Call schedules face closer scrutiny

Investor scrutiny of call schedules increased further in the wake of Santander’s AT1 non-call, with a CACIB investor survey finding resistance to giving away quarterly optionality for free, although a KBC EUR500m AT1 on 26 February successfully attracted some EUR2bn of orders in spite of similar concerns.

Among AT1 features called into question by the non-call was the quarterly call option after the first call date afforded Santander.

“Issuers already have a lot of value given to them in the call option and investors should no longer be giving quarterly away for free,” said one London-based portfolio manager in the wake of the non-call. “This is something I intend to bring up in every AT1 roadshow I attend going forward if the terms show quarterly calls.”

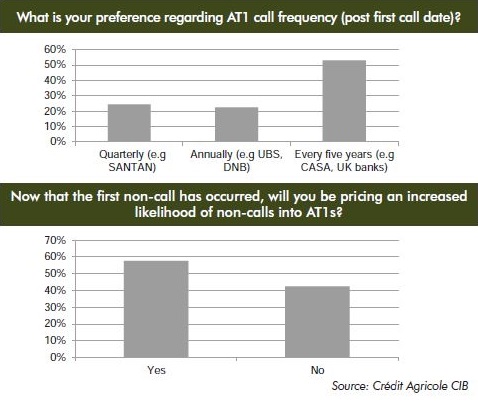

Crédit Agricole CIB (CACIB) FI syndicate surveyed almost 100 investors in the fortnight after Santander’s non-call and more than half of respondents, 53%, said they prefer AT1 to be callable every five years. Just less than a quarter, 24.5%, expressed a preference for quarterly calls, and 22.5% prefer annual calls.

Several investors subsequently said they did not participate in a KBC EUR500m 4.75% perpetual non-call five AT1 on 26 February because it is callable semi-annually after the first call date. Others participated despite looking unfavourably on the call schedule.

“We have gone in for it,” said one big player in Mayfair, “but for a significantly smaller size and only for a couple of funds. We would expect to end up with 20% of what we did in the last AT1 we liked, and the call schedule has definitely played a strong part in that decision.”

However, any investor disgruntlement with the call schedule had a negligible impact on KBC’s outcome, as the Belgian issuer attracted some EUR2bn of demand to its EUR500m no-grow AT1, allowing it to tighten pricing from initial price thoughts of the 5.375% area to a coupon of 4.75%.

“There was considerable interest in the issue of our euro-denominated CRD IV-compliant AT1 instrument of benchmark size, which was four times oversubscribed,” said Johan Thijs, KBC Group CEO. “The success of the transaction emphasizes the trust of the market in KBC’s solid capital position and business model.

“We continuously monitor our capital structure and our current portfolio of outstanding securities in light of market conditions. The issue of the securities enables us to maintain an optimal capital structure and continue to support our already excellent solvency ratios.”

Vincent Hoarau, head of FI syndicate at CACIB, said the limited size of the transaction and modest volumes of KBC worked in favour of the deal and diminished the impact of the call topic.

“KBC is a top credit,” added Hoarau, “but not a frequent issuer in subordinated format and the EUR500m no-grow size helped it gain traction from the outset. The books were several times oversubscribed even though the issuer hardly paid any new issue concession.

Despite acknowledging that they may have limited leverage over issuers and pricing, many investors were adamant that too much flexibility is being handed to issuers for free.

“Anything shorter than five years is open to abuse by the issuer,” said one portfolio manager. “It is giving too much optionality away without compensation.”

Some respondents suggested that quarterly calls should at least be accompanied by the coupon resetting on a quarterly basis. Others outlined the benefits of FRN AT1 in such circumstances, particularly in a low rate environment

“A quarterly call with quarterly reset is good,” said one. “A quarterly call with a five year reset — as in the Spanish case — is not good as it is impossible to hedge.”

However, one hedge fund manager argued that quarterly calls reduce the market impact of a non-call — as reflected in the non-called instrument never trading far from par.

Cécile Bidet, head of DCM Solutions and Advisory at CACIB (pictured below), expects the majority of issuers to opt for five year subsequent calls, driven by the market and regulators.

“This frequency offers the best response to investors towards hedging and reinvestment risks, and simplifies the call exercise management policy,” she said.

Investors shift towards uniform pricing stance

The survey meanwhile found that a clear majority of respondents, 57%, will be pricing an increased likelihood of non-calls in general into AT1s in light of Santander’s non-call decision.

Of the 42% who said they would not be pricing in an increased likelihood of non-calls, many stated they were already pricing in extension risk appropriately and clearly differentiating in the money and out of the money situations with the appropriate yield-to-call or yield-to-perp approach.

“I already did not assume calls would be exercised unless economically interesting for the issuer,” said one. “I actually assume the SSM won’t be allowing issuers to call and refinance at a much higher rate.”

Others said they consider Santander to be a special case, noting that its handling of the episode was the main factor in the price action surrounding the AT1 in question, while decisions taken by issuers with forthcoming first calls will be closely monitored.

“I await to see what others do,” said one investor. “If this gains momentum amongst issuers, then expect yields to increase.”