Solvency II Disclosure: Raising the Bar

Disclosure by insurance companies has improved in the run-up to the implementation date of Solvency II, but the complexities of the new European capital framework coupled with investors’ expectations means that there is still room for improvement when it comes to reporting, writes Michael Benyaya, DCM solutions at Crédit Agricole CIB.

1 January 2016 was no big bang in the insurance space. The length of the Solvency II (SII) process gave insurance companies lead time to adapt to the new regulatory framework, while the various SII tweaks have certainly helped smooth the transition. Still, SII entails numerous challenges, one of them being communication. The fundamentals and dynamics of the insurance sector have not changed because of SII, but stakeholders will have to put on new glasses to assess the sector. Therefore, insurers need to educate investors to a complex framework which will affect reporting and potentially the perception of the sector. Communicating clearly and consistently will also underpin success in the transition to SII.

Converging towards investors’ expectations

With the exception of a very few idiosyncratic situations, a relatively benign SII outcome was expected. Indeed, the large insurers and reinsurers have long disclosed an economic capital position that was generally viewed as a guide to the SII outcome. But this was clearly insufficient as investors did not wait for the formal SII implementation date to form a view on the level and type of disclosures needed. The sector had to raise the bar in terms of disclosures to meet expectations and avoid unnecessary speculation.

Timing-wise, the best practice was to communicate ahead of January 2016 by means of dedicated investor days (often in conjunction with an announcement of regulatory approval of the SII model). Some other companies (e.g. CNP Assurances, Aviva) have released the SII position (or are expected to do so) together with full-year 2015 results. Bancassurers will also probably come out of the woods at some point. SII communication within a conglomerate may entail additional challenges (e.g. the appropriate set of sensitivities given the predominance of a life business) but Danica Pension’s and KBC’s presentations may provide a blueprint.

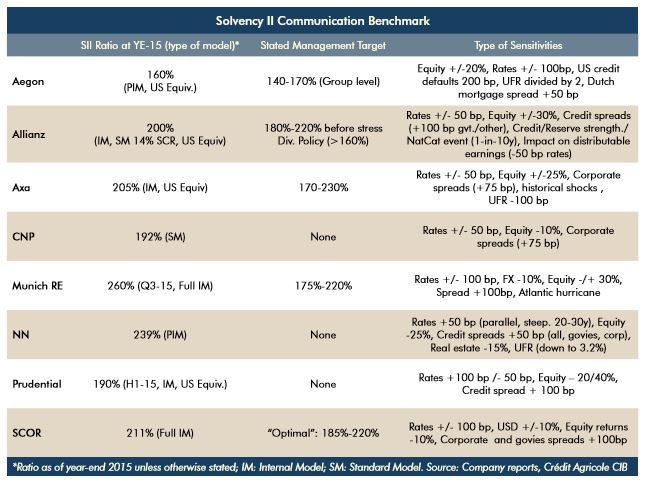

Overall the sector conforms to investors’ minimum requirements. The level of disclosure has dramatically improved, although it remains uneven and key items such as sensitivities are not uniform.

Some of the topics and minimum disclosures expected by investors are:

- Type of model used: internal models or standard formula depending on the business line and equivalence, particularly for a US business.

- The sensitivities to interest rates and equities are the minimum items required to gauge the potential volatility and resilience of the Solvency Capital Requirement (SCR) margin. Insurers often go beyond this and include credit spreads, real estate or natural catastrophes.

- Breakdown of the SCR modules and available capital, including the grandfathering treatment of subordinated debt: this is needed to assess financial flexibility. Investors were seeking assurance as to the robustness of the grandfathering treatment, particularly following Prudential’s announcement that it will use the variation clause of a US dollar perpetual debt issue to cure a capital disqualification event. There was no negative surprise and the fear of a wave of regulatory call exercises has now vanished. Some investors continue to question the rating agencies’ treatment of grandfathered instruments, but the risk of rating methodology events also seems marginal.

- Impact of the various SII arrangements, e.g. volatility and/or matching adjustment, ultimate forward rate, transitional measures: longer term, some of these measures might be discounted by investors in their credit assessment.

- There is an increasing focus on local capital requirements because this can affect dividend sustainability, although this is currently of primary relevance for equity investors. However, this could gain in importance for credit investors if and when insurance companies start issuing Restricted Tier 1 (RT1).

No SCR comparison, but absolute thresholds remain

Investors are fully conscious that SII ratios cannot be compared across the industry and the approach to assessing the strength of an SCR ratio has evolved significantly. The headline ratio now seems to be de-emphasised in investors’ analyses and there is an increasing focus on its mechanics as well as consistency with the company’s business model. For example, Standard Life reported a 162% SII ratio, which may appear at the low-end in a European peer group; it is actually very comfortable in light of the company’s fee business model, which results in a stable SII position.

Yet absolute thresholds remain anchored in investors’ minds. In most instances, an SCR margin in the 130%-140% range (or below) will be deemed too low. In this regard, the capital increase announced by Delta Lloyd when it reported an SCR of 136% is not really surprising. This also raises the question of the communication of an SCR target by insurance companies as well as capital generation (and depletion) under SII. Few insurance companies have a set a SCR level target, and when disclosed, the range remains relatively wide. This is because the SCR ratio is expected to be volatile and insurance companies want to avoid taking strategic decisions on the back of short term volatility. Likewise, the quality of communication on capital movements will be crucial because it will be affected by a number of non-cash items and the unwinding of SII-specific items (e.g. risk margin, transitional measures).

More clarity on the SII capital position, more visibility on Restricted Tier 1 issuance?

As expected, the implementation of SII will not trigger an increase in insurance capital issuance volumes and 2016 supply should primarily be driven by refinancing in the Tier 2 formats. It is not clear whether 2016 will see the first RT1 issues as issuance drivers are elusive. Indeed, the size of the Tier 2 bucket is optically large enough to allow for the refinancing of all existing subordinated debt. The capacity to tap the Tier 2 market remains an important factor of financial flexibility, including from a ratings perspective. Issuers are therefore expected to retain some Tier 2 headroom.

However, EIOPA’s Opinion on the calculation of tier limits for insurance groups that use the combination of the consolidation and deduction/aggregation methods might be a game-changer. A few issuers may actually have a lower than anticipated Tier 2 capacity and hence may be forced to turn to RT1.

But before the RT1 market opens, a few structuring issues need to be sorted out and the subordinated market, bank AT1 in particular, will need to recover.