Nordic Bank Day: Safe haven picks for 2023

Nordic banks are among the best positioned in Europe to ride out the uncertainties facing the banking sector in 2023, according to Crédit Agricole CIB bank analysts Gwenaëlle Lereste and Pascal Decque, highlighting the banks’ positioning vis-à-vis rate rises, while flagging real estate as an area to monitor.

You can download a pdf of this article, alongside a market focus, by clicking here.

Crédit Agricole CIB gathered major Nordic borrowers and French real money accounts in Paris on 14 February for its Nordic Bank Day, and Decque set the scene by noting that the overall European banking sector had entered the year facing three key areas of uncertainty: the extent of any recession; geopolitical tensions; and the development and impact of monetary policy.

Amid this new paradigm — also including the withdrawal of European Central Bank support — the way to play the banking sector in 2023 is via a stock-picking strategy, said Lereste.

“Combining the macro picture and higher rates with business model specificities,” she added, “we’ll see that the safe haven is the Nordics.”

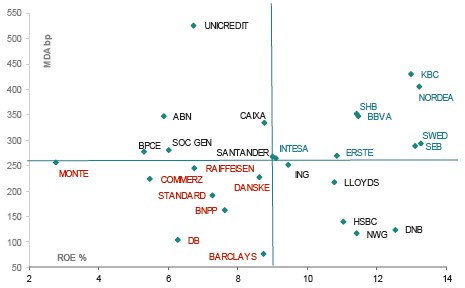

Key factors cited by Crédit Agricole CIB’s analysts are very high MDA buffers combined with strong earnings generation — as highlighted by their banking radar (see below) where Nordic players are clearly among the best positioned of European banks.

Crédit Agricole CIB Banking Radar Issuers

Source: Bloomberg, Crédit Agricole CIB

Under a stressed MDA buffer scenario run by the analysts — including flat revenues, costs up 5%, LLPs back to Covid stress levels, and RWAs up 6% — MDA levels are still “very comfortable” for Nordic banks, according to Decque: ranging from 1.24% for DNB to 2.27% for Danske, for example, and 3.52% and 4.05% for Svenska Handelsbanken and Nordea, respectively.

“High rates means higher revenues that can partially absorb higher LLPs going forward,” he added. “The absolute level of NPLs has been extremely low, so even a doubling of NPLs remains largely manageable by banks. And there are still unused Covid provisions available, the so-called management buffer.

“Nordea has close to €600m available, for example, and Swedbank SEK2.2bn in overlays.”

At the same time, the exit from negative rates is good news for banks, and particularly Nordic banks who have all enjoyed increases in net interest income (NII) of more than 30%.

“We have, intuitively, the notion that positive rates support the whole financial sector,” he said, “but the impact will be quite different from one bank to the other depending on the profile of their loan book — the more long term fixed rate you have, the longer it takes to reprice your lending book, while the more short term fixed or variable rate you have, the quicker it goes.”

Interest rate risk in the banking book (IRRBB) and related supervisory tests bear out the view that Nordic banks perform favourably in this regard. For example, in the quarterly ECB “parallel up” test whereby rates rise 200bp along the curve, Nordic banks experience a positive NII impact and relatively mild changes in economic value of equity (EVE).

“The ones in the best position are clearly the Nordic banks,” said Decque.

The strong fundamentals of the Nordic banking sector are meanwhile well known, he noted.

“Very strong asset quality, better profitability than the European average, very strong efficiency, extremely low cost-to-income ratios — in the area of the low 40s, and clearly a good cost of risk. The same for the capital base compared to the European average.”

Where they are not scoring so well, added Decque, is in terms of liquidity and leverage.

“This is largely due to the historical habit of Nordic households investing much more in mutual funds and pension funds than depositing funds long term with banks. As a result, Nordic banks remain highly reliant on market funding, notably covered bonds and short term funding — that’s the only, let’s say, small weakness compared to the rest of Europe.”

Regarding capital, Decque (pictured below) highlighted how Swedish banks face elevated requirements from their local regulator, citing the 2% level of the countercyclical buffer and aggregate 4% for the systemic risk buffer and other systemically important institution (O-SII) buffer. As a result, SEB, Svenska Handelsbanken and Swedbank face capital requirements above 14%, compared to some 9%-11% for the rest of Europe.

“So there is a massive difference in terms of requirement,” he said, “and they have to run with a very high level of capital.”

According to Lereste, in today’s environment, high credit ratings offer an increasing competitive advantage, and in this regard, the Nordics come out favourably — not just in terms of senior ratings, but also with their Additional Tier 1 (AT1) being largely investment grade, a status few other European banks enjoy.

Danske Bank, rated lower than its regional peers at A+/A3/A, is meanwhile seen as a potential recovery story. After clarification on the anti-money laundering front last year, a return to business as usual could see potential upgrades in the medium term, according to Lereste, offering the potential for outperformance — particularly given that the Nordics’ safe haven status is generally already priced in elsewhere.

While FIG supply pressures may this year prove less intense than initially feared, and supply year-to-date has met with strong investor demand, the high ratings should also stand Nordic issuers in good stead in a busy and competitive bond market. Nordic banks are expected to be active in fulfilling their MREL needs ahead of 2024, while Norwegian issuers specifically could opportunistically enter the market for Tier 2 and AT1 for P2R optimisation.

Real estate a pocket of vulnerability

With the exception of Norway, the Nordics are facing a mild recession somewhat worse than in the rest of Europe, highlighted Decque.

“The main reason is the fall in private consumption clearly linked to the fall in house prices, which has a wealth effect on households,” he said. “They are much more impacted by higher interest rates due to the variable rate mortgages they have to pay.”

This is borne out by the correlation between house prices and the evolution of domestic consumption, he noted, flagging a Riksbank study that showed Swedish households to be twice as sensitive to interest rate rises as they were 15 years ago, with debt-to-income levels having increased.

A key theme to explore in the challenging economic environment and in particular higher interest rates is the real estate market, according to Lereste, especially given that residential mortgages and commercial real estate lending represent more than 60% of some Nordic banks’ loan books.

“That’s why it’s one of the main concerns from investors,” she said, “that has also been highlighted by central banks as a potential pocket of vulnerability.”

After sharp increases, house prices have been falling since last summer, especially in Sweden, and are expected to fall further. Meanwhile, household debt, primarily in the form of mortgages, is high in the Nordics compared to the European average, at more than 150%, while mortgages — with the exception of Denmark — are generally floating rate.

However, Lereste (pictured below) noted that Q4 results have shown Nordic banks’ asset quality to be remaining “solid”, with Stage 3 loans remaining very low and among the best in Europe, while impairments have not increased.

“So, for the time being, what we are seeing is that they benefit from a double-digit increase in NII,” she said, “and at the same time, at least for the residential mortgages, asset quality is very sound. As for unemployment, it’s very low, while there is a robust social safety net and incomes are relatively high, so we are quite comfortable regarding exposure on residential mortgages in the Nordics.

“Don’t forget that they learned from their housing crises of the 90s,” added Lereste. “And, compared to the last crisis, the Nordics have more conservative policies, and in terms of loan-to-values, for example, we are talking about 50%-60% maximum on average.”

Concerns about commercial real estate are particularly high among investors and something to monitor in 2023, according to Lereste, with exposure to CRE greater than 10% of total lending, and more than 40% of corporate lending for Swedish and Norwegian banks.

“What is important for commercial real estate is cashflow,” she said, “and this can be impacted by the combination of high rates and economic slowdown, through rental income and also bearing in mind higher vacancies, while the sector potentially faces tighter credit conditions.”

Again, asset quality thus far has remained strong in spite of the tougher conditions, noted Lereste, while banks have adopted a conservative approach by increasing overlays for 2023.

“Considering all the metrics, Nordic banks should be able to handle this issue, although CRE vulnerabilities could pose headline risk for Swedish banks’ spreads,” she concluded.

You can download a pdf of this article, alongside a market focus, by clicking here.