European banks — the regulatory angle: EBA, ECB & SRB on supervisory priorities

Crédit Agricole CIB hosted a web conference on the theme “European banks: the regulatory angle” in December 2021, with delegates hearing from ECB supervisory board member Edouard Fernandez-Bollo, Sebastiano Laviola, board member and director of strategy and policy coordination at the SRB, and Isabelle Vaillant, director of prudential regulation and supervisory policy at the EBA.

The European Banking Authority and European Central Bank representatives both opened their presentations by commending the health of the European banking sector.

“Fortunately, the banking system has shown its resilience,” said the ECB’s Fernandez-Bollo, “not only to the shocks of the last year, but also its capacity to absorb further shocks. In the troubled situation we find ourselves in, we do believe in the structural resilience that has very much improved in the European banking system.”

Indeed, Vaillant at the EBA said that key to the European banking sector’s ability to navigate and weather the “unbelievable shock” of the pandemic “with no definitive hurt” was its capital and liquidity position going into the Covid crisis. Compared with a fully-loaded CET1 ratio of less than 11% at the start of the Great Financial Crisis, EU banks entered the Covid crisis with a level of 14.7%, and this rose to 15.3% at the end of 2020, she noted, while they had a liquidity coverage ratio of 173% at the end of 2020, up from 148% at end-2019. NPLs declined further in 2020, from 3.1% end-2019 to 2.5%.

“But also as regulators and supervisors, we could react in a different way than we could have ever done in the past,” added Vaillant. “The adaptive changes that we took were quite quick and well coordinated.”

She cited, for example, the postponement of stress tests, moratoria guidelines and the regulatory relaxation, containing both temporary and permanent measures, known as the CRR Quick Fix.

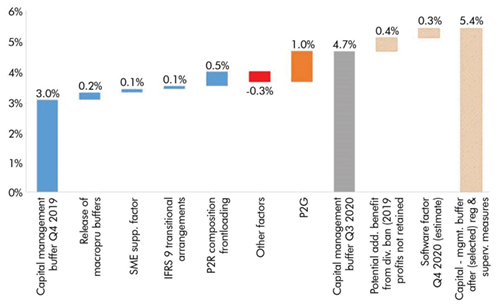

Management buffer build-up in 2020 - Indicative estimates* June 2020

Source: Supervisory reporting data (preliminary data for Q4 2020), EBA calculations and estimates. *Based on a reduced sample of 116 banks.

Vaillant also hailed the functioning of capital instruments during the crisis, even if the EBA continues to scrutinise developments to weed out unduly complex practices.

“One of the best achievements we have in Europe is that there is no longer doubt about the quality of capital of European banks,” she said.

“When I entered the EBA 10 years ago, this was quite a problem. It’s not anymore.”

Fernandez-Bollo meanwhile pointed to the 2021 stress test results, which he said offer additional comfort. These showed a system level fully-loaded CET1 ratio depletion of around 5.2 percentage points (from 15.1% to 9.9% under the adverse scenario).

“It was a significantly more adverse scenario than the previous one in 2018,” added Fernandez-Bollo, “but the losses were still really manageable, so we can see that banks’ capacity to absorb losses is good.”

Basel III: speedy, fair, loyal

Implementation of the final Basel III reforms (previously referred to by market participants as “Basel IV”) in line with international standards was cited as a priority by both the banking authority and the central bank to ensure continued stability of European banks.

“The regulatory package that is on the way will consolidate the resilience of the European banking system,” said Fernandez-Bollo, “so we will very much welcome that.”

Vaillant called for the “speedy and fair” adoption of the Basel III package to maintain the strength of the banking sector. She acknowledged the importance of “no significant increase” in capital requirements, but noted this constraint is valid on an average level: thus, certain banks and business types will see material increases in risk-weighted assets.

“We are quite happy with the proposal as it is now,” she said.

“It’s very important for us that we remain loyal to the global standards,” added Vaillant. “It’s such a great asset to have global standards that we should not deviate from them.”

And Fernandez-Bollo stressed that banks should be able to grow into the new Basel requirements.

“They can fully absorb it just by continuing the path they are on in terms of risk-weighted assets and CET1 with their current distribution policies,” he said. “We can thereby have a very smooth transition to finalising the new regulatory environment.”

Still lagging on profitability

European banks’ profitability was, however, flagged by the EBA and ECB as a cause for concern, as it has been for many years since the Great Financial Crisis of 2008.

“This post-pandemic situation should be used by the banks of the Eurozone to tackle in particular the structural challenge to profitability,” said Fernandez-Bollo. “Profitability has now rebounded to pre-pandemic levels, but it’s still lagging behind the peers, and the cost-to-income ratio is still really high.”

He acknowledged that the latter may partly be the result of banks investing heavily to transform themselves and prepare for the future.

“And we think that the [Covid] crisis has really been a big driver for M&A,” he added.

“But some are moving, and some are not, so we are really in a mixed situation, and we think that at system level we really need very important steering action.”

Vaillant also cited overcapacity and cost reductions as issues to be addressed, as well as improving confidence in group supervision in order to tackle capital and liquidity trapping at Member State level (also referred to as the Home-Host issue).

Fernandez-Bollo at the ECB said preparations for the challenges of the post-pandemic era now need to be made, particularly a likely delayed increase in non-performing loans (NPLs).

“We have had the paradoxical situation of a very, very strong economic crisis without, for the time being, seeing the pandemic fallout materialising in the position of banking clients,” he said.

Asset quality going forward is also high on the EBA’s agenda, according to the priorities for supervision that it released in November, noted Vaillant.

“What I would like to highlight is that we will need now to manage the long exit path from this crisis,” she said. “The longer the crisis goes on, the greater attention we have to pay to structural effects on the economy, with some sectors declining while others strengthen.

“So we will stress that there is a need for banks to conduct comprehensive risk assessments. Early recognition and having good provisioning policies are very important, as is proactive engagement with individual borrowers — this is what we think is always the best solution.”

Fernandez-Bollo highlighted pockets of risk building up in certain sectors. He said that the environment of abundant liquidity and search for yield had let to the loosening of underwriting standards, for instance, in the leveraged loan market, while the pandemic situation had contributed to greater risks in real estate.

“We have seen the return of very traditional risks that stem from the fact that the financial cycle has not, in fact, been broken by the crisis,” he added. “We can see from equity prices and stresses in fixed income that we are in a traditional high phase of a cycle, even if we are in a non-traditional situation.

“This cycle at some point will reverse, and we need to be prepared for the downturn phase of this cycle.”

In the context of credit risk management, the Vaillant mentioned the report it issued in late November on the benchmarking of IFRS 9 implementation by banks. She said that banks have made significant efforts in implementing the standard, while noting that although the regulator found variations in the way banks have been implementing IFRS 9, this was only to be expected, given the high level of judgement embedded in the standard.

Limited use of the Significant Increase in Credit Risk (SICR) collective assessment is nevertheless one aspect that warrants further scrutiny, noted Vaillant.

Buffers need reviewing post-crisis

The EBA and ECB representatives both acknowledged that regulatory buffers had not operated as intended during the crisis, and Vaillant said the situation definitely has to be reviewed.

“During the crisis, we called many times, as regulators and supervisors, for the buffers to be used, because this is indeed the right moment to dip into the buffers and continue lending to the economy,” said Vaillant. “But there was no such use of the buffers, despite the good capital and liquidity positions that I highlighted.

“There are many possible causes for this,” she added. “Sometimes it may mean that we have not yet built sufficient space for these buffers to be used without too high a stigma. There is obviously the role of the macro-prudential buffers [e.g. the counter-cyclical and systemic risk buffers; these buffers are releasable], which were quite lean in Europe — probably too lean — but also various types of buffers that are individual to banks [e.g. the G-SII/O-SII and Pillar 2 buffers and requirements], where we need to gain a little bit of space for the market to accept the moment they have to be used.”

CACIB notes that some of the early ideas around enhancing buffer usability consist in having a larger share of releasable buffers in “normal times” or reviewing the automaticity of MDA application upon buffer breach (e.g. the UK recently modified its rules such that a pending buffer breach does not mean automatic MDA, as long as there is a credible path to buffer restoration and buffers are breached for the “right reasons”, such as avoiding deleveraging in a recession).

Fernandez-Bollo echoed Vaillant’s thoughts, noting that any enhancements in the usability of buffers must be made without the need for any significant deviations from international standards.

He also underlined that the ECB is not seeking new exceptional or system-wide legally binding powers in respect of stopping dividends or other variable payments outside of the MDA zone, such as AT1 coupons/redemptions and variable compensation. (Note: this matter is the subject of a review article in the CRR Quick Fix).

“We were quite happy with how things evolved, because the banks understood and followed the [dividend retention] recommendation, even if they were not particularly happy about that,” said Fernandez-Bollo. “It was the prudent thing to do at a time of unprecedented uncertainty and it contributed very much to the build-up of the capital base, at the same time that we relaxed some other regulatory standards. But then you’ve seen, once the uncertainty come back to, I would say, normal levels, we were also very happy to withdraw, because we don’t think this should become a regular crisis measure and we are not asking for that.

“Why? Because we think this will give the wrong message, that now, in each crisis, you could expect a general ban on dividends. Dividend measures should be related to the specific situation of a bank — in past crises, it was a quid pro quo for receiving help from the state. In a future crisis, we hope there will never be help from the state, and what has replaced this quid pro quo is the MDA.”

Climate, cyber challenges in focus

Alongside these “classic” risks, the EBA and ECB flagged “emerging” risks — even if they noted that these are already upon us.

“The first one, unsurprisingly, is how to address climate change risks,” said Fernandez-Bollo.

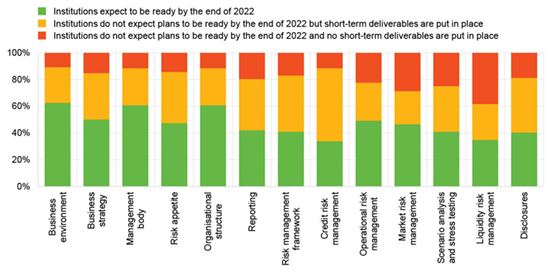

He noted that more than 90% of banks are not aligned or only partially aligned with the ECB’s supervisory expectations on climate risk, and furthermore over 10% of banks neither expect plans to implement these supervisory expectations to be ready by the end of next year, nor have short term deliverables in place.

“We will be taking very important action next year to see that those with plans really go ahead with implementing these, and that the others really start to do something in 2022,” said Fernandez-Bollo. “This is really one of the biggest priorities for next year.

“We don’t expect to find all the answers next year, but we surely should be on track to find them.”

The ECB’s first climate stress tests next year will be a tool in this regard, he noted, although this is unlikely to result in higher capital charges under Pillar 2R or 2G.

“If there is a credible plan, there is no reason why there should be a capital charge,” said Fernandez-Bollo. “As for more traditional risk management issues, we normally ask for qualitative improvements, and it’s only when we are not happy with the path in the qualitative improvements that we go for the quantitative.

“So we hope we will not have to have any quantitative effects next year — this would be a good result.”

Vaillant said the EBA is on board to better define and measure climate risks, and agreed with the ECB that banks need to adopt specific strategies in this regard, noting that the EBA has a mandate to measure the potential impact on Pillar 1 capital charges of climate risk.

“This will be quite a difficult task, because we lack data,” she said, “but intuitively it’s clear to everybody that this risk is growing, so there would probably be a need to better consider the capital charges against it.”

Vaillant meanwhile reiterated the EBA’s cautious stance on banks issuing loss-absorbing instruments in sustainability-linked bond formats (e.g. with step-up features upon ESG KPI breach).

“It’s obvious to everyone that there can be contradictory objectives in such green instruments,” she said, “between their greenness and their loss absorbency. We have to be clear that loss absorbency is the top priority when it comes to capital, and we will never sacrifice that.”

Cyber and IT challenges were the other key emerging risks cited by the EBA and ECB, whether operationally or in terms of competition.

Fernandez-Bollo said that although banks have reported slight improvements with respect to IT, they see potential disruption as the number one operational risk and have reported both an elevated number of incidents and issues with end-of-life systems and greater outsourcing.

“I’m not completely sure the banks are currently identifying the challenges that are arising,” he said, “so this will really be a key factor in our actions in the next years.”

Vaillant also flagged digitalisation as a factor in the profitability issue, although she noted positive changes and investments, alongside the impact of the EBA’s software RTS, and the Digital Operational Resilience Act (DORA).

“Increasing competition from FinTech and BigTech firms require regulators to ensure the level playing field and banks should streamline their digital capacities,” she said.

Vaillant and Fernandez-Bollo both highlighted their institution’s work to enhance “fit and proper” governance, with the EBA keen to facilitate a database that authorities can refer to in respect of board appointments, and the ECB seeking to improve internal governance.

Timeliness of banks’ plans to implement the 13 supervisory expectations set out in the ECB Guide

Source: European Central Bank