Unprecedented stimuli spur rally, supply surge, but pandemic casts long shadow

The primary market roared back to life last week on the back of unprecedented concrete support from central banks and governments to counter the economic and financial markets impact of the coronavirus pandemic. Financial institutions issuance surged at the new wider levels, while bank capital prices recovered from their lows. But with deaths still mounting, market participants are braced for further downward moves and volatility. Neil Day reports for Bank+Insurance Hybrid Capital, in association with Crédit Agricole CIB.

You can download a pdf of this article here.

After earlier measures had proven insufficient to prevent record falls in equity markets and dislocations in financial markets, governments and monetary authorities across the globe last week followed up on the European Central Bank’s announcement of its Pandemic Emergency Purchase Programme (PEPP) on Thursday of the previous week (18 March) with bigger and bolder stimulus moves.

In the US, the unleashing of effectively unlimited QE alongside targeted sectoral support by the Federal Reserve on Tuesday, in tandem with progress towards a $2 trillion fiscal package ultimately signed on Friday by president Donald Trump, helped the Dow Jones Industrial Average to its biggest percentage gain since 1933 on Tuesday.

Although sentiment was weaker on Friday in the wake of dire employment figures, the US measures — bolstered by further actions in Europe and elsewhere (see below for more) — at least temporarily stabilised financial markets after they had been faced with a potentially catastrophic scenario a week earlier.

“The previous week — the worst since 2008 — was an extraordinary week of financial and economic deleveraging, with dramatic consequences for capital markets,” said Vincent Hoarau, head of FI syndicate at Crédit Agricole CIB (CACIB). “Central banks backstopped facilities and liquidity while everyone worked on securing cash. The greatest challenges and priorities were how to fix the underlying situation, contain the magnitude of the global recession, and keep the financial system functional.

“The subsequent avalanche of policy responses — monetary and fiscal — triggered a sharp rebound in risk assets as market participants absorbed all the details.”

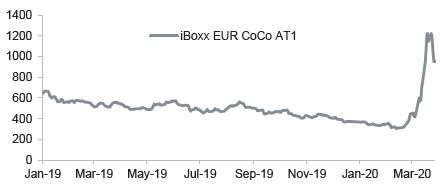

Secondary AT1 index

Source: Markit, Crédit Agricole CIB

The latest measures allowed US fixed income markets to pick up speed after they had already absorbed $63bn of investment grade supply the previous week, with even more new issuance taking March IG volumes to record levels.

New deals quickly snapped tighter — a $6bn (€5.6bn) two-tranche trade for Wells Fargo in the 10 and 30 year parts of the curve on Monday priced at Treasuries plus 375bp and 370bp, respectively, was quoted some 100bp tighter on Thursday alongside similar tightening on deals for Citi, JP Morgan and Morgan Stanley issued the previous Thursday. HSBC opened the Yankee market on Wednesday, with its $2.5bn 10 year HoldCo senior deal being priced at 415bp following initial price thoughts (IPTs) of the 460bp area on the back of $17.5bn of orders, and tightening some 75bp by the following day as Credit Suisse and Standard Chartered entered the market.

“The magnitude of the financial institutions supply over the past two weeks — some $40bn — coupled with the quick sequencing underscores the strong market liquidity that continues to support market access for the big banks — despite an even more active corporate new issue calendar,” said Fadi Attia, managing director, US dollar FIG, at CACIB.

“Significant tightening of spreads on the break of 20bp-30bp reflects follow-through buying on secondary and is repricing the next deal tighter. The velocity of the move tighter has been quite remarkable and new issues are now repricing older secondary bonds tighter.”

He highlighted that the bulk of financial institutions’ dollar issuance has responded to a concentration of demand in the 10 and 30 year maturities, flattening curves materially and in some cases leaving then meaningfully inverted. However, State Street and Goldman Sachs tested the three and five year maturities on Thursday and Attia said the front end of the curve should open up going into the second quarter, noting the activation of the Fed’s Commercial Paper Funding Facility (CPFF) in mid-April.

“While US banks led the charge in reopening the market for FIs, Yankee banks are following suit,” he added. “Expect others to follow over the next few weeks as they have more runway before they enter their blackout periods, with their US peers starting reporting on 14 April.

“We are nowhere close to being out of the woods, but for the time being things are heading in the right direction and windows of execution are available for size in US dollars.”

Euros open tentatively for banks

Euro fixed income issuance surged, with some €75bn of supply hitting screens across asset classes and collectively garnering over €400bn of orders. As well as representing a sharp pick-up on the previous week’s €12bn of supply, the new issue volumes were the second highest of any week this year, behind only the record-breaking first week of 2020.

Financial institutions contributed €10bn of the total (excluding covered bonds), although only US and non-Eurozone banks chose to enter the market at the new levels.

Bank of America led the charge on Tuesday with the first senior euro deal in over a month, selling a €1.5bn nine year non-call eight HoldCo deal at 365bp over mid-swaps. This paved the way for the UK’s Lloyds, Barclays and NatWest, as well as Credit Suisse and Goldman Sachs to hit the market in the five year part of the curve on Wednesday and Thursday.

“As in the US, new issue concessions have been elevated — in the context of 50bp,” said Hoarau at CACIB. “This supported robust demand with multiple times subscribed books — order volumes sometimes exceeded the €10bn mark — suggesting some signs of exuberance already. The hunt for yield remains intact.”

But although the new issues were anything from three to six times oversubscribed and priced at spreads of 350bp-375bp over, tightening from IPTs to re-offer was in some cases less than anticipated — Lloyds Banking Group’s €1.5bn six year trade on Wednesday, for example, was priced at 375bp over mid-swaps following initial talk of the 400bp area. Meanwhile, NatWest’s €1bn five year trade widened significantly in the aftermarket.

“The IPTs have been extremely generous, which tells us that the market is actually a little bit worried about getting deals away,” said William Rabicano, director, credit trading, at CACIB, “and the execution and performance of the new issues shows the market still isn’t entirely convinced. The new issue premiums have spooked the market a little — obviously now everyone expects any issuance that does hit the screens to be coming with a NIP of 50bp-plus against secondary paper just to get people interested, and people are mindful of a possible deluge of supply.

“The market could get saturated very quickly, but there definitely is real money buying, especially in seasoned bonds, at these levels.”

The ECB has more firepower at its disposal after the PEPP legal act was published on Wednesday, but Eurozone supply expectations remain modest in light of the elevated costs — not least because of the other funding support the central bank is offering financial institutions.

“The activation of PEPP is set to stabilise credit spreads further, as liquidity should spread indirectly across the entire bank capital structure,” said CACIB’s Hoarau. “This should encourage Eurozone issuers to consider primary in senior format, while two-way flows also having returned in secondary. But I expect to see a resurgence of euro covered bond new issues before we can anticipate a deluge of deals in higher beta instruments from continental Europe borrowers.

“Hybrid debt will in any case for some time continue to be highly correlated to equity, where volatility will persist,” he added. “Unfortunately, we still have a lot of bad news ahead of us and this will drive the valuation of risk assets south.”

According to Hoarau, factors to monitor in this respect include:

● The effectiveness of stimulus measures: moving from a policy announcement-driven market to a policy effectiveness-driven one;

● A deterioration in economic data points as lockdown measures are intensified and implemented more widely;

● The significant lag between data and the on-the-ground situation it reflects, obscuring visibility around the economic turning point;

● Nonfarm payrolls;

● Corporate recession, defaults, and the rating impact as companies file for bankruptcy;

● A likely wave of bank announcements (profit warnings/pay-out cuts) and rating agency actions;

● Those with weak balance sheets, who will suffer the most;

● Last, but not least, the Covid-19 death toll in Europe and the US: the worst is yet to come. The underlying situation needs to improve before there is some light at the end of the tunnel.

AT1 prices bounce back, but calls still in doubt

Additional Tier 1 prices have been closely correlated with equity movements, hitting bottom on 18 March as the Dow suffered record losses, before recovering sharply from last Tuesday onward as share prices surged.

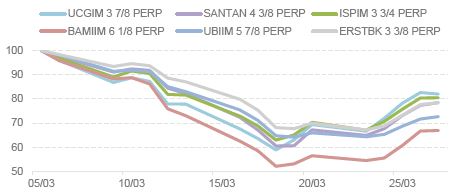

The whiplash moves were highlighted in extremis by the performance of a $1.25bn 6% perpetual non-call five AT1 issued by Deutsche Bank on 11 February: the recent issue fell from par to a cash price near 50, before recovering to trade around 70 at the end of last week.

Selected AT1 performance (cash price rebased on 5 March)

Source: Crédit Agricole CIB

Although more recent issuance with lower reset spreads faced the biggest swings, even older AT1s less subject to convexity dipped below January 2016 lows amid the sell-off.

The heightened extension risk of AT1 as prices fall explains their underperformance versus alternative asset classes, but concentrated selling pressure played a large part in the downward move, according to CACIB AT1 trader Nigel Brady.

“The other main factor last week was some heavy margin call selling from Asia,” he said.

However, both the convexity of the instrument and the behaviour of the wider investor base also played their role in helping AT1 outperform as markets rallied in the past week.

“There was no more selling pressure from Asia,” said Brady, “and actually we had new cash coming into the market. We knew that the amount of Asian money to be put to work is huge, and for every five or so investors facing margin calls, there are another 95 who are happy to step in.”

Contributing to the upswing and encouraging for the asset class has been the behaviour of European CoCo funds.

“The big funds weren’t selling much,” said Brady, “and this past week we saw some start buying. That was a very positive sign that there wouldn’t be the forced selling that people potentially feared, and it was supportive to have that off the table.

“The whole system is still very vulnerable,” he added, “but if we see another meltdown, it’s not necessarily going to be an AT1-specific thing.”

However, AT1 prices remain in a corridor of uncertainty when it comes to upcoming first call dates. After Deutsche on 11 March announced that it is not calling a $1.25bn 6.25% AT1 next month, Aareal Bank did likewise on 20 March for a €300m 7.625% issue, although all other AT1s have been called this year, most recently SEB announcing it will be redeeming a $1.1bn 5.75% AT1 in May.

“Even though we’ve bounced back,” said Brady, “a number of these issues are well out of the money. Whereas back in February everybody was refinancing because they knew these bonds could definitely be called, that’s definitely no longer the case, so market participants will be very keen to check on forthcoming calls on a case by case basis.”

Heading the queue with a call window from 28 April to 28 May is a €750m 6.375% Lloyds AT1 with a first call date on 27 June, callable every five years thereafter. This was most recently quoted around 95, according to Brady, but could on the one hand be called at par or on the other trade down to 90.

“With a reset of 529bp, this bond is out of the money economically from being called in the current environment,” said Neel Shah, financial credit analyst at CACIB. “There is still at least a month before the call window opens, so the probability of the call will closely follow the overall tone in the AT1 market.”

Pressures postponed as Basel Committee joins regulatory relief efforts

The Basel Committee on Banking Supervision on Friday delayed the implementation of Basel IV by a year, in the latest of a series of regulatory initiatives that should alleviate short term pressures on banks — even if they will face challenges later in the year.

“Today’s measures will free up operational capacity for banks and supervisors as they respond to the economic impact of Covid-19,” said Pablo Hernández de Cos, chairman of the Basel Committee and governor of the Bank of Spain.

The deferral comes after the easing of capital requirements by various supervisory authorities, notably the ECB in conjunction with the launch of PEPP. The European Banking Authority and European Securities & Markets Authority have meanwhile moved to mitigate the potential impact of debt moratoria under IFRS9.

“The regulators want to help banks better absorb whatever the economy throws at them in terms of extra lending or loans becoming non-performing,” says Cécile Bidet, head of DCM solutions and advisory at Crédit Agricole CIB. “What is very clear is that the banks can now operate within their current capital stack.

“This helps bridge the time until markets reopen and banks are better able to access capital when pressure on CET1 materialises later this year. Banks who had been preparing for the risk-weighted asset inflation of Basel IV will also be better positioned now that has been postponed.”

Further alleviating the need for banks to issue AT1 is the possibility of not calling outstanding issues, she notes.

Also on Friday, the ECB — in line with some Nordic supervisors and individual bank initiatives by the likes of Santander — recommended that banks pay out no dividends. Bidet believes this should not have any negative implications for AT1 coupons.

“The guidance on MDA is very clear and banks are operating well above their MDA,” she says. “The Spanish and the Germans are close to 2% but still have headroom, for example, while the weakest of the Dutch, ING, has 4% and hence they are quite comfortable.

“So I don’t think AT1 coupon skipping is going to materialise yet.”

MREL has been absent from the raft of supervisory announcements and Bidet suggests this is one area in which pressure could begin to build.

“The total MREL needed may have been reduced by the capital requirement measures,” she says, “but the subordination requirement has not been reduced or affected at all. And at the moment the market is only open for covered bonds or for senior at very expensive levels.

“Everybody is rightly focused on the current situation, but we need to be careful about what could happen further down the line.”

Noting that rating agencies have now begun a likely cycle of negative rating actions, Bidet says downgrades could be a further obstacle to banks accessing the market.

“We could see structures being adapted and more defensive structures used,” she suggests. “On AT1 the choice is limited, but we could perhaps see a five year bullet Tier 2, for example.”