Market ‘wide open’ as insurers outperform banks in rebound

The insurance sector’s apparent health entering the crisis has not offered it immunity from the volatility and widening that have struck financial markets, according to André Bonnal, FI syndicate at Crédit Agricole CIB.

You can also download a pdf version of this article within a broader insurance sector feature here.

“Insurers have not escaped seeing their spreads being stressed,” he says, “and that’s been the case across the whole capital structure, be that senior, Tier 2 or the RT1 space, which — similarly to AT1 — has been extremely bruised.”

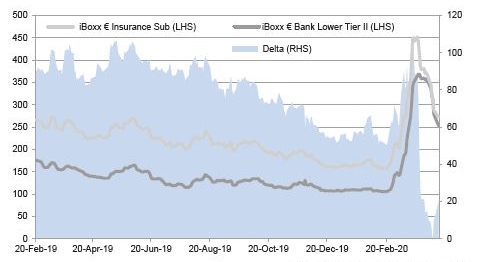

In keeping with past performance in strong credit market moves, the sector underperformed banks during financial markets’ initial capitulation in the face of the coronavirus. However, Bonnal notes that more recently the insurance sector has outperformed banks, with the differential between their key iBoxx indices widening from a tight of 50bp in February to as much as 100bp, before narrowing to some 20bp.

Insurance sub debt vs. bank Tier 2

Source: Markit, Crédit Agricole CIB

He attributes this to two factors. Firstly, the ramping up of ECB QE, with senior insurance paper eligible for the corporate sector purchase programme (CSPP) and PEPP.

“That helped erase a lot of the insurance widening,” says Bonnal. “Euro insurance Tier 2 cannot but perform when you have the direct impact of the Eurosystem on the euro senior market.”

The second reason behind the relative improvement in insurance spreads versus banks, he adds, is the vulnerability of bank Tier 2 ratings to downgrades that could see them become sub-investment grade or split-rated.

In spite of the sector’s positives and the reopening of the euro market for a range of asset classes, insurers are yet to test investor appetite in the new environment, with no supply since as far back as January. But Bonnal says the market is wide open should any insurer step forward.

“The fact we haven’t seen any supply is in itself a strong support,” he says. “If you are a Eurosystem-eligible name, you are going to get direct traction from that, and even if you are not eligible you are going to indirectly benefit.

“And we’ve seen from the corporate side that essentially all tenors are open.”

The US dollar market has already seen a resurgence of insurance supply in recent weeks. MetLife and Aflac, for example, each sold $1bn 10 year issues on 19 and 30 March at Treasuries plus 350bp and 295bp, respectively, as markets recovered from the record falls in equities, and non-US names AIA and Prudential following as the US supply tightened.

“All the deals were very well received and have performed well on the secondary, underscoring the deep bid for this rare paper,” says Fadi Attia, managing director, US dollar FIG, at CACIB. “Relative value is also attractive compared to the US bank paper that has come to market in big size during the same period.

“The Investor bid has been strongest in the long end of the curve — 10 years and longer — which has dovetailed well with issuer needs in this space. The funding dynamic has been similar to other sectors, namely borrowers taking advantage of significant cash on the buyside, a robust enough market window, and the opportunity to bolster their liquidity.”

Bonnal says the next step in the market reopening, for either the euro or US dollar market, is a subordinated trade.

“It was perhaps a bit premature last week, but after the recent insane rally on credit spreads, it’s impossible to say that a subordinated trade would not work in the current market,” he says, “especially as the underlying Covid-19 situation continues to show signs of improvement.”

Read more about the state of the insurance sector in the face of the pandemic here.