IFRS 17: Anticipating the ‘disruptive’ new standard

All sides of the market have to grapple with how the introduction of IFRS 17 will affect insurance companies’ business performance and credit dynamics ahead of its introduction in 2023. Here, Crédit Agricole CIB’s DCM solutions team and rating agency analysts share their views on the revolution that the new accounting standard is expected to foment.

After more than a decade of development and a few false starts, IFRS 17 is now due to be implemented as of 1 January 2023. Compared to the existing IFRS 4 accounting framework, IFRS 17 will be a revolution, in particular in the life sector, in terms of profit recognition (no more front-loading of profitability) and accounting rules for insurance liabilities, which will be held at current values by applying current discount curves.

“IFRS 17 will have a disruptive impact on insurance companies, primarily from an accounting perspective, but potentially also on the companies’ underlying business model,” says Alberto Messina, director, EMEA insurance, at Fitch Ratings.

Investors, rating agencies and other stakeholders will need to grapple with the new standard to understand business performance and companies’ credit dynamics.

One of the purposes of the new framework is to bring greater comparability and transparency around the profitability of new and in-force business, but this might not be fully achieved.

“There are many options and underlying assumptions in IFRS 17, in particular in the Contractual Service Margin (CSM), which may hinder the comparability of the key performance indicators,” says Michael Benyaya, co-head of DCM solutions at Crédit Agricole CIB (CACIB).

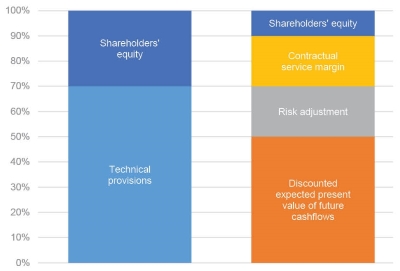

Comparing IFRS 4 and IFRS 17 balance sheet (liability side)

Note: the relative size of each accounting items is only for illustrative purposes; Source: Crédit Agricole CIB

The opening balance sheet and the comparative year will be a key focus point for the market, adds Szymon Wypiorczyk, DCM solutions at CACIB.

“A comprehensive set of disclosures will be crucial to help investors distinguish between the impact of movements resulting from accounting changes and those related to underlying business performance,” he says.

The new framework will result in the emergence of two new components on the liability side: the CSM, which represents the unearned profit of the group of insurance contracts that the entity will recognize as it provides services in the future; and the Risk Adjustment, which reflects the compensation an entity requires for bearing the uncertainty associated with non-financial risks. Concurrently, shareholders’ equity may decline for some companies.

According to Stephan Kalb, senior director, EMEA insurance, at Fitch, the CSM is expected to be included in the shareholders’ equity in the rating agency’s Prism Factor-Based Capital Model and in the denominator of capital-based ratios.

“As the CSM represents the profit that a company expects to earn over the contract duration, we consider it to have the characteristics of loss-absorbing capital,” he says. “This treatment also means it would compensate for the decline in shareholders’ equity compared to current accounting standards, as day one gains are not recognized immediately under IFRS 17.”

By contrast, the CSM will be treated differently by S&P Global, as up to 50% credit will be granted to the CSM in the S&P insurance capital model. In addition, the Risk Adjustment component will be treated like reserve surpluses not reviewed by S&P, which receive a maximum of 25% credit. As such, it is likely that life insurance companies will have a lower capital output. Regarding financial leverage, the CSM will not be included in the equity base. Although this could result in an increase of the ratio for some companies, it should generally remain below the 40% limit for a “Neutral” assessment under S&P’s criteria.

Moody’s has not publicly commented, but it is expected that the CSM will not be part of the equity base for the computation of leverage ratios.

In the past, a change in solvency or accounting frameworks has not resulted in massive rating changes. In that regard, Messina at Fitch confirms that the rating agency’s view of underlying capital strength and financial performance will most likely not change following the implementation of IFRS 17, as the underlying economic substance remains the same.

“We therefore expect minimal rating impact to insurers under our coverage,” he says.

Companies have not yet communicated on preliminary IFRS 17 figures, but the new framework could have broader implications for insurance rating methodologies.

“We may need to consider adjusting the rating bands associated with the capital-based ratios that we use as part of our rating analysis, depending on the results of the calibrations that will be run as IFRS 17 company data becomes available,” concludes Kalb.