Bank capital emerges from lockdown, but Fed warns even as its support drives market

Bank and insurance hybrid capital issuance is back on the agenda in Europe, largely due to the rapid central bank largesse that has driven a recovery in financial markets. However, the weight of credit market supply has begun to weigh on spreads, which remain vulnerable to Covid-19’s lasting impact. Neil Day reports, with insights from Crédit Agricole CIB’s FI team.

You can download this feature with related articles here.

The full suite of bank capital instruments hit the market last week for the first time since the coronavirus struck financial markets, and Tier 2 trades for Allianz and Barclays on Friday showed the market remaining constructive in spite of socio-economic Covid-19 fears and broader supply weighing on sentiment.

Royal Bank of Scotland had the previous Wednesday (6 May) reopened the European market for bank capital with the first such trade since Greece’s Piraeus Bank sold a €500m 5.5% 10 year Tier 2 issue at the height of the pre-crisis market. The UK bank’s £1bn (€1.13bn) 10.25 year non-call five Tier 2 deal was then last week followed up by a Deutsche Bank €1.25bn 11 year non-call six Tier 2 on Monday and a €675m 7.5% perpetual non-call five Additional Tier 1 for Bank of Ireland Group on Thursday, before the Allianz and Barclays trades.

However, following a strong recovery in spreads since the market’s wides in mid-March, credit markets experienced a reversal last week on the back of warnings of the long shadow cast by the coronavirus on the health and economic fronts. Dr Anthony Fauci, a leading member of the White House coronavirus taskforce (pictured), warned that a premature relaxation of pandemic prevention measures could lead to “suffering and death”, even as a range of countries were reporting encouraging reductions in Covid-19 infection rates. Meanwhile, Fed chair Jerome Powell on Wednesday highlighted that “the scope and speed of the downturn are without modern precedent” and called for more fiscal support given the limits of central bank powers.

For opinion on the latest ECB developments from CACIB Eurozone economist Louis Harreau, see Q&A here.

Vincent Hoarau, head of FIG syndicate at Crédit Agricole CIB (CACIB), said the comments brought the disconnect between financial markets and the impact of the crisis on the real economy into stark relief.

“The retracement of the losses in equities and credit has been amazing and mainly driven by the liquidity element and the Fed backstop for the financial markets,” he said, noting that global equity markets had rebounded to trade only around 15% lower than their peaks, with the Nasdaq even up year-to-date. “Central banks managed to avoid a very nasty situation in global credit markets and the most recent moves by the Fed and ECB on asset eligibility criteria towards sub-IG instruments have been decisive.

“But the chasm between Wall Street and Main Street is not sustainable. 36.5m people in the US have filed unemployment claims since early March and the unemployment rate is 14.7% — the worldwide economy is on the edge of a horrific collapse and, logically, at some point this could impact the credit market.”

Further dampening credit market performance has been a deluge of supply, with a record €65bn of euro corporate bond issuance in April continuing into May, with some €26bn last week alone. Financial institutions issuance was a relatively modest €18.5bn, but the move in spreads no less impressive — the spread on a €1.5bn nine year non-call eight HoldCo Bank of America deal that reopened the euro FIG market on 24 March had more than halved from a re-offer of 365bp to as tight as 160bp before widening again to 190bp last week.

Corporate bonds had to pay higher new issue premiums and were less subscribed as the week progressed and NatWest’s and Deutsche Bank’s Tier 2 issues ended the week wide of re-offer.

“Last week we really started to see a little weakness on the macro side, with Q1 results also starting to sink in,” said André Bonnal, FIG syndicate at CACIB, “and maybe pointing to an end to the bear market rally. Meanwhile, the corporate market continued to be extremely busy and over the course of the week investors’ fatigue started to take its toll on the execution of new issues.”

However, he said that financials should remain supported by the excess cash in the market.

“What helped us as well on Allianz is the fact that there hasn’t been much issuance from financials overall,” said Bonnal. “The financial specialists among portfolio managers had been waiting for supply, so there isn’t the same investor fatigue as on the corporate side.”

See article here for more on Allianz.

The extent to which the Fed and ECB fuel credit markets via balance sheet growth will remain the fundamental driver for markets until there is greater visibility on the economic impact of the coronavirus and lockdowns, according to Hoarau.

“We have entered a phase of consolidation post-earnings and for the time being investors are simply following the path being shown by central banks,” he said. “I expect this to remain the case until we have hard data regarding the shape of the recovery, which will be determined by how economic agents react to the reopening of the economy and how long it takes to get to the new normal. June data will be key and the evolution of the temporary component of unemployment numbers is one of the key metrics to follow.

“Overall, downside risks for markets are very high.”

Tentative Tier 2, AT1 reopening

Ahead of the weakening, RBS Group’s £1bn 10.25 year non-call five Tier 2 reopener on 6 May attracted some £5.5bn of orders, allowing for pricing to be tightened from initial price thoughts of the Gilts plus 400bp area to 355bp and a coupon of 3.622%.

Deutsche’s reopening of the euro sub debt market last Monday with a €1.25bn 11 year non-call six Tier 2 was in conjunction with a tender offer for €2bn across eight senior non-preferred securities maturing from 2021 to 2023. The liability management exercise boosted demand for the paper from investors comfortable with the credit. The German issuer was able to tighten pricing from 625bp over mid-swaps to 600bp over, but the deal underperformed in a weaker secondary market, widening some 25bp.

“The transaction offered a positive signal,” said CACIB’s Hoarau. “Already last week RBS was active in this space with a £1bn issue showing strong evidence that the market was able to absorb Tier 2 debt, so things continue to move in the right direction.”

Barclays followed with a £500m 3.75% 10.5 year non-call 5.5 Tier 2 on Friday, which was priced at Gilts plus 275bp on the back of some £1bn of demand following IPTs of the 300bp area.

The final step in the recovery of the European market for bank capital was that taken by Bank of Ireland Group on Thursday, when it sold the first AT1 since a €1.5bn dual-tranche Intesa Sanpaolo deal on 20 February.

The Irish lender raised €675m in its perpetual non-call five AT1 sale on the back of some €1.4bn of orders, having entered the market at short notice in the morning with its leads already having gathered sufficient indications of interest to cover the deal and gone out with a 7.5% coupon for a €625m size.

“The new deal was effectively ‘reverse enquired’ by investors and the lead managers, making it a virtually riskless transaction for the borrower and the arrangers in terms of investor demand,” said TwentyFour Asset Management CEO Mark Holman, “a sensible way to operate with the most sensitive part of a bank’s capital structure in these times.”

The transaction was launched in a tight window, between Bank of Ireland announcing results on Monday (11 May) and the last day of the first call window for its €750m 7.375% AT1, tomorrow (Tuesday), when the new issue settles. The bank announced that the deal would contribute to refinancing its only outstanding AT1, which was launched in 2015.

The Irish bank is the first to both issue and call AT1 since the pandemic struck financial markets in March, with others having either not called outstanding issues or gone ahead with calls without needing to refinance during the crisis.

The 792bp reset spread on its new issue is almost 100bp higher than that of the outstanding, 696bp. However, whereas the new €675m AT1 is issued at the group level, the outstanding €750m was at the OpCo level and hence subject to haircuts when calculating group level capital, taking its regulatory value down to €611m. According to CACIB analysis, this means that the cost per euro of regulatory value of the old AT1 is 8.1% post reset, significantly higher than the new bond’s 7.5% coupon.

Bank of Ireland also incorporated a six month anytime par call feature into its transaction.

With Bank of Ireland’s position and the execution of its trade considered something of a special case, expectations for further AT1 issue remain subdued and likely limited to other issuers approaching first call dates, according to Neel Shah, financial credit analyst at CACIB.

“Funding levels for AT1 issuance remains elevated for issuers given the macro uncertainty and we expect this to remain the case in the near term,” he said. “With iBoxx US dollar AT1 spreads at around 675bp and euro AT1 spreads at around 775bp, we do not expect banks to be in a rush to issue at these wide levels.”

A €750m 6.375% Lloyds AT1 is also in its call window, ending on 28 May, while RBS has a $2bn 7.5% AT1 with a month-long call window opening on 11 June.

The lack of new AT1 supply — further exacerbated by capital relief initiatives from regulators — has contributed to a lack of trading in outstanding AT1 following the initial dramatic falls and rebound, according to CACIB AT1 trader Nigel Brady.

“Overall trading volumes have fallen off a cliff,” he said, estimating them at 15%-25% of pre-crisis levels.

However, he said that supply/demand dynamics remain favourable.

“I would be fairly confident that if a deal came, more so in dollars, it would do very well and start a virtuous circle,” said Brady, citing the success of preference share issuance by US banks, such as a recent 5.25% Bank of New York Mellon trade. “That gives you a benchmark as to where European names could come.”

According to Brady, peripheral credits have underperformed core European credits in the recovery after several printed AT1 at the market’s tights early this year, and Hoarau said he expects increasing discrimination among credits as the fallout of the crisis becomes clearer and ratings come under pressure.

“After the recent rally in AT1, the pricing approach needs to discount a much more prudent view that investors will take in light of increased macro event risks but also idiosyncratic risks,” he said. “Investors are moving up in quality and focusing on stronger balance sheets.”

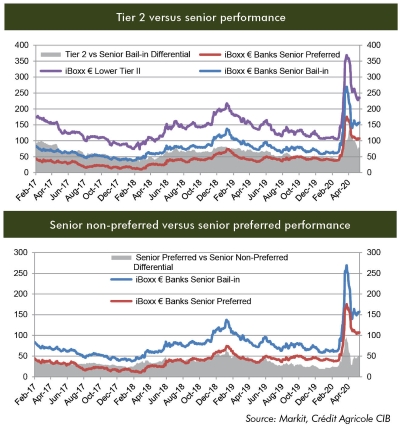

A slew of senior non-preferred issues launched in mid-April also underperformed, hitting the market ahead of a previous bout of weakness, leaving spreads versus senior preferred paper at differentials — around 70bp in some core jurisdictions, versus 25bp pre-crisis (see chart) — where supply from core European issuers is unlikely to materialise, according to Hoarau.

The performance of SNP is in contrast to senior preferred issuance, which has enjoyed a mini renaissance. Svenska Handelsbanken opened the sector on 6 April and achieved the then lowest crisis era new issue premium by a bank, 15bp, on the back of €8.25bn of demand for a €1.25bn five year trade at 135bp over, while SEB underlined the continued buoyancy of senior preferred last Monday with a €1bn three year priced at 68bp over, with the shorter-dated deal coming some 5bp inside its curve.

Supply dynamics are expected to be reinforced by an easing of MREL requirements. Already in Denmark the authorities have fast-tracked the implementation of BRRD II, which limits the amount of MREL subordination required, and extended the deadline to 2024. Alpesh Varsani, director, DCM solutions and advisory at CACIB, said that although MREL requirements across the EU are expected to be largely unchanged, non-GSIBs could effectively expect to see similar measures to those in Denmark, leading to a somewhat more important role for senior preferred than previously anticipated and a reduced level of overall funding needs given the possibility of a longer compliance period than previously anticipated.