AT1: To call, or not to call?

The window for Santander to decide whether to call an AT1 in March had been a date for the diary since the turn of the year, and the Spanish bank duly made history with the first non-call. But the market’s reaction suggests it may have been a case of much ado about nothing, even if some investors are reappraising pricing and call schedules. Neil Day reports.

Fears that the first non-call of an Additional Tier 1 could do lasting damage to the asset class were allayed in February, as AT1 prices held up despite Santander deciding not to call a euro AT1 and investors proved willing to pick up the outstanding Spanish instrument, even if its handling proved contentious.

The EUR1.5bn 6.25% perpetual security with a first call date of 12 March 2019 had long been viewed as a candidate for being the first AT1 not to be called, given that it was trading at a cash price in the low 90s in early January and the anticipated refinancing spread made a call look potentially uneconomic.

Many investors had been concerned that a non-call could have a sustained and negative impact on AT1 valuations, and a quarter of buyside respondents to a Crédit Agricole CIB survey in November 2018 said that such an event would shut down the primary market for AT1s.

Speculation about Santander’s intentions then mounted on 6 February when it approached the market with a new $1.2bn (EUR1.06bn) 7.5% perpetual non-call five AT1 (CACIB was joint bookrunner) (see below for more) — although the new issue announcement did not contain any notice or other confirmation of a call.

The Spanish bank had until 12 February to issue a call notice for the euro AT1 and late that afternoon reports emerged that the issuer would not be exercising the call option.

“When making call judgments we have an obligation to assess the economics and balance the interests of all investors,” Santander said in a statement. “We will continue to monitor the market closely and will seek to exercise call options where we believe it is right to do so.”

The price then fell from 98.50 to below 97.00, but it quickly recovered and was trading back in the context of 98.50 or higher the next day.

“It dipped below 97.00 for literally a couple of minutes,” said Nigel Brady, AT1 trader at Crédit Agricole CIB (CACIB), “and then we had real money accounts — who had all been buying at 98.50 to 99.90 — wanting to top up at 97.00, 97.50.”

In spite of complaints from some investors that were amplified in press reports in the immediate aftermath of the non-call, Brady said the market was well prepared for the event.

“I just don’t think this was a huge surprise from Santander,” he added. “In the last few days an increasing number of investors were resigned to the fact that it wasn’t going to be called — they’d looked through the facts, considered it from the issuer’s point of view and its statement around the call exercise the week before when it released earnings on 30 January, and come to that conclusion.

“People were saying that there was a 10%-20% chance of a non-call, but the market was pricing in a much higher probability.”

Alexander Pelteshki, investment manager, fixed income, at Kames Capital, noted that Santander had been very vocal that its decision would be primarily an economic one.

“This, combined with the particular structure of the bonds in question, as well as the current size of Santander’s AT1 bucket, ought to have left very little to the imagination regarding the call for anyone sporting a decent-sized calculator,” he said.

Business as usual

The non-call event had a negligible impact on the rest of the asset class, according to Brady, with prices unmoved. He said this was particularly notable in certain dollar issues that — unlike most euro AT1 — have not been pricing the non-call risk so efficiently, and still have not done so in the aftermath of Santander.

“You would have expected those bonds to have sold off as the market comes to the realisation that bonds aren’t necessarily going to be called,” he added, “but they haven’t.”

Brady said the market’s reaction was encouraging for the future of the asset class.

“The market is now valuing the Santander bond on a yield to perp basis of 6.60% and a lot of investors — real money and retail — are happy to buy it there,” he said. “Previously, we didn’t know whether investors would be comfortable owning the bonds once a call has been skipped, but it has now been proven.”

Buoyant credit market conditions contributed to the market’s benign response to the non-call, according to Vincent Hoarau, head of FI syndicate at CACIB (pictured below). The market saw successful peripheral subordinated issuance follow in the week of the non-call, such as BBVA in 10 non-call five Tier 2 format enjoying a five times oversubscribed book with no new issue concession — further underlining the idiosyncratic nature of the episode.

“Conditions in primary are very favourable, and that helps explain the reaction we saw from the market,” he said. “If it had happened in the context of an avalanche of supply in SNP, Tier 2 and AT1, the market would in my opinion have collapsed on the back of the absence of a call notice.

“We are in a market characterised by a relative lack of supply in high beta format,” he added. “If you don’t want an AT1 from a high quality issuer at these levels, what are you going to buy? It’s still an issuer’s market, and this predicament investors are facing may have fuelled their misplaced hopes.”

And later in the week Svenska Handelsbanken proved definitively that appetite for AT1 remained strong, with the Swedish bank attracting over $4.5bn of orders to a $500m perpetual non-call five and achieving a competitive coupon of 6.25% and a reset below the symbolic 400 mark, as low as 368.9bp.

And Santander’s decision appeared to have a negligible impact on the execution of subsequent AT1s in the dollar market, where ING and Crédit Agricole also successfully launched new issues.

“The topic was not even a focus of any of the major investors during the bookbuilding of the Crédit Agricole AT1 US dollar deal,” said Fadi Attia, managing director, US dollar FIG at bookrunner CACIB. “Investors will continue to distinguish between issuers on the basis of credit and valuation — it’s not a one-size-fits-all approach.”

Pause for thought

Santander’s handling of the non-call was nevertheless deemed to have exacerbated an episode that was always likely to prove sensitive for investors trying to gauge the probability of the bank not calling the issue and potentially setting a new precedent for the relatively young instrument.

“In the case of the Santander instrument, the market’s surprise may have stemmed as much from misreading Santander’s intentions as from underestimating its willingness to challenge market norms,” said Giles Edwards, senior director, financial services ratings at S&P Global. “Santander has long stated that it would make these call decisions based on their economic merit, and the market might have read too much into the bank’s recent issuance of a new US dollar AT1 security.”

Indeed, to some market participants the announcement of the new dollar AT1 on Wednesday, 6 February suggested the issuance might be to refinance a call of the euro. This impression was reinforced by an unusually short, T+2, settlement period, which market participants initially considered meant settlement would fall on the last day on which Santander could issue a call notice for the euro, two days later, on the Friday. Santander then informed the market that according to its interpretation, the following Tuesday was the last day on which it could issue a call notice — however, this attempt at clarification only reinforced speculation the issuer might call the bond. As a result, the price of the euro rose from 98.00 to above 99.00, before its later price action around the non-call, while the new dollar issue widened after pricing.

One investor said he had initially not expected the euro to be called, but after the decision to print the $1.2bn AT1 and Santander pointing out its interpretation of the date, he entertained the possibility that it would be called. Others — whether involved in the euro and new dollar trades or not — flagged the Spanish bank’s communication strategy and said they would need to be paid more to get involved in future Santander issuance — raising questions over the “economic” decision of the issuer not to call.

Any decision to break with standard practice and simply not call such a hybrid had long been deemed to carry reputational risk.

“They have definitely removed a big no-no,” said Cécile Bidet, head of DCM solutions and advisory at CACIB. “Other issuers will see the market reaction and will now consider it possible to not call.”

But although Santander highlighted that it is prioritising economics in its decisions, Bidet warned against too simplistic a reading of its decision, with issuers making calculations in a variety of ways, depending on swaps, hedges, currencies, ALM strategies, etc.

On notice

The reset spread on the 6.25% euro was 541bp, implying a reset coupon of around 5.5% (which was ultimately set at 5.481%), and CACIB’s Hoarau estimated that fair value for a new euro perpetual non-call five would have been around 6% ahead of the non-call decision. A straightforward calculation put Santander’s saving in line with a threshold of around 50bp that many market participants previously considered could trigger a non-call.

Some market participants have meanwhile speculated that Santander may not have called the euro simply because it did not manage to put itself in a position to do so in time, and that it could yet call the bond at the second opportunity, during a window from 13 April to 13 May. One suggested Santander would not announce a call before 30 April, when it announces its first quarter results.

Neel Shah, financial credit desk analyst at CACIB (pictured below), said a call notice is more likely than in February/March.

“The economics are more in favour of calling it,” he said. “That’s just driven by the broader AT1 market, which has been very firm this year and made the economics of issuing AT1 for all issuers more favourable.”

Any upside from the euro being called is mostly priced in, noted Shah, although this also reflects the bond being callable on a quarterly basis.

The bonds rallied an eighth when Santander on 16 April exercised the first call on a $1.5bn 6.375% AT1, in the first test of its call policy since the non-call. This call had been anticipated and price in, since it had a reset spread of 479bp and the $1.2bn 7.5% issued in February was trading at 102.75, equivalent to a z-spread of around 450bp.

Although a call had been expected, the 6.375% issue rallied in the wake of the call notice, from around 99.875 to 100.30. All of Santander’s AT1s rose on the news and the 7.5% issue, now Santander’s most liquid AT1, was the biggest beneficiary, rallying from 102.75 to 103.50.

“Santander has demonstrated what it means to have an efficient and thought-out call policy,” said Hoarau. “If you look at the pricing and most importantly reset parameters of the 7.5% dollar AT1 issued in February, you may better understand the dynamic of the decision and the rationale of calling the 6.375% dollar now.

“Elsewhere AT1 refinancing costs continues to improve. I think we will hear more about Santander AT1s this year to the benefit of the sector.”

Alongside its full-year 2018 results, Santander flagged net AT1 issuance of EUR500m for 2019, and the issuance of its $1.2bn 7.5% and call of its $1.5bn 6.375% implies issuance of EUR763m to hit this target — or EUR2.263bn if it calls the EUR1.5bn euro at its second opportunity.

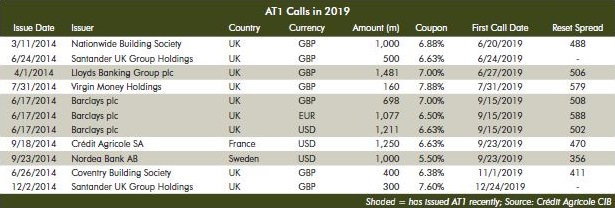

Among other AT1 call decisions being keenly awaited this year are those in respect of Barclays 6.625% dollar and 7% sterling trades on 15 September, and a Crédit Agricole 6.625% dollar on 23 September.

Unlike Santander’s AT1, which is callable quarterly after the first call date, these are only callable every five years, meaning that the calculation of extension risk and hence valuation differs.

(See here for more on call schedules.)

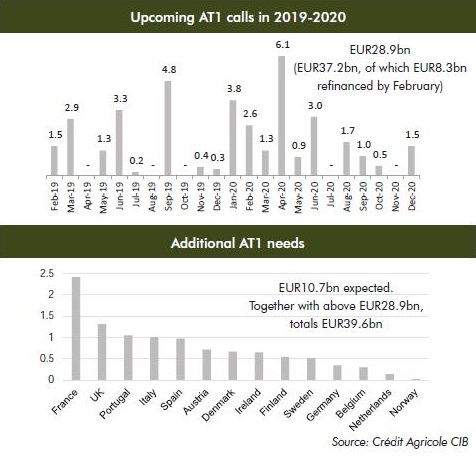

A greater focus on economics when it comes to call decisions is expected to be supported by a slowdown in net issuance of AT1, with major banks having largely filled their 1.5% buckets — subject to increases in RWAs resulting from, for example, the implementation of new Basel IV risk weights in 2022.

“This AT1 market is roughly $200bn,” said Shah at CACIB, “but most issuers have filled their AT1 bucket, so there is no pressure for them to issue any more AT1, and they are now looking at it purely from an economic perspective, in terms of what it costs them to issue a bond and the existing financing levels.”