Bail-in: Joining the dots

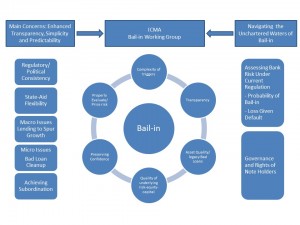

Bringing together various members of the ICMA Asset Management & Investors Council’s Bail-In Working Group, regulators, issuers and other market participants, a bail-in seminar, chaired by Tim Skeet, was held on 7 April to examine several aspects of the key area of banking regulatory reform: the bail-in regime and capital requirements for banks.

Convened under Chatham House rules, the seminar discussed three broad topics. These included an examination of pricing of bank debt in the current environment; a look at disclosure and credit evaluation of banks; and a debate on corporate governance for banks, with a specific focus on whether fixed income investors are getting a fair deal.

Pricing bank risk

There are two distinct lines of thought. On the one hand, the market appears well able to absorb the different capital instruments currently being issued by the main European banks. Pricing has moved away from being largely driven by supply and demand towards becoming more predominantly based on well established, market-driven factors, including the differentials between various degrees of subordination, although different parties may disagree over precise basis points differences. That said, stability of rules and clarity over, for example, point of non-viability (PONV) would certainly ease pricing.

On the other hand, some investors suggest that the current market is not indicative of the true underlying demand or pricing. Current markets are very technical, driven by a lack of alternative investment options, central bank QE actions, and limited ability to price accurately due to a lack of information.

Primary markets specialists agree that the market, particularly for AT1 instruments, is driven in part by investors in search for yield inflating demand, but a solid core of demand gives the market some depth. Investors suggest, however, that beyond the immediate positive market outlook, the underlying sector remains weak, volatile, and liable to close in response to bad news or unexpected events. This might suggest that the markets have the appearance of being robust but are not so.

Moreover, many smaller banks and some jurisdictions remain marginalised even in the current robust market conditions.

Another concern for market participants is the fact that there is no homogeneity of instruments, and that the market remains very fragmented when it comes to bail-in. Different jurisdictions offer different models (HoldCo versus OpCo, structural subordination, etc.) and there are differences between instruments even within jurisdictions, making the overall picture highly confusing and technical. This is particularly true of AT1/CoCo issues. It is largely up to investors to become familiar with the different regimes across the European Union in what has become a “tiered” system. This adds to the danger that investors will focus on those jurisdictions with the clearest rules of engagement and sideline others. Investors continue to call for simplicity as well as transparency, harmonisation of rules, and improved communication of each banks’ capital requirements throughout the EU.

Investors continue to argue that the market currently prices probability of default (PD), and as yet is not adequately taking into account the true loss-given-default (LGD) in light of the new bail-in rules and insolvency regime for banks. Some investors warn that the current firm demand for bank risk will not end well and predict that significant losses may be likely for unwary investors in the event of a large adjustment in very narrow, illiquid secondary markets. Opinion remains divided on these points.

Disclosure and credit analysis

While much has been done to standardise definitions and data for balance sheet disclosure purposes, particularly regarding asset quality (NPLs, etc.), there remain areas of great uncertainty. Mindful of the technological challenges, analysts continue to ask for standardisation of data, and a unified chart of accounts for European banks to allow a better cross-border comparison of fundamentals, something that is well developed in the US. They acknowledge, however, that much progress has been made, although availability of information remains slow.

Analysts noted the significant bad loan overhang that remains in the euro area and certain periphery jurisdictions where NPLs relative to GDP remain at unprecedented levels. Some argue strongly that the bad loan overhang needs to be resolved before investors are potentially asked to pay for clean-ups of legacy NPLs. A good bank/bad bank solution should be considered. The probability of bail-in remains quite high, a risk that more conservative analysts/investors are not prepared to take on in the absence of a credible plan to deal with the bad loans.

Large areas of public policy remain unclear, particularly regarding bank resolution. Competition policy, ECB intervention and flexibility on EU State Aid, and local regulators setting varying priorities, all add up to unpredictable challenges for investors. In addition, there is uncertainty over key Pillar 2 and accounting (IFRS 9) guidelines, MREL strategies, SREP guidance, and the strategies on individual classes of instruments. Without clarity, some investors argue that it is hard to evaluate a bank’s performance and if it might be in trouble, at what point the authorities might wish to intervene and on what basis. Lack of clarity over the PONV — and how it relates to a resolution — remains a concern.

Against these arguments, issuers and regulators argue that informal internal guidelines will become unhelpful and inflexible targets once in the hands of investors. Regulators realise that they need to have flexibility to deal with future unpredictable banking crises. Regulators need to reserve the right to intervene with precautionary recapitalisations.

Nevertheless, although the failure rate for banks is significantly higher than for corporates, increases in capital and reduction in gearing have made a significant contribution to improving the overall quality of banks’ balance sheets.

Overall, the consensus was that the level of regulatory transparency and disclosure requires further work and enhancement.

On a more practical note, analysts observe that the buy-side needs to focus more on balance sheet analysis as well as technical and regulatory evaluation.

Given the above challenges, an open question remains: what happens with the first bail-in of a large European bank?

The governance debate

The key question many investors are asking is whether there is a fair balance between the rights and obligations of debt holders versus shareholders. The cumulative impact of bail-in and other bank capital and liquidity rules have increased levels of subordination for fixed income investors and increased exposure to regulatory change. Shareholders, under some scenarios, enjoy a better risk/reward trade-off, their rights are clearly defined and they have an ability to make their voice heard.

There is no easy solution to this. Fixed income investors have historically not wished to become involved in managerial decisions, but given the actual or potential capital nature of their exposures, a rebalancing of their rights should be considered. One aim must be to ensure that noteholders always do better than shareholders under all scenarios. In the case of CoCo bonds, for instance, investors note that they can potentially receive unfavourable treatment.

There may be a requirement for additional rights to accrue to investors in cases where they have been written down to protect them against unfair treatment by regulators, bank managements, or even shareholders. There is an evident potential conflict of interest between the interests of shareholders and those of noteholders that has not been fully addressed to date.

The general comment is that the incentives in fixed income instruments are set up badly. Regulators and the market should work together to exert discipline and better align interests in the pursuit of a more stable and predictable long term source of capital for banks, in all cases before any future crisis might strike.

There is also a wider debate to be had over the role of banks and the shape of their businesses in the broader context of the modern European economy. Changes to regulations and response to the past crisis have curtailed key aspects of the functioning of banks without broader consideration of the effects of this.

In particular, it should be considered how the crucial multiplier effect of leverage and maturity transformation roles of banks will function in future. Will banks be able to provide the necessary levels of capital as Western economies begin to grow once more? If sources of capital remain uncertain or restrictive, this will further hinder future growth.

There was no consensus on these questions but participants were asked to consider if the bail-in rules are the right response to the future needs of the European banking system, if they will work in practice, and if the system is significantly more robust. While there is much evidence to suggest that great progress has indeed been made, that the legacy concerns around bank balance sheets have been in many cases (but significantly not all) dealt with, the lack of an overall coherent plan leaves the system potentially still vulnerable to future shocks.

Against this, some participants felt that re-regulating banks was a work in progress and that the industry is now set on a better course. Bank bail-in may not be fully refined or perfect, but represents a better set of policy options compared to open-ended bail-out that characterised previous interventions.

Click chart to zoom

The Bail-in Working Group (BIWG) is comprised of a number of highly experienced industry specialists who, speaking as a team, amplify a buy-side consensus. The BIWG reports into, and is supported by, the Asset Management & Investors Council (AMIC), the buyside voice of the International Capital Market Association (ICMA).