Primary hit by curve repricings as inflation hastens rate, purchase programme moves

“Faster, higher, stronger — together.” The Olympic motto has not only been in evidence in Beijing this month, but at the ECB in Frankfurt and across the Federal Reserve System, with inflation forcing their hands. The resulting yield and credit curve repricing has shaken the primary market, as Neil Day reports, with insights from Crédit Agricole CIB syndicate and strategists.

The primary market is expected to remain in stop-go mode for the foreseeable future, following the realisation of inflation fears and central banks’ acceleration away from accommodative monetary policy regimes.

Financial institutions issuance has dived this month as US and Eurozone data has prompted the Federal Reserve and European Central Bank to step up their action and rhetoric, leaving investors nursing losses and giving issuers pause for thought before approaching the market.

“Since the beginning of the year we are clearly dealing with a change in the inflation and rates regime,” said Vincent Hoarau, head of FIG syndicate at Crédit Agricole CIB (CACIB). “Markets across the board are now adjusting to this new environment quite late, and hence quite violently, particularly in the past two weeks.

“The repricing of the yield and credit curves is ongoing, and only exacerbated by the geopolitical situation — it’s not necessarily playing a key role, but it’s adding to the fear.”

While the situation in Ukraine and Russia is fluid, the market has been hit thick and fast by data and central bank pronouncements that have progressively upped the macroeconomic ante.

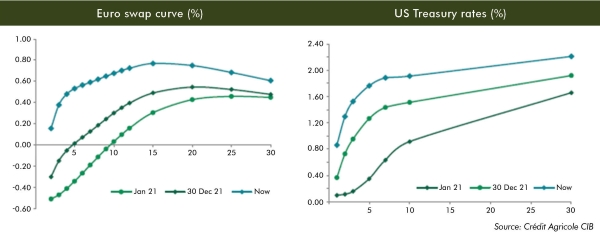

US CPI released on Thursday showed inflation hitting a 40 year high in January of 7.48% year-on-year, 30bp above consensus, pushing the yield on the 10 year US Treasury above 2% amid market expectations of a 50bp rather than 25bp rate hike at the Fed’s 15-16 March meeting.

As many as seven rate increases are now being forecast in the US this year on the back of the data as well as hawkish comments from policymakers. St Louis Federal Reserve president James Bullard, for example, on Thursday in a Bloomberg interview called for a full percentage point of increases by July.

The inflation number came hot on the heels of an upside surprise in January nonfarm payrolls the previous Friday (4 February), with the employment measure rising 467k versus a 125k consensus, while the previous months’ figures enjoyed a net 709k upward revision.

But the even bigger shock had come a day earlier across the Atlantic, when ECB president Christine Lagarde on Thursday, 3 February highlighted “unanimous concern” over inflation among the ECB governing council in unexpectedly hawkish comments, which followed a relatively neutral monetary policy statement that had given only the barest hint of what was to follow in the press conference.

According to CACIB inflation strategist Jean-François Perrin, following a “massive overshoot” in 2022 — with headline inflation set to approach 6% and core inflation close to 3% in H1 — the uncertainties around Eurozone inflation are huge, particularly in light of the energy outlook, which could take the headline number to 0.5% or 2.5% in 2024.

In the near term, he expects forecasts to be aggressively raised this quarter, with the ECB’s to be published on 10 March. Perrin expects its forecast for 2022 to be strongly increased from December’s 3.2%, and upwards revisions of around 20bp for 2023 and 2024.

“There will be enormous focus on these numbers,” he said.

In the wake of Lagarde’s press conference, the market began pricing in a 10bp rate hike as early as June, and while this may have been an overreaction, earlier than expected monetary tightening raises the prospect of the Asset Purchase Programme (APP) coming to an abrupt end this year given that the ECB is maintaining its sequencing of ceasing purchases before any rate hike.

The 10 year Bund subsequently hit its highest level since March 2019, and has since remained above 0.20%, while the two year swap rate is now well established in positive territory. The BTP-Bund spread meanwhile approached 180bp, versus 130bp ahead of the ECB meeting, highlighting the tightrope the central bank will have to walk when exiting its extraordinary monetary policy measures.

CACIB ECB strategist Louis Harreau said he expects APP to run through until the end of the year at the pace outlined by the central bank at its December meeting, with the possibility of a first rate hike in March 2023. However, he acknowledges that this may sound dovish, and notes that there is a risk of APP ending this September ahead of a December rate hike.

Indeed, the confluence of Fed and ECB voices — not to mention the Bank of England announcing earlier than expected asset sales — has panicked the market to the extent that the possibility of intra-meeting rate hikes is even being entertained.

Bullard at the St Louis Fed told CNBC yesterday (Monday) that he hopes that tightening can be done in a way that is “organised and not disruptive in markets”, but questions remain as to the extent to which this is possible.

“A key issue is to what extent central banks can regain control of the inflation narrative and the market dynamic around it,” said Hoarau at CACIB.

February US CPI is due on 10 March ahead of the Fed meeting, where further details on balance sheet reduction could be forthcoming, while the next ECB meeting on 10 March is awaited for clarification on its plans for APP and any changes in sequencing.

“The only thing that is for sure is that the scope for bad surprises ahead of these meetings is extremely elevated,” said Hoarau, “while there is little chance we will have a pleasant surprise.”

Any primary recovery to be fragile

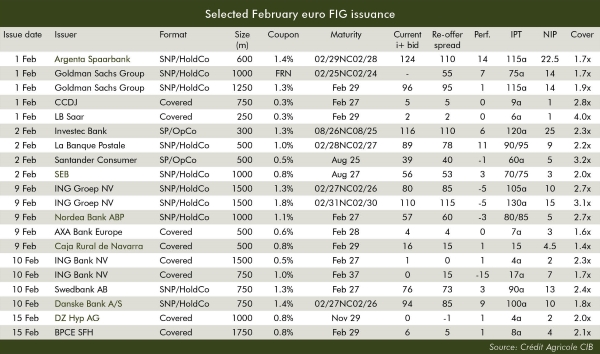

With the exception of a €1bn long seven year debut green Pfandbrief for DZ Hyp and a €1.75bn seven year BPCE covered bond today (Tuesday), financial institutions issuance in euros has been absent since Thursday. Encouraging signs in the geopolitical sphere today could see the wider FIG market reopen tomorrow (Wednesday), but primary market conditions are expected to remain challenging.

“It will be stop-go for the forthcoming weeks and months,” said Hoarau. “Since we saw the pick-up in volatility, we have a situation where every time it eases, supply from issuers spikes, because everyone is happy to offer the requisite concession to get deals done now.”

The transient nature of market windows in the new paradigm was evident in the short burst of European FIG activity last week, over Wednesday and Thursday.

ING and Nordea hit the market on Wednesday with the first unsecured European FIG supply since Lagarde’s press conference, with the Dutch bank raising €3bn of HoldCo debt across two tranches and Nordea selling a €1bn five year senior non-preferred (SNP) green bond.

The Dutch bank attracted an aggregate €8.7bn book, pricing a €1.5bn five year non-call four tranche at 85bp over mid-swaps on the back of some €4.1bn of orders, following initial price thoughts of the 105bp area, and a €1.5bn nine non-call eight at 115bp on the back of €4.6bn of demand following IPTs of the 130bp area. The new issue premium of the shorter tranche was seen at around 10bp and the longer at 15bp.

“ING was first out of the blocks and showed that there is a first-mover advantage,” said Hoarau. “The approach they took appeared designed towards taking out size if the market permitted, even if that meant paying the commensurate new issue premium, and that’s basically what happened.

“They paid 10bp-15bp against secondary market references that had already repriced much wider — French banks, for example, were issuing in 10 years at around 80bp at the start of the year.”

Nordea meanwhile priced its €1bn five year green bond at 60bp on the back of a €2.7bn book and following IPTs of 80bp-85bp.

“They managed to come relatively tight, despite the repricing,” said Hoarau. “You can maybe argue that the combination of a single-tranche, a very strong name, the green label and a relatively defensive part of the curve allowed them to limit the damage in terms of repricing and ensure performance in the secondary market.”

But while Nordea and ING tightened several basis points in the aftermarket, follow-on supply the next day showed conditions to remain weak.

Danske Bank on Thursday priced a €750m five non-call four green SNP at 85bp on the back of a €1.35bn book following IPTs of the 100bp area, and Swedbank a €750m five year SNP at 73bp on €1.8bn of orders and after IPTs of the 90bp area. The new issue premiums were seen at around 10bp and 13bp for Danske and Swedbank, respectively, but the Swedish issue widened a touch in the days after launch and the Dane’s by around 5bp.

Their fate was not helped by the release during the day of the historic high US CPI number.

So while the week’s activity demonstrated the ongoing demand from investors, it also highlighted the temperamental state of the market.

“Despite rates and credit being in a kind of rollercoaster mode, those investors who are not too risk averse are happy to put money to work at yields and spreads that in absolute terms are much more elevated than they were a month ago,” said Hoarau. “For example, a five year covered bond is now yielding what a five year senior was a month ago.

“But dealers are continuing to mark paper wider on the back of increasing new issue concessions, particularly when they are having difficulty recycling the bonds on their balance sheet, so we have the primary market repricing even wider. We therefore have a kind of downward spiral fuelling an ongoing repricing of the market.”

With this in mind, it is unclear just how further bouts of issuance will be received in the short term.

“Year-to-date performance for investors has never been so bad in the first weeks or months of the year and they have accumulated significant losses,” said Hoarau. “And in the first wave of issuance, the entire curve repriced.

“The primary market remains challenging but actionable. The big question is, to what extent will investors play again next time volatility eases? Any type of recovery is going to be very fragile and we need to get used to that.”

He noted that Tier 2 spreads now appear rich versus AT1, while amid the repricing the differential between SNP and SP has widened — dramatically so in some cases.

“In that context, senior preferred is certainly where there is some value to be captured,” added Hoarau. “In the senior non-preferred space — depending on who you are talking to and where you are on the curve — it’s a tough call.

“Spreads are particularly elevated and the upside potential in waiting does exist.”