandum it clearly leaves the door open to introducing MREL guidance.”

The SBA’s Hansing meanwhile characterises the changes from initial to final proposal as “only small adjustments”.

“We would like the Swedish system to be in line with other systems in the EU,” he says. “Swedish banks have very high capital requirements.”

Hansing explains that the method used by the Debt Office implies that the MREL requirement will be twice the capital requirements — meaning that the higher the capital requirements, the higher the MREL requirement.

“This is not logical in our view,” he says. “Furthermore, the Debt Office require that MREL only be met with capital and subordinated debt, which means the large Swedish banks have to issue subordinated bonds to an amount of SEK500bn (EUR52bn).”

Individual MREL requirements will be set towards the end of the year, after FI’s supervisory review and evaluation process (SREP). The requirements will then be phased in from 1 January 2018 — when the liabilities proportion will become effective, i.e. firms should have MREL liabilities at least equivalent to the recapitalisation amount — to 2022, when a requirement that MREL be met with subordinated instruments will come in.

Even if Tier 2 debt will be eligible, the subordinated instruments in question are set to be Sweden’s version of the senior non-preferred asset class pioneered by France with its legislative product, which the EC will move all member states towards, and followed up on by Spain’s Santander with a contractual version. Market participants suggest that a combination of factors mean that Swedish banks are likely to wait until a legislative solution is in place.

“The understanding is that we will end up with a new type of security very closely related to the French approach,” says a representative of one bank. “But from an issuance perspective, it’s still going to be quite some time before any Swedish issuers are going to move on this — even if it is clear the resolution authorities would like banks to move well in advance of any deadline. One of the reasons is that it’s going to take quite some time before the Swedish government concludes legislation, and the changes are not likely to start to be implemented before the EC work is concluded.

“So I would say that we are definitely talking a year and a half or longer. It is not clear what would trigger issuance any sooner as that would mean going out with transactions that are sub-optimal, both from a cost perspective and a structural perspective.”

However, in an analyst call following Swedbank’s first quarter results, head of investor relations Gregori Karamouzis left open the option of pre-empting a legislative solution when it comes to MREL.

“First, we want to know what the requirements are,” he said. “We want to see how long it will take for the insolvency law to be changed in Sweden to be allowed to issue those type of instruments. If we make the assessment that it takes too long and we want to get started, we might look at different structures that are being discussed in the market, as you know, with calls and different structures that basically allow you to either buy back or convert those instruments into something that is eligible later on.

“It’s a consideration that we are working on and thinking of,” he added, “but we’re not at all in a hurry to come to the market early.”

Contractual-based issuance is, however, not widely expected, not least because the terms and conditions of outstanding Tier 2 instruments preclude higher ranking subordinated debt issuance. The absence of holding company/operating company structures among Swedish banks rules out the alternative structural solution that might otherwise have been possible.

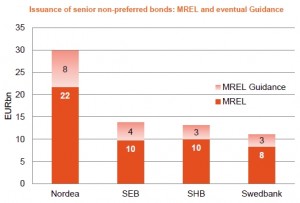

Swedish banks are not, meanwhile, expected to be troubled by the 2018 implementation date, having sufficient senior unsecured debt outstanding to meet the forecast MREL amounts, before transitioning to having up to around half of this replaced by Swedish senior non-preferred by 2022.

Click chart to zoom

“The introduction of a new funding instrument will lead to important changes for the Swedish banks,” said Swedbank analysts. “However, we believe that these changes will be relatively straightforward.

“Given that the subordination requirement will be applicable only from 2022, banks will not have to increase wholesale funding beyond their funding needs. Rather, we anticipate that the banks will let senior unsecured bonds mature and replace them with senior non-preferred, until 2022.”

They estimate that Swedbank will face the biggest change, with around 50% of senior unsecured debt needing to be replaced by senior non-preferred, with the respective Nordea figure being 48%, SEB’s 44% and Svenska Handelsbanken’s 31%.

Handelsbanken CFO Rolf Marquardt said in a first quarter results analyst call that the bank is in “wait and see” mode when it comes to getting greater clarity on the way in which MREL requirements will be met.

“And we also think that we have a really good position since we have a lot of maturing senior unsecured debt that we could start replacing when we know the rules of the game,” he confirmed. “So we think we still have time to wait a bit until we move.”