Euro Tier 2s fly on back of renewed rally, as optimism feeds fear of missing out

With investors drawing comfort from positive headlines on the health and economic fronts, and supply easing, the recovery in credit markets kicked on last week, allowing Commerzbank, Crédit Agricole and Swiss Re to garner big books and tight pricing for euro Tier 2s, all jointly led by Crédit Agricole CIB. Neil Day reports.

You can also download a pdf of this article with associated coverage here.

Credit markets moved another leg tighter last week on the back of optimism around pandemic and economic prospects, allowing banks and insurers to tighten subordinated trades sharply from IPTs and print at levels well inside what had been possible a week earlier.

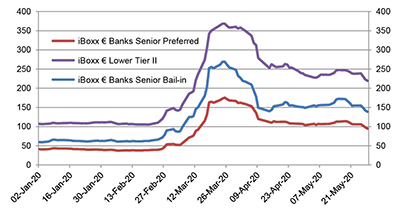

After treading water the previous week, subordinated indices tightened anew to break levels last seen a month ago and set new pandemic era tights (see graph below). Credit markets moved hand in hand with equity markets, where banks outperformed.

In the euro market, Commerzbank, Crédit Agricole and Swiss Re were able to price Tier 2 issues inside fair value, with order books multiple times oversubscribed. André Bonnal, FIG syndicate at Crédit Agricole CIB (CACIB) — joint bookrunner on the three trades — said the markets were much stronger than just a week earlier.

“Investors are clearly choosing to focus on the positive headlines,” he said. “i.e. the health situation being much better, lockdowns being lifted, prospects of vaccines sooner than later, and the implications this has for the economic recovery. Plus we had the European Commission’s proposal for a €750bn stimulus package last week.

“Clearly the market feels that it can disregard potential new trade tensions between the US and China and Hong Kong becoming another geopolitical hotspot, while investors are instead ready to put cash to work in the credit market.”

Although supply across fixed income asset classes continued to tick over, the recent wave of corporate issuance eased, further supporting the rally in financial institutions paper, according to Vincent Hoarau, head of FIG syndicate at CACIB.

“Corporate supply has not disappeared, but the flows are less intense than they were a couple of weeks ago,” he said. “This relative decrease in supply is also supporting the FIG space, where likewise we are not seeing a deluge of supply — the regulators have made it clear to banks that they will do what is necessary to ensure that they can manage their funding and balance sheets without facing any pressures. Flexibility is the new rule.”

Source: Markit, Crédit Agricole CIB

Spreads have nevertheless recovered to levels that make it harder for issuers to justify staying away from the market.

“Funding officials need to realise that at this particular moment in time there is probably more downside risk then upside risk in terms of spread,” said Bonnal. “Are they willing to take the risk that spreads could go, say, 20bp tighter? Or risk that they go 75bp wider?”

Smaller and second tier peripheral names could be next to approach the euro primary market, according to Hoarau, as well as national champions who have not yet tested the recovering market.

Similar dynamics have been at play in the US market, where Macquarie Bank on Wednesday sold a $750m (€675m) 10 year Tier 2 at 295bp over mid-swaps, some 55bp inside IPTs, and Bank of Nova Scotia issued a $1.25bn perpetual non-call five Additional Tier 1 (AT1) with a coupon of 4.9%, inside initial talk of the 5.25% area. Likewise, Phoenix Group slashed pricing on a $500m 11.25 non-call 6.25 Tier 2 by 62.5bp on the back of an 11 times subscribed book.

“US dollar market sentiment has been gathering further steam over the past week, as investors price in more upside on the health front and the phased economic reopening,” said Fadi Attia, managing director, US dollar FIG, at CACIB. “Yankee bank secondary paper has been particularly well bid as of late — scarcity of supply has been a key driver around this dynamic, and while there have been plenty of new issues from US players, it has been limited from European bank names.

“Subordinated deals are increasingly are gathering attention,” he added, “as investors look to pick up relative value.”

Swiss Re in ‘compelling’ €800m

Swiss Re generated the biggest order book in the European market, its €800m 32 year non-call 12 Tier 2 being around 10 times oversubscribed on Wednesday. The deal is only the second subordinated insurance euro benchmark this year, after Allianz on 15 May reopened the sector with a €1bn 30 year non-call 10 Tier 2 that attracted some €2bn of orders.

Priced at 228bp over mid-swaps, Allianz’s deal had tightened to around 205bp over by the time Swiss Re approached the market, while Swiss Re’s own paper had recovered strongly from mid-March highs, its 2050 non-call 2030s tightening from around 400bp over to be bid at around 249bp when the new issue hit the market.

Following initial price thoughts (IPTs) of the 325bp area for Wednesday’s trade, guidance was set at the 285bp area on the back of books in excess of €6.25bn, before the spread was fixed at 275bp on the back of more than €7.75bn of demand, pre-reconciliation. The bonds then rallied two points on the break.

The new deal is issued via Swiss Re Finance (UK) plc and guaranteed by Swiss Re Ltd, whereas the 2050 non-call 2030s were issued by Swiss Re Finance (Lux) SA and guaranteed by Swiss Reinsurance Company Ltd, following a change in Swiss tax law at the start of the year that made the new set-up more efficient. Whereas the outstanding comparable is rated A2/A, the new security is rated A3/BBB+.

With around 15bp of the 26bp pick-up between the old and new issues reflecting the curve extension, the remaining 11bp captured any new issue premium as well as the change in issuer/guarantor and related lower rating, noted Bonnal at joint bookrunner CACIB.

“Is that 0bp of new issue premium and 10bp for the credit differential, or 20bp for the differential and minus 10bp of NIP?” he said. “No one can pinpoint that exactly, but regardless, it’s clearly an extremely strong result for the issuer.

“The book was really strong, featuring all the major asset managers you want to see in a subordinated euro trade. The re-offer yield of 3.2% at IPTs for the A3/BBB+ security was way too compelling for people to miss out.”

Swiss Re’s paper also offered an attractive pick-up over the likes of Hannover Re and Munich Re, whose 2039 non-call 2029s and 2049 non-call 2029s were quoted around 187bp and 180bp, respectively, added Bonnal.

See Q&A with Swiss Re head of funding Daniel Bell here for more.

Two’s company for Commerz, CASA

Commerzbank and Crédit Agricole each launched €750m Tier 2 trades into the buoyant tone on Thursday and the market proved more than able to digest them both, with their relatively modest €750m sizes and a perceived lack of competition between the different trades helping them achieve pricing inside fair value.

Commerzbank enjoyed the biggest book of this week’s European bank trades — which also included BBVA and Banque Fédérative du Crédit Mutuel with senior preferred and senior non-preferred trades — as the German’s €750m 10.5 year non-call 5.5 Tier 2 attracted peak demand of €5.2bn and a final order book above €4.7bn good at re-offer.

Following IPTs of the mid-swaps plus 490bp area for the December 2030 non-call December 2025 issue, guidance was set at 440bp-450bp for a €750m size with orders above €4.25bn, and pricing was ultimately set at 435bp, for a coupon of 4%, on the back of more than €5.2bn of orders, pre-reconciliation.

“They were able to take advantage of a red hot market,” said Hoarau at joint bookrunner CACIB. “We had a very positive trend across senior non-preferred and Tier 2 over the week and Commerzbank’s outstanding bullet Tier 2s tightened some 50bp in the 48 hours ahead of launch.”

Its March 2026s were quoted at 386bp over mid-swaps on the morning of launch and its March 2027s at 395bp. Curve extension worth around 30bp-35bp as well as 15bp to reflect the call feature of the new issue put fair value in the context of 445bp, according to Hoarau, implying a negative new issue premium of some 10bp.

The UK and Ireland took 39% of the paper, France 18%, Germany 10%, Asia 8%, Scandinavia 7%, Italy 5%, and Austria and Switzerland 5%, Spain and Portugal 3%, the Benelux 3%, and others 3%. Funds were allocated 67%, hedge funds 10%, and banks 8%, government/agencies 6%, insurance companies and pension funds 6%, private wealth 2%, and others 1%.

Commerzbank’s deal came after it announced results on 13 May and a downgrade from S&P on 23 April, which led to the new issue carrying a rating of Baa3/BB+/BB+. On Tuesday the bank also announced that it had established a €3bn AT1 issuance programme.

Crédit Agricole was also able to come inside fair value on its €750m 10 year non-call five Tier 2, a trade that was launched in conjunction with a tender offer for senior preferred debt (see article here for more).

The distribution profile of the French issuer’s trade differed from the German’s thanks to its three investment grade ratings (Baa1/BBB+/A-), noted CACIB’s Hoarau.

French accounts were allocated 43%, the UK and Ireland 23%, Germany and Austria 9%, the Benelux 8%, Italy 7%, Spain and Portugal 5%, and others 5%. Real money accounts and asset managers took 75%, insurance companies and pension funds 14%, central banks and official institutions 9%, and others 2%.