P&C and Life Insurers: Moody’s Capital Tool

A new Moody’s Capital Tool (MCT) has been introduced to inform a risk-based analysis of the capital adequacy of property and casualty (P&C) and life insurers. Although no ratings will be changed, the tool is expected to enhance dialogue with insurers around their management of capital and risks, explains Benjamin Serra, senior vice president in Moody’s financial institutions group.

Why is Moody’s proposing the introduction of the Moody’s Capital Tool?

Our new capital tool is a stochastic and market-consistent framework. We already look at similar metrics in our analysis of insurers’ capital, notably in Europe, following the introduction of Solvency II, and in some parts of Asia. Market-consistent capital ratios add value because they are more economic than accounting ratios. Nonetheless, these ratios are not available in every country and are computed directly by companies thanks to complex models that can vary significantly across the industry. Our new proprietary tool will allow us to perform a market-consistent analysis globally, and in a consistent manner.

What is the targeted scope of application in terms of sectors and geographies?

We are only updating our life and P&C insurance methodologies. Therefore, the tool will not apply to reinsurers and specialised insurers such as credit insurers or mortgage insurers.

The tool is global by design, and we will use it in Europe, Asia-Pacific and the Americas. We are still adding life products in some countries such as the US or Japan, and we do not have scenarios in the Middle East region, but we will continue to expand the scope of the tool.

How is Moody’s going to use the MCT in the rating process?

The tool will complement, but not replace, our existing analysis. We are not proposing to change the scorecard in our insurance methodology and we will continue to look at and discuss regulatory solvency ratios reported by insurers. The tool will add value, but we are also aware that market-consistent capital ratios can be volatile, as we learnt with Solvency II. Therefore, we are not incorporating a direct linkage between the new tool’s capital ratios and our capital adequacy score.

The main benefit of the tool is to improve our discussions with insurers around their management of capital and risks. The tool will, for example, also provide an allocation of capital per risk or by product that will give us more insights and will provide a basis to discuss and better understand how insurers measure and manage the main risks they are facing.

Benjamin Serra, Moody’s

What is the expected rating impact?

There will be no change in ratings because of the introduction of this tool. As I said, the tool will complement our analysis, not replace it. In addition, by construction, this tool incorporates and reflects our current views around risks. In other words, the outputs of the tool should reflect our current thinking. In some instances, the tool will help us formalise this thinking. In other instances, we know, however, that the tool will not be able to capture all the specificities of an insurer, and in these cases, the tool will be less relevant in our analysis.

What is the overall architecture of the MCT?

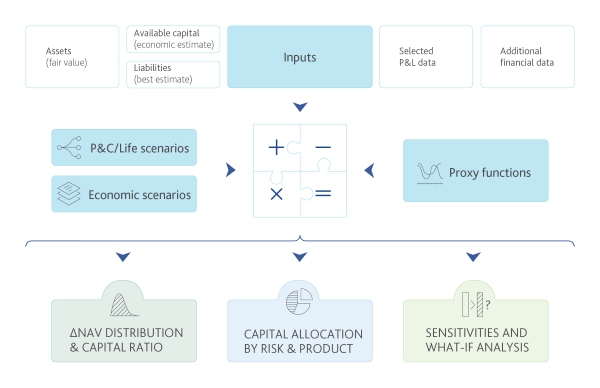

The tool will project the balance sheet of insurers over a one year horizon in a large number of stochastic scenarios. We have collaborated with Moody’s Analytics — a sister company of Moody’s Investors Service but separate from the rating agency — to build this tool. We have leveraged existing Moody’s Analytics’ products to generate the scenarios, for example, but also to create proxy functions that we use to recalculate how assets and liabilities change in all scenarios.

We then use the results of all these simulations to compute capital ratios, but also other types of outputs that can help us slice and dice the results in multiple dimensions.

Source: Moody’s Investors Service

What are the key sources of information used as inputs to the MCT?

We have decided to rely on public information and on a certain amount of private information that we already collect today for our rating process. We use, for example, a breakdown of investments by asset category, a breakdown of liabilities by country or by product, exposure to cat risk, or relative synthetic indicators such as the duration of assets.

Simple data may be a source of limitation of the tool, but with more than 600 inputs, we believe we struck a good balance between granularity, relevance and keeping use of the tool manageable. In particular, we will not ask insurers for new information; we would rather spend time with companies discussing the risks we have identified and how they manage these risks, than focusing too much on the inputs.

How would you describe the economic scenarios compared to the Solvency II formula (e.g. more, or less severe)?

We have not tried to replicate the Solvency II methodology and it is therefore difficult to compare the two frameworks. Our scenarios are also updated every year, so we are not using static capital charges.

Having said that, we did look at some specific risk factors, such as equity risk. The 99.5% quantile of the European equity markets distribution in our scenarios is actually very close to the 39% capital charge used in the Solvency II standard formula.

One of the differences is the treatment of sovereign bonds: we factor in the default risk of sovereign bonds, while Solvency II does not.

Does Moody’s intend to publish the output of the MCT?

Initially we will only share some outputs with issuers and engage in credit discussions based on these outputs when we think that the tool is relevant. The introduction of the tool in our rating process and the disclosure of outputs in our research will be gradual. Again, we will continue to use and analyse regulatory capital ratios and our scorecard ratios in the assessment of capital.

Will the MCT template be available to external stakeholders?

We have not planned to make the tool available to external stakeholders. The value of the tool resides in all the outputs that are generated besides the capital ratios. We will see which outputs are more valuable for issuers and which ones are more valuable for investors, and we will work to increase transparency over time if we think it is valuable for external stakeholders.

In terms of the available capital, what will be the main adjustments performed by Moody’s, in particular regarding subordinated and hybrid capital instruments?

As we do today for other ratios, we look at capital and at quality of capital in various ways.

In the tool, the standard definition of “available capital” will be calculated from our current definition of shareholders’ equity, calculated based on accounting figures and adjusted to reflect the economic balance sheet (by taking into account, for example, the difference between the fair value of assets and their accounting value, or the difference between the market-consistent value of liabilities and their accounting value). One of the traditional adjustments in shareholders’ equity that we are performing today is the addition of equity credit for hybrid debt. This means that the available capital will incorporate credit for Solvency II Tier 2 debt — which is generally considered as 25% equity and 75% debt — and Restricted Tier 1 (RT1) — which is considered 75% equity and 25% debt.

However, we also look at capital more holistically. For example, when we look at Solvency II ratios today, 100% of the debt component is included in capital, and we will also consider ratios under our new tool by including all hybrid instruments within capital. We also know that the future profits of long term P&C products can be a key source of economic capital for some insurers in Asia, and although this is not explicitly included in our stochastic tool, we will take this into account in our analysis.