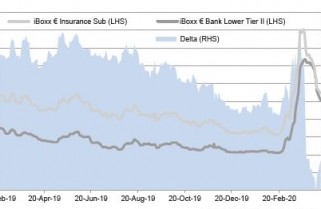

The insurance sector’s apparent health entering the crisis has not offered it immunity from the volatility and widening that have struck financial markets, according to André Bonnal, FI syndicate at Crédit Agricole ...

Market ‘wide open’ as insurers outperform banks in rebound

Market

The primary market roared back to life last week on the back of unprecedented concrete support from central banks and governments to counter the economic and financial markets impact of the coronavirus pandemic. Financial ...

Unprecedented stimuli spur rally, supply surge, but pandemic casts long shadow

Market

The AT1 market has reached fever pitch, with investors unable to resist the asset class in the lower-for-longer rates environment, meaning record low coupons are there for the taking for those issuers ready to seize the ...

Italians lead AT1 charge as insatiable demand drives asset class to new heights

Market

Santander on Thursday moved to refinance a €1.5bn 5.481% Additional Tier 1 issue and saw its strategy deliver big savings as clear and consensual execution helped it attract over €10bn of demand to a €1.5bn perpetual ...

Santander strategy pays off as blow-out €1.5bn AT1 reopener delivers refi savings

Market

A €5bn book for an inaugural, €750m RT1 from Ageas on 3 December showed the subordinated insurance sector to be in surprisingly fine fettle going into year-end, as a flurry of deals provided a welcome late encore to the ...

Ageas shows strong insurance bid into year-end

Market

La Banque Postale achieved one of the lowest ever coupons on a euro AT1 with its debut issue on 13 November, a €750m perpetual non-call seven that attracted a peak €3.5bn of demand, but also demonstrated the price ...

La Banque Postale in €750m AT1 milestone

Market

Sumitomo Mitsui Financial Group (SMFG) was able to achieve an attractive size and price when it issued a €1.25bn 10 year senior HoldCo benchmark on 15 October, raising funding some 20bp inside what was available in US ...

SMFG happy with size, price on €1.25bn 10s

Market

Banks could substantially cut cost of carry when refinancing AT1s by using a “six month par call” feature introduced in a £600m Nationwide Building Society deal in September that increases issuers’ flexibility. ...

Nationwide ‘six month par call’ promises savings

Market

Some 16 insurance trades hit the market between the post-summer reopening and mid-October, providing for the sector’s busiest period of 2019, as the depressed rate environment enabled companies to raise subordinated debt ...