CACIB investor survey: Game on for FIG in 2018!

The buyside is positioning for sustained strength in subordinated bank bonds in the New Year, according to an investor survey by Crédit Agricole CIB syndicate, with few clouds on the horizon. New German and Italian instruments are anticipated, while the search for yield should open up new opportunities. Neil Day reports, with insights from CACIB’s Vincent Hoarau.

You can download a pdf of this survey write-up including charts by clicking here.

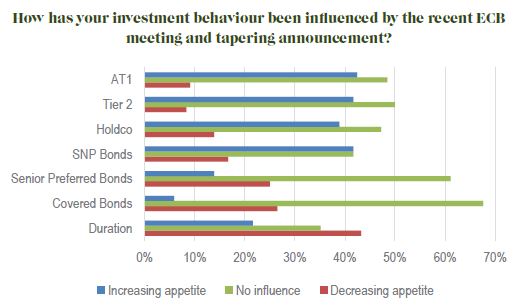

Tapering may have been the biggest concern of investors surveyed in a previous Crédit Agricole CIB investor survey, in August, but the ECB’s October announcements — being more dovish than expected — have on balance increased appetite for higher beta products, according to a new CACIB investor survey conducted in November.

The instrument that experienced the highest increase in appetite is Additional Tier 1 (AT1), on 42%, with Tier 2 matching its net increase in appetite (those reporting an increase in appetite minus those reporting a decrease in appetite). Only marginally fewer respondents reported an increase in appetite for senior non-preferred (SNP) and HoldCo debt.

In contrast, 25% of respondents said Draghi’s latest pronouncements has lessened their appetite for senior preferred bonds, versus 14% reporting increased appetite for them, while covered bonds saw a net decrease of 21%.

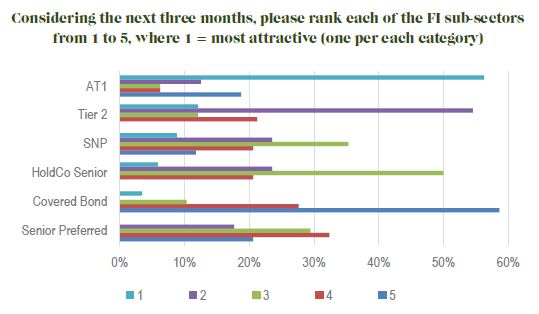

Looking ahead over the coming three months, AT1 is still seen as the most attractive financial institutions instrument for investors, being ranked top by 56% of those surveyed. Tier 2 is second on 12% and enjoying wide support in being ranked second by 55% of respondents. Senior non-preferred and HoldCo debt were ranked first by 9% and 6% of investors, respectively, with covered bonds on just 3% and senior preferred ranked top by nobody.

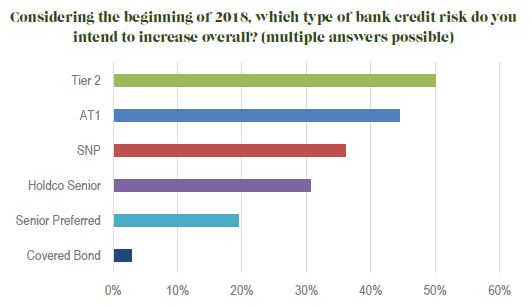

Despite ranking behind AT1 in the asset class deemed most attractive, Tier 2 is the instrument most-cited by investors as that which they intend to increase exposure to at the start of 2018: it was chosen by half of respondents, ahead of AT1 on 44%. SNP and senior HoldCo were chosen by 36% and 31% of accounts, respectively, with senior preferred on 19% and covered bonds on 3%.

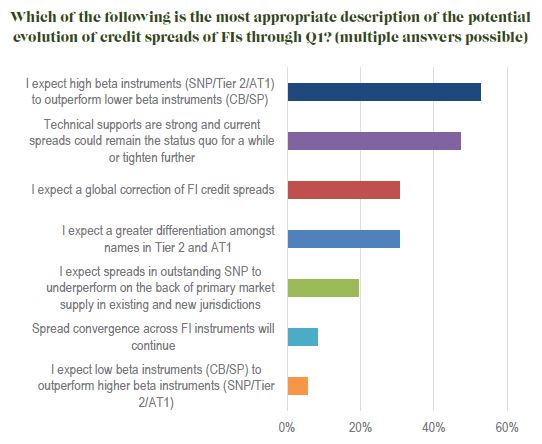

Asked which of various statements best captured their view on the potential evolution of credit spreads in the first quarter of 2018, investors were in the main positive, with 47% agreeing that technical supports are strong and current spreads could remain the status quo for a while or tighten further. An outperformance of high beta instruments versus low beta was the consensus, with 53% expecting such a scenario and only 6% the opposite.

Vincent Hoarau, head of FIG syndicate at Crédit Agricole CIB, shares the benign market view, expecting the spread environment to remain favourable.

“QE remains as good as intact, in spite of the slowdown in the growth of the ECB’s balance sheet,” he says. “Meanwhile, the global economic recovery is confirmed, and the critical mass of forced buyers remains intact, driven by LCR considerations, the deposit rate and excess cash.”

However, a substantial minority — 31% — expect a global correction of FI credit spreads. More specifically, 31% expect a greater differentiation among names in Tier 2 and AT1, and 19% expect spreads in outstanding SNP to underperform on the back of primary market supply in existing and new jurisdictions.

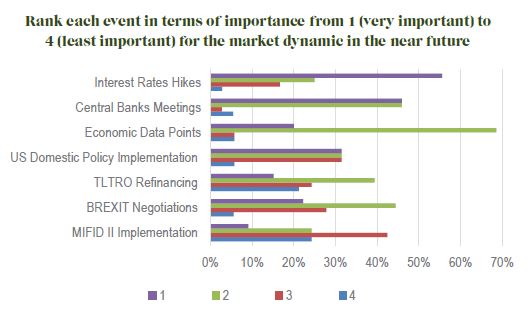

Central bank meetings and their actions, and related economic data points, are cited as the key factors affecting market dynamics in the near future: interest rate hikes were ranked top out of seven possible choices by 56% of those surveyed, while central bank meetings were top taking into account first and second choices (an aggregate 92%) and economic data points second (89%).

“The normalisation of interest rates will put a check on the decline in investment yields,” says Hoarau. “It will be interesting to see how the ECB orchestrates its tapering and asset purchases across asset classes in primary and secondary.

“Which asset class will be hit the most? We expect European government bonds to regain in importance and attractiveness if yields go up.”

US domestic policy and Brexit negotiations remain significant clouds on the horizon, but TLTRO refinancing and MiFID II implementation were overshadowed by these other factors. Europe’s political problems have not been wholly forgotten, with a handful of respondents variously citing Italian and German elections, and events in Catalonia.

“When it comes to geopolitical risks, it is a question of, so far, so good,” says Hoarau at CACIB. “The markets remain immune from Brexit, Italian elections and the North Korea saga.”

One investor may have literally been looking into a crystal ball for their forecast, citing astrology as potentially market-moving…

ITALIAN, GERMAN IPTs

Senior preferred debt is deemed too expensive versus covered bonds by almost half (49%) of investors, with 41% seeing them as correctly valued, and a minority considering senior preferred cheap versus the secured instrument, suggesting a high level of discrepancy in investors’ views and hence a lack on visibility on spread evolution in the non-subordinated asset class.

Senior non-preferred and HoldCo notes are also seen as too expensive by many investors, with 43% saying they are too expensive versus senior preferred and 41% too expensive versus Tier 2. A significant minority, 24%, nevertheless view SNP/HoldCo debt as too cheap versus senior preferred.

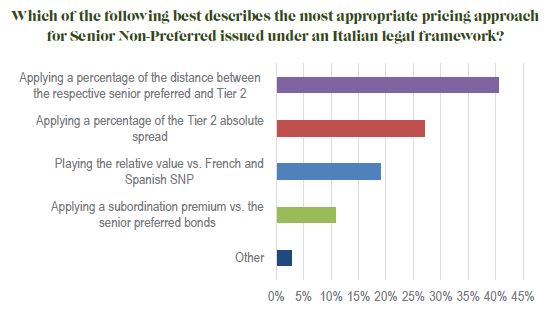

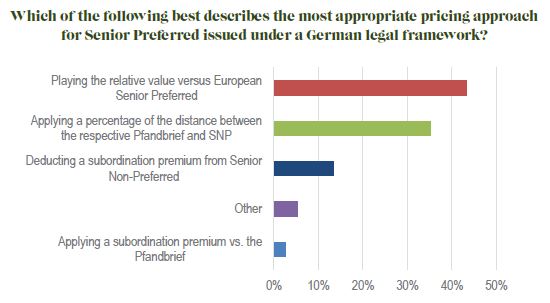

With Italian senior non-preferred in the pipeline and German senior preferred issuance under a legal framework anticipated, the survey asked investors what would be the most appropriate pricing approach for each.

For Italian SNP, the application of a percentage of the distance between the respective senior preferred and Tier 2 was deemed most sensible, by 40% of respondents, with the application of a percentage of the Tier 2 absolute spread second-most popular, at 27%. 19% chose relative value versus French and Spanish SNP and 11% applying a subordination premium versus senior preferred.

But for German senior preferred, playing the relative value versus other European senior preferred was the top response, chosen by 43%, followed by a percentage distance between Pfandbriefe and senior non-preferred, at 35%. 14% chose deducting a subordination premium from senior non-preferred, and 3% applying a subordination premium versus Pfandbriefe.

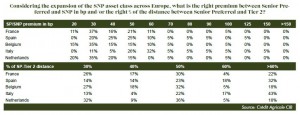

Investors were also asked what is the right premium between senior preferred and senior non-preferred in basis points, or the percentage distance between senior preferred and Tier 2 of senior non-preferred. Out of five countries — France, Spain, Belgium, Italy and, expected later in 2018, the Netherlands — Italian senior non-preferred will require the highest pick-up on both counts, according to the survey, with over half of investors deeming a premium of some 50bp or 60bp appropriate, and 44% a percentage distance of over 60%.

Hoarau at CACIB nevertheless expects the nature of the ultimate Italian senior non-preferred market opener to be below the 50% mark.

“We anticipate the first mover in Italy being a national champion,” he says. “Wary of missing out on a key inaugural SNP trade in a very liquid and supportive market, investors are likely to come in at a tighter level than that implied by the survey responses.”

This compares with averages of France, Belgium and the Netherlands coming in at roughly a 30bp-40bp range, and Spain at 40bp-50bp, with percentages of 40%-50% being the median for the first three and 50%-60% for Spain.

“This is certainly valid for a given jurisdiction on average,” says Hoarau, “but we expect a greater differentiation in terms of premium to materialise depending on whether we are looking at a tier one issuer or a second tier issuer. The higher the beta, the higher the premium.”

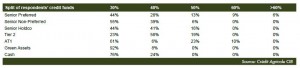

Click table to enlarge

The survey noted that benchmark AT1 transactions have priced with much lower reset spreads recently, and asked investors how much incremental yield they would require for a 100bp lower reset for a given issuer. Ranges of 25bp-30bp and 50bp-75bp were equal-most chosen, by 37% of respondents each, with 13% requiring 75bp-100bp, 10% just 0bp-25bp, and 3% more than 100bp.

“In the euro market, for a given core European top notch issuer, we expect pricing to be driven by relative value versus Nordea’s and ABN’s recent AT1s, rather than by reset spreads,” suggests Hoarau. “They offer very good reference points, whereas in US dollars, price discovery will certainly be higher and incorporate reset spread factors.”

FAVOURED MATURITIES AND FLEXIBILITY IN STRUCTURES

In their responses to how the ECB’s tapering announcement affected their stance, more investors reported a decreased appetite for duration than an increase, although the share of each was substantial, at 43% and 22%, respectively. For 2018, 54% of accounts cited five to seven years as their tenor of choice for credit, 30% up to five years, 14% seven to 10 years, and 3% longer than 10 years.

The 10 year non-call five structure remains the callable structure investors are most open to, with 91% of respondents able to invest in it, with 69% able to buy 12 non-call sevens, 63% 30 non-call 10s, 60% perpetual callables, and 57% 15 non-call 10s. Some 17% of respondents only buy bullets.

“With interest rates at long time lows, investors — driven by the fear of missing out on the rallying subordinated market — are likely to look at longer callable issue with a greater appetite,” says Hoarau. “We are indeed glad to have the confirmation that more than half of the respondents feel comfortable with the 15NC10 structure, which is not a common maturity in the euro market.”

Regarding floating rate notes, 44% of those surveyed said they will be increasing their FRN holdings in 2018, but 47% will not, and 8% opted to express concern about the phasing out of Libor, with this having a negative impact on their appetite for floaters.

SURVEY PARTICIPANTS, AUM AND ALLOCATIONS

Respondents reported a diverse allocation across instruments, from senior preferred to AT1, with limited cash holdings. Green investments remain limited, with only 8% having more than 10% invested in such assets.

Click table to enlarge

Just over half, 53%, of respondents were asset managers, 19% banks investing on their own behalf, 8% hedge funds, 3% banks investing on behalf of clients, and others — mostly self-identifying as prop or trading desks — 17%. European investors were in the majority, constituting 54% of those surveyed, with 22% in the UK, 22% from Asia ex-Japan, and 3% elsewhere.

Some 20% of respondents have more than EUR10bn of fixed income assets under management (AUM) dedicated to financial institutions, 3% EUR5bn-EUR10bn, 37% EUR1bn-EUR5bn, and 40% less than EUR1bn.

The buyside is positioning for sustained strength in subordinated bank bonds in the New Year, according to an investor survey by Crédit Agricole CIB syndicate, with few clouds on the horizon. New German and Italian instruments are anticipated, while the search for yield should open up new opportunities. Neil Day reports, with insights from CACIB’s Vincent Hoarau.