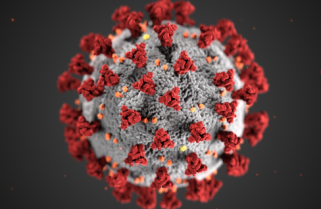

Vaccines look set to offer the world a way out of the pandemic, but the damage wrought by Covid-19 should ensure monetary and fiscal support persist. How will banks and AT1 fare in light of this and the regulatory response ...

2021: A new hope

Focus

Crédit Agricole CIB hosted a web conference themed “Banking turbulences in a Covid world: the regulatory angle”, with delegates hearing from European Central Bank (ECB) supervisory board member Edouard Fernandez-Bollo, ...

Banking turbulences in a Covid world: ECB, SRB & EBA on supervisory priorities

Focus

Insurers have weathered the initial impact of the Covid-19 pandemic, but second round effects could put pressure on solvency ratios. Neil Day surveys the industry’s health, with insights from Crédit Agricole CIB’s ...

Insurers pass initial test of resilience, but unknowns could impact solvency ratios

Focus

Financial markets’ capitulation in the face of the coronavirus has proven a reality check for the Additional Tier 1 market, with prices collapsing after a booming start to the year. Here, issuers, investors and Crédit ...

AT1: Reality check

Focus

2019 was going to be all about quantitative tightening, right? Wrong! QE is back on the agenda in a big way, with Christine Lagarde’s forthcoming arrival as new ECB president helping reboot the bond market rally. With ...

QE is dead! Long live QE!

Focus

The window for Santander to decide whether to call an AT1 in March had been a date for the diary since the turn of the year, and the Spanish bank duly made history with the first non-call. But the market’s reaction ...

AT1: To call, or not to call?

Focus

Investor scrutiny of call schedules increased further in the wake of Santander’s AT1 non-call, with a CACIB investor survey finding resistance to giving away quarterly optionality for free, although a KBC EUR500m AT1 on 26 ...

Call schedules face closer scrutiny

Focus

In spite of the insurance sector’s attractions, technicals contributed to it underperforming in 2018. Crédit Agricole CIB and Bank+Insurance Hybrid Capital gathered issuers and investors together to find out how ...

Insurance Outlook 2019

Focus

Politics trumps economic fundamentals in the New Year outlook, an investor survey by Crédit Agricole CIB’s FI syndicate has found. But in spite of the volatility Italy and Brexit may bring, the buyside is less bearish ...