Insurers pass initial test of resilience, but unknowns could impact solvency ratios

Insurers have weathered the initial impact of the Covid-19 pandemic, but second round effects could put pressure on solvency ratios. Neil Day surveys the industry’s health, with insights from Crédit Agricole CIB’s Michael Benyaya and Julien de Saussure of Edmond de Rothschild Asset Management (France), while CACIB FI syndicate appraise the market impact.

You can also download a pdf version of this article here.

First, the good news: over a month into the most testing time for the global economy since the Great Depression, all but one of the largest insurance markets covered by S&P Global Ratings remained on stable outlook.

In a research note, Covid-19 will test insurers’ resilience, published on 25 March, S&P highlighted that the industry’s average rating of A is the highest of any corporate or financial services industry it rates, and that the capital strength typical of the insurance sector will help it stave off widespread downgrades in the face of the pandemic.

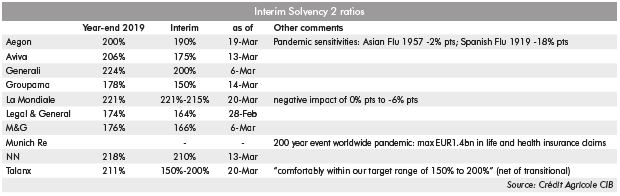

Within Europe, Solvency 2 ratios stood at around 200% or greater before the coronavirus struck, notes Michael Benyaya, DCM solutions, Crédit Agricole CIB.

“The majority of insurance companies entered the crisis in a position of strength,” he says. “And the sensitivities they have published generally show that Solvency 2 ratios are quite resilient to market shocks, so for now insurance companies seem able to weather the storm.”

European insurers’ regulatory solvency ratios decreased by around 20 percentage points on average from the beginning of 2020 to the end of the first quarter, according to Moody’s estimates, although it noted that the ratios remained at “strong levels” of around 190% — which Benyaya says is backed up by interim announcements from the insurers themselves.

(Expand/download table at bottom of article for further details on solvency ratios and sensitivities.)

The bad news is that the strength of insurers’ business models and capital buffers are set to be tested by a macroeconomic backdrop and financial market stresses that remain an unknown quantity.

S&P says the greatest “pain point” for the industry’s creditworthiness is disruption to financial markets.

“The actual market shocks we are observing — particularly for equities and corporate bonds — go beyond the reported sensitivities,” says CACIB’s Benyaya, “and we have no idea of the behaviour of the Solvency 2 ratio in such a scenario.

“We suspect that there is a very high level of convexity,” he adds, “so if we are beyond the reported sensitivities, it is very likely that the shock to the Solvency 2 ratio will be meaningful.”

Moody’s incorporated a 100bp increase in spreads in its estimates, double the 50bp typically used in insurers’ reported sensitivities (although a 10bp swap rate fall versus a typical 50bp), but agrees solvency ratios remain very sensitive to potential further reductions in interest rates and to potential spread widening. It noted that European Central Bank and government stimulus measures — such as the ECB’s Pandemic Emergency Purchase Programme (PEPP) — are providing some relief, but that corporate bond spreads remain elevated, while some government bond spreads have also increased.

The rating agencies themselves could be the harbingers of second round negative effects on Solvency 2 ratios in the form of downgrades of corporate bonds that are already underway and set to hit insurers’ figures in the coming months and quarters.

“The interest rate, spreads and equity shocks affect the solvency position in real time,” notes Julien de Saussure, fund manager at Edmond de Rothschild Asset Management (France) (EDRAM), “but the solvency impact stemming from the rating migration will take more time to materialise.”

Should insurers’ capital buffers deteriorate further, greater proximity to mandatory coupon deferral triggers could exert pressure on S&P’s ratings of some hybrids, following changes to its criteria in July 2019. Under the new methodology, a Solvency 2 ratio below 165% could result in a wider notching between insurers’ ratings and their hybrids’ ratings to reflect a higher risk to coupon payment.

“We are closely monitoring the solvency ratios and their sensitivity to market movements for those issuers that have issued rated hybrids that include these mandatory deferral features,” says S&P, noting these are most common in EMEA and Bermuda.

Claims manageable, clamour unpredictable

While S&P considers life insurers to be more at risk of negative rating actions than non-life players because of larger exposure to financial market risk, it considers mortality and medical claims to be manageable.

For example, a hypothetical US life insurance industry stress test based on a “moderate” mortality stress similar to 1957 Asian flu would result in additional mortality claims equivalent to about 2% of capital in the US life market, according to S&P analysis, while a “severe” mortality stress based on 1918 Spanish flu would result in additional claims equivalent to 12% of capital ($52bn).

Moody’s says claims increases across the industry should in general remain manageable unless the lethality of the virus increases, but nevertheless has changed the outlook on the UK and Italian life insurance sectors from stable to negative. Among the largest markets S&P covers, the only one on negative outlook is Asia-Pacific primary life insurers.

Although the pressures facing insurance companies are lessened by the fact that pandemic-related claims are excluded from most business interruption policies, some observers warn that insurers could be drawn into costly ad hoc measures in response to the pandemic and its effects.

“For now, claims look to be fine,” says CACIB’s Benyaya, “but what happens if insurers are called upon to participate in the collective effort, so to speak? Perhaps governments will ask insurance companies to provide greater support to the population, for example, by extending initial guarantees or minimising premiums.

“If that were to happen, the impact could be quite meaningful.”

French insurers have already contributed €200m to a special solidarity fund to maintain guarantees for corporates late in paying premiums and to cover some sick leave normally excluded from their policies, notes Moody’s, while S&P highlights that in the US legislation to extend business interruption policies retroactively to cover virus-related losses was floated in one state.

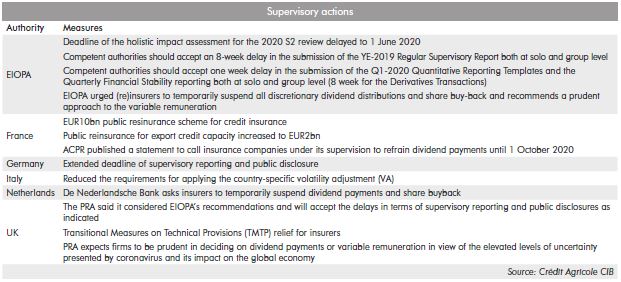

Insurance companies have at the same time not benefited from anything like the degree of forbearance measures that authorities have granted in favour of banks, such as capital relief and the postponement of Basel IV.

“Banks benefit from regulatory forbearance because they are used by governments to channel credit to the real economy,” says de Saussure at EDRAM. “This is less true for insurance companies, and regulatory measures have been limited so far.”

Among the few initiatives that have been undertaken, he cites a reduction in the country-specific volatility adjuster in Italy, which mitigates for insurers the impact of severe BTP volatility. Elsewhere, the only respite offered to insurers has mainly come in the form of week to months long delays to various reporting requirements.

Benyaya at CACIB attributes the muted response partly to the lack of a single Europe-wide supervisory mechanism for the insurance industry, contrasting this to the banking sector, where the regulatory relief was also announced in conjunction with the ECB’s PEPP.

Cautious confidence on refinancing

The mitigated impact of the pandemic on insurers’ businesses and their capital strength are cited by rating agencies and others as reasons to be relatively relaxed about any impact of financial market disruptions on their liquidity and capital positions.

Moody’s, for example, notes that although delayed premium payments and lower levels of business activity will likely reduce insurers’ liquidity, they hold substantial volumes of liquid assets — even if some have lately increased illiquid investments — and the rating agency says European insurers face little refinancing risks in the short term.

And CACIB’s Benyaya says insurers’ solid solvency positions mean that substantial capital-raising exercises are unlikely to materialise yet.

“But as the situation develops, I would not be surprised if here and there we see some capital-raising mostly in the form of sub debt,” he adds, “if and when the market reopens, of course.”

See market article here for more.

S&P notes that the first insurance issuance to have occurred since the onset of the crisis — in the US market — has had to pay higher spreads, suggesting some insurers may turn to liquidity programmes such as credit facilities or commercial paper programmes to ease any pressures in the difficult environment, with short term implications for leverage.

“If bond issuances dry up for a significant period of time,” the rating agency adds, “insurers with bonds due to mature during that time could face some capital pressure if they cannot refinance them. Where instruments are up for call, insurers risk alienating investors if they decide against the call due to refinancing risk.”

S&P says it will closely monitor the capital positions of issuers with forthcoming calls or maturities, but notes that many insurers took advantage of low rates to prefinance.

De Saussure at EDRAM says extension risk in the insurance sector is lower than for banks, some of whom have, for example, already extended Additional Tier 1 instruments.

“The existence of the 100bp step-up, the amount of Solvency 2 grandfathered instruments in the insurance market, and the recent Tier 2 call by AXA show that extension risk is limited in the insurance space, despite the change in S&P criteria that reduced the minimum required residual maturity to 10 years.”

Another flashpoint for bank sub debt that has not yet played out in the insurance sector is dividend cancellation to conserve capital. Observers note, again, that while the ECB was in the position to recommend this of banks, the issue is dealt with piecemeal across Europe in the insurance industry.

EDRAM’s de Saussure nevertheless notes that any decisions in this regard will need to be monitored.

“The dividend debate in the insurance space also has implications for Tier 2 subordinated debt holders,” he says, “as the optional deferral remains subject to a dividend pusher.”

Click the image below to expand detailed solvency ratios table, or download it within the full article in pdf format.