Insurance outlook 2022: industry ‘well placed’ to face regulatory, rating challenges

IFRS 17 and a revised S&P model are among challenges the insurance sector will have to tackle this year, even if they have weathered the Covid-19 pandemic well. ESG is meanwhile rising up the agenda, and the interest rate environment could see insurers bringing forward issuance plans. Neil Day reports, with insights from Crédit Agricole CIB DCM solutions and advisory, and syndicate.

You can also download a pdf of this and related insurance outlook articles here.

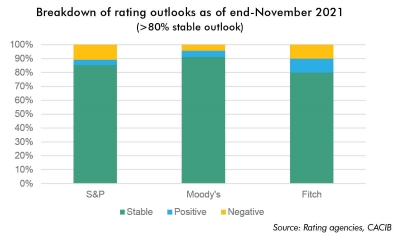

Insurance companies are entering 2022 on a stable footing, according to the rating agencies. The health of the industry is reflected in both their individual ratings of insurers, and their outlooks for the main sectors.

For life, P&C and reinsurance, all Moody’s and S&P’s outlooks are stable, with the exception of Moody’s having a negative outlook for P&C and S&P negative for reinsurance, while Fitch’s outlook for the latter is “improving”. At least 80% of each rater’s outlooks for insurers are stable, with the remaining positive and negative outlooks evenly balanced.

“Insurance companies have proven pretty resilient,” says Michael Benyaya, co-head of DCM solutions and advisory at Crédit Agricole CIB (CACIB), “and were on track to end 2021 in good shape in terms of capital position. This is reflected in the level of comfort the rating agencies have with the sector.”

Moody’s, for example, noted in its global outlook for life insurance that European insurers’ solvency ratios are stabilising at a higher level entering 2022 as a result of higher interest rates, after having fallen amid the pandemic. As well as higher rates, the economic recovery is helping the sector, while many companies have been able to raise prices. The reinsurance sector is meanwhile benefiting from diminished Covid-19 claims uncertainty.

The inflation seen in conjunction with higher rates is, however, seen putting some pressure on parts of the industry. Moody’s noted in its P&C outlook, for example, that elevated inflation will push up the average cost of claims, while pandemic-related improvements in insurers’ financial results in 2020-2021 will magnify social and political resistance to price increases this year, with intense competition also deterring issuers from raising prices.

But overall, the view from the rating agencies is encouraging.

“S&P Global Ratings considers EMEA insurers to be well prepared for the challenges of 2022,” it said in its outlook for the year. “Their capital surplus has largely recovered, and now stands at 92% of its pre-pandemic level. For the EMEA insurance sector in aggregate, capitalization is 9% above the AA category, which supports our current ratings.

“EMEA insurers are well prepared for the current and upcoming challenges.”

IFRS 17: Choose wisely

Among the challenges facing the sector is IFRS 17, which will finally enter into force on 1 January 2023 together with an opening balance sheet (2022 comparative year).

“That will for sure be a major challenge for insurance companies,” says Benyaya at CACIB, “notably in terms of financial communications, because a number of KPIs will be affected by the introduction of IFRS 17. And there is some leeway in the transition to the new standard, so insurance companies will have important policy and management decisions to take.

“These management choices will impact their financial reporting, which will result in challenges for investors in terms of comparability of KPIs.”

For example, return on equity could be calculated either including or excluding the new Contractual Service Margin (CSM) element. Other important policy choices to be made include transition methodology and what to take through P&L or other comprehensive income.

“This will impact the future shape of financials,” says Benyaya.

The introduction of the Risk Adjustment element as well as the CSM will meanwhile lead to potentially higher volatility and, particularly in the life sector, lower equity in the IFRS 17 balance sheet.

However, the new standard is not in itself expected to impact the ratings of insurance companies, even if changes to some metrics may be required.

“Rating agencies will have to adapt their criteria and have already communicated on some potential adjustments, with a key focus being the CSM,” adds Benyaya. “But rating criteria are supposed to be applicable across accounting frameworks, and there are parts of the world like the US, for example, that are not under IFRS 17 and have the same rating criteria.

“Furthermore, Solvency 2 is now pretty well established in Europe and is a key part of insurance reporting, including for the rating agencies.”

S&P update ‘a major event’

The industry can expect rating actions on up to 10% of S&P Global’s ratings in the insurance sector, after the rating agency flagged the possible consequence of proposed changes to its risk-based capital model for insurers and reinsurers on 6 December. A consultation on the proposals is open until 18 March.

Insurers will be busy understanding and assessing the magnitude of the changes proposed by S&P, according to Benyaya.

“It’s a major event for the sector,” he says. “Firstly, because S&P’s capital model is a key part of the capital management for insurance companies. And secondly, because the last version of the model was published almost 10 years ago and the scope of the changes is very large.

“S&P is proposing many adjustments, both in terms of eligible capital and in terms of required capital.”

The rating agency anticipates a material impact on its capital and earnings assessment, with changes in this key rating factor foreseen for up to 35% of insurers, in turn affecting up to 20% of standalone credit profiles. According to S&P, the majority of rating changes would be by one notch, with more upgrades than downgrades.

“We anticipate potential improvements in capital adequacy for some insurers, primarily due to our proposal to capture diversification benefits more explicitly and due to increases in total adjusted capital (TAC), owing to the removal of various haircuts to liability adjustments and not deducting non-life deferred acquisition costs,” said S&P. “On the other hand, some insurers could face declines in capital adequacy because of factors including changes to our methodology for including hybrid capital and debt-funded capital in TAC, as well as the recalibration of our capital charges to higher confidence levels.”

Key proposed changes include:

Hybrid capital and debt-funded capital

- No changes to the hybrid criteria but some adjustments and new limits are introduced in the proposal.

- Debt-funded capital eligible in TAC is defined as proceeds of a non-operating holding company (NOHC) debt issuance that are downstreamed as common equity or S&P -eligible hybrid capital, and where the structural subordination is considered to be high. The subordination is “high” where the NOHC is outside of the regulatory perimeter (which is not the case in Europe and Bermuda for example).

- Hybrid eligibility in total adjusted capital is now based on adjusted common equity (ACE). For example, the updated tolerance limit for intermediate equity content hybrids, at 33% of ACE, is broadly equivalent to 25% of TAC (the previous limit).

- S&P also aligns the tolerance limits on a global basis.

Diversification benefits

- More explicitly capturing diversification benefits by revising the confidence levels to calibrate risk charges and updated correlation assumptions.

Up to 100% Value of In-Force in TAC

- S&P is proposing to include up to 100% of VIF in TAC (vs. 50% under the current approach). VIF can reflect values that are shown in other reports (e.g. EV report) or on balance sheet.

- Under IFRS 17, the contractual service margin and the life risk adjustment are viewed as eligible under VIF.

Narrower definition of policyholders’ capital eligible in TAC

- Eligible policyholders’ capital is available to absorb losses across the entity; not restricted to absorbing losses in a segregated, or ring-fenced, fund and it does not relate to the expected value of future discretionary benefits included in technical provisions.

- Participation aux excédents (PPE) in France or freie Rückstellung für Beitragsrückerstattung (free RfB) and terminal bonus in Germany are eligible according to S&P.

New pandemic risks capital charge

- New charge to capture excess mortality losses due to pandemic risks.

Solvency 2 review, IRRB pending

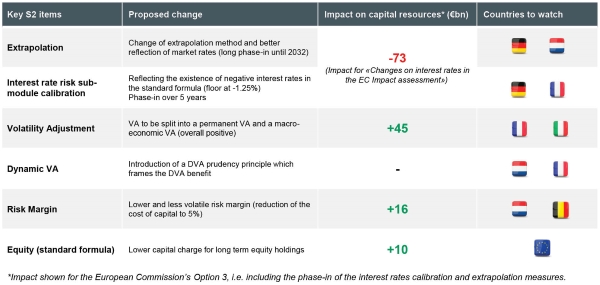

Longer term, the Solvency 2 review is an ongoing preoccupation of the industry. Following EIOPA’s opinion in December 2020, the European Commission in September 2021 adopted its comprehensive review package, but the legislative process and finalisation of the initiative is not anticipated until at least 2024.

Although the Commission proposals largely mirror EIOPA’s, differences between the two mean that the September package is more balanced, according to Benyaya. A figure of €90bn of capital relief has been touted in the market, but he notes that this is a gross number also reflecting the short term impact, and says the net impact, including the phase-in of changes in respect of interest rates, will be €8bn.

“Factoring negative interest rate in the IR risk sub-module and the change in the extrapolation approach will have sharp negative implications,” he says. “The phase-in periods will help to smooth the impact.

“But for 2022, I don’t expect that it will impact the way insurance companies manage their balance sheet,” he adds.

The proposed Insurance Recovery & Resolution Directive (IRRD) is meanwhile expected to have only limited credit and rating implications for insurers and the instruments they issue, given that — unlike the Bank Recovery & Resolution Directive (BRRD) — there is no requirement for a minimum amount of bail-in-able liabilities.