Italians lead AT1 charge as insatiable demand drives asset class to new heights

The AT1 market has reached fever pitch, with investors unable to resist the asset class in the lower-for-longer rates environment, meaning record low coupons are there for the taking for those issuers ready to seize the opportunity. Neil Day explores the factors underlying the frenzy and their implications, for this special Bank+Insurance Hybrid Capital report, in association with Crédit Agricole CIB.

A pdf version of this article is available by clicking here.

Insatiable demand for Additional Tier 1 has prompted a frenzy of activity so far this month, with landmark trades for UniCredit and Deutsche Bank last week demonstrating the market to be wide open at irresistible levels, and even a postponed ING trade failing to knock the market off course as Intesa Sanpaolo issued a dual-tranche euro benchmark AT1 yesterday (Thursday).

A day after the Dutch group on Wednesday halted a $1bn AT1 sale despite attracting over $11bn of orders and tightening pricing, citing undisclosed information it had required and needed to study, the Italian bank yesterday proceeded with its €1.5bn total perpetual non-call fives and non-call 10s trade. The first ever dual-tranche euro benchmark AT1 attracted more than €8bn aggregate of demand during the process, with Intesa Sanpaolo able to increase the combined size from an expected €1.25bn and tighten pricing from IPTs of 4.25% and 4.625%, respectively, to 3.75% and 4.125%, with the coupon on the non-call five the lowest on any Italian AT1.

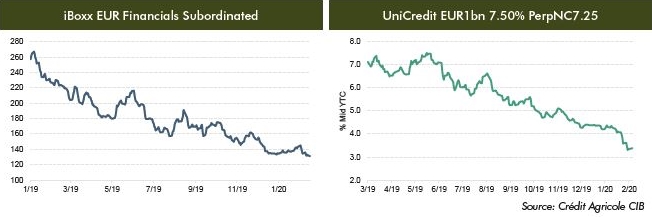

Since Santander opened the asset class for 2020 on 9 January with a €1.5bn perpetual non-call six issue that attracted €10bn of orders for a euro benchmark AT1, the market has gone only one way: AT1 has been the best performing fixed income asset class year-to-date, with the iBoxx EUR CoCo AT1 index up 2.9% in the year to 14 February and the equivalent USD index up 2.8% — this, coming on the back of 17.0% and 18.9%, respectively, in 2019.

“The subordinated market as a whole and more precisely the deeply subordinated market is in simply rip-roaring form,” says André Bonnal, FI syndicate at Crédit Agricole CIB (CACIB). “This is clearly where investors are putting their money at the moment, as it is the only asset class providing some kind of yield and return in fixed income.”

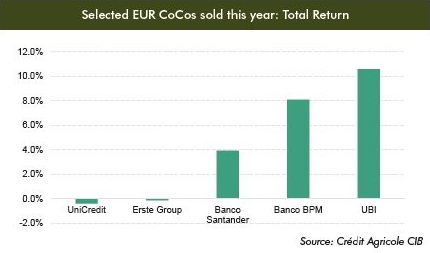

After UBI Banca uncovered over €6bn of orders from some 450 accounts with a €400m 5.875% perpetual non-call 5.5 debut on 13 January and was swiftly and successfully followed to market by compatriot Banco BPM, Erste Bank a week later (20 January) achieved the second-lowest coupon on a euro benchmark AT1, 3.375% for its €500m perpetual non-call seven.

The rally in yields was most starkly underlined by a €1.25bn perpetual non-call seven AT1 for UniCredit on Wednesday of last week (12 February): the national champion attracted more than €9bn of demand at a final coupon of 3.875% that was almost halved from a 7.5% coupon it paid on a €1bn perp non-call seven in March 2019.

The appetite for higher beta, higher yielding financial institutions issuance has been felt in other parts of the FIG market, as illustrated by Tier 2 transactions for Greece’s Alpha Bank and Piraeus Bank. Their €500m 10 year non-call five triple-C rated sub deals attracted multi-billion euro order books at coupons approaching half those seen in summer 2019, as the yield on the 10 year Greek sovereign fell to below 1%.

Another sign of the feverish market conditions in the AT1 market was the return of Deutsche Bank, with its first new issue in six years. After having been at the centre of some of the asset class’s most turbulent times, Deutsche on 11 February attracted some $14bn of orders to its $1.25bn (€1.16bn) 6% perpetual non-call five issue.

Credit Suisse had opened the AT1 Yankee market with a bang on 16 January with a $1bn (CHF983m) perpetual non-call 10 that attracted some $20bn of demand, enabling tightening from initial price thoughts (IPTs) of the 5.75% area to 5.10%.

By this week, the Swiss bank’s trade had tightened sharply, to 4.50%, and BNP Paribas was this Tuesday able to achieve a 4.5% coupon on a $1.75bn perpetual non-call 10 following IPTs of 5.125% after receiving some $15bn of orders. The 4.50% coupon is the lowest achieved by a French bank on an AT1 and compares, for example, with 6.625% on a perpetual non-call five issued in March 2019, while the reset spread of 294.4bp is its second lowest and the first sub-300bp reset since a 5% perpetual non-call five issued by UBS in January 2018 (243bp).

Fadi Attia, managing director, US dollar FIG, at CACIB, says BNP Paribas’ execution — following the Credit Suisse and Deutsche trades — underscores the significant liquidity available in the US dollar segment.

“Demand for AT1 product continues to be very deep and robust,” he says. “Issuers have full pricing power in this product, pricing pretty much flat to fair value, while higher beta bank names have priced inside their AT1 curves.”

Click on table below to enlarge for details of 2020 AT1 issuance

A one-way street?

Vincent Hoarau, head of FI syndicate at CACIB, says the potential for the market to prove so accommodating to issuers raising the riskiest form of bank debt was already suggested by limited price moves in the wake of the Iran crisis at the very start of the year.

“QE is delivering in full and investors have been conditioned by the fundamental liquidity situation to the extent that nobody wants to over-anticipate any risk event,” he says. “As such, the geopolitical events in the early days of January proved to be a non-event, as did Brexit, and the market reaction to the coronavirus is also relatively limited.

“Indeed, the prospect of further central bank stimulus and rate cuts in Europe is gaining ground given the risks the outbreak implies for global growth,” he adds. “And the greater prospect of lower rates for a prolonged period of time is likely to further support valuations in the asset class.”

The prevailing lower-for-longer central bank mantra and prevalence of negative yields across lower beta asset classes is cited as the key driver for investors piling into AT1.

“Valuations in the asset class are at historical highs, but this should be put in the context of falling interest rates in Europe,” says Hoarau. “Meanwhile, investors are sitting on mountains of cash, with daily inflows growing.

“AT1 is the only asset class still offering anything semi-respectable — or even juicy when you look at the stock of debt with negative yields — and so they are all quasi-forced to buy in a market where there is such a strong imbalance in the supply/demand dynamic — only around €5bn of net AT1 supply is forecast for the year before CRD V Article 104 allows P2R to be met with AT1 and Tier 2.”

(See below for more details on P2R.)

And despite the outperformance of the sector in 2019 and already this year, Nigel Brady, CACIB AT1 trader, suggests there are further reasons to believe the asset class can continue to perform.

“If you go back to 2006-2007, the differential between Tier 1 and Tier 2 debt was tighter than where it is today,” he says, “so you could easily argue that there’s still room for compression — and also versus high yield, where there’s been outperformance, too.”

Confidence in the banking sector and its regulatory landscape, as reflected in rating agency analyses, has only been encouraged by the latest earnings season, according to Neel Shah, financial credit analyst at CACIB.

“Of the banks who have reported this year, for the clear majority their financial performance has been better on capital, and trading revenues as well, which supports the dividend pay-out and also the AT1,” he says. “So although banks have faced this low rate environment for a decade-plus now, their profitability has been surprisingly very resilient.”

The asset class has also been boosted by name-specific events, such as the purchase of UBI by Intesa Sanpaolo ahead of the latter’s new issue, which resulted in a sharp rally in the acquired bank’s AT1. Political developments have meanwhile boosted jurisdictions such as Italy, giving investors more confidence in countries where AT1 have otherwise remained at a more elevated pick-up to other bank debt.

Given such reassurance about the sector’s fundamentals, broader macroeconomic or geopolitical factors are seen as the key risks to AT1 prices.

“Volatility in the asset class may return on the back of an equity correction driven by the deterioration of the global macroeconomic backdrop,” says Hoarau.

“Nonetheless, such a situation — i.e. a resurgence of mark to market volatility — should not call into question the intrinsic attractiveness of the asset class in the world of fixed income products where trillions of assets are trading in negative territory,” he adds. “The probability of default, loss absorption or non-payment of coupons is very limited if we look at the current state of bank capital metrics and rating trajectories in the sector.”

And while Brady acknowledges AT1 would not be able to resist a sharp downturn in equity markets, he argues that it would continue to outperform equities and high yield on a beta-adjusted basis.

“I certainly would still expect AT1 to outperform further on any macro sell-off,” he says, “given the supply/demand dynamic has not changed and does not look like changing any time soon.”

Indeed, rather than if and when the market might correct, perhaps the more pertinent and immediate question facing the market is how low coupons can go. With the likes of Rabobank non-call sevens trading at a yield-to-call below 3%, a sub-3% print is potentially in top issuers’ sights.

“We have not seen a coupon with a ‘2’ handle yet in the euro market,” says Hoarau, “and that would be the next major step in the market should it continue to evolve in this direction. But there are definitely some strong banks who could target a sub-3% mark right now. Those issuers have calls to potentially refinance in 2021, and they will have to consider the cost of carry and the risk of a correction in the AT1 market.

“In our view, they would be well advised to accelerate any such funding plans — in conjunction with a liability management exercise, if appropriate — and take advantage of this market while it lasts.”

Demand could beget supply

Underpinning the variety of successful trades across countries and currencies has been the large and diverse investor base now playing in the asset class, says Brady at CACIB.

“Demand is coming from every region,” he says. “A lot of people have highlighted the Asian retail investor base when it comes to demand, but if you look at these peripheral deals we’ve been seeing, they wouldn’t be getting done without European real money demand, while Deutsche in dollars, for example, was mainly sold to US real money. The Asian retail demand then helps the secondary performance of all these names.

“What we’ve been seeing,” he adds, “is not only those names coming to market tighten on the back of the 10 times-subscribed books they’re achieving, but the whole secondary market tightening in parallel.”

However, Brady cautions that the behaviour of some accounts can at times lead to inflated order books, while “tourists” may have contributed to some of the more dramatic pricing outcomes. After pricing at 3.875%, UniCredit’s AT1 widened to trade above 4% in the aftermarket.

And after “whopping” price moves from IPTs to final pricing as the buyside and sellside struggled to anticipate the strength of the rally, execution may be less chaotic as the market finds its new levels.

The attractive opportunities on offer could also potentially skew the demand/supply dynamic, should a sufficient number of issuers take advantage of the market conditions.

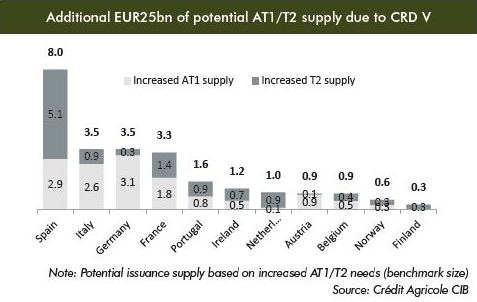

Such a scenario is deemed increasingly likely in light of certain amounts of AT1 and Tier 2 now being allowed to contribute to meeting Pillar 2 Requirements, rather than only CET1, under article 104a of the CRR. According to CACIB analyses, the implementation of CRD V could hence prompt an additional €14bn of AT1 needs and €11bn of Tier 2 in the medium term.

“UniCredit was the first bank, in December, to signal its ability to use subordinated capital instead of CET1 to fill the P2R bucket,” notes Shah. “In bank earnings calls in the past few weeks there have been a lot of questions about whether they will take up the opportunity to do likewise and most have said they are monitoring the regulatory landscape but not committing to it.

“We nonetheless get the impression banks will be issuing more subordinated debt this year than they initially planned to, so overall issuance expectations will have to be revised up from what was envisaged at the beginning of the year.”