Commission review raises hopes after EBA bombshell

A key contributing factor to the Additional Tier 1 market’s turbulent start to 2016 was a European Banking Authority (EBA) Opinion that would potentially tighten the rules on an issuer’s ability to pay AT1 coupons, although the European Commission on 10 March announced a review that market participants hope will address their concerns.

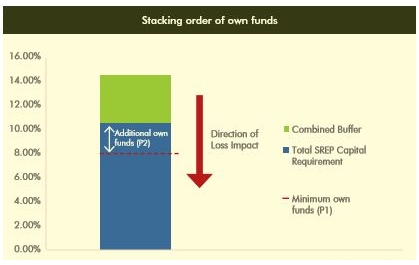

On 18 December the EBA issued Opinion 24/2015 on the interaction of Pillar 1, Pillar 2 and combined buffer requirements, and how they play into restrictions on discretionary distributions based on the Maximum Distributable Amount (MDA). As per Art. 141 CRD, discretionary distributions encompass economic transfers of benefits to shareholders (e.g. dividend payments/share buy-backs), to employees (e.g. discretionary bonuses and pension contributions), and distributions on AT1.

“The Opinion clarifies that the MDA should be calculated taking into account both minimum (Pillar 1) and additional (Pillar 2) capital requirements which should be met at all times, as well as the combined buffer requirement,” said the EBA.

The positioning of Pillar 2 in the capital stack for such calculations had not previously been clear and the regulator’s Opinion ran counter to what some market participants had understood.

Andrea Enria, EBA chairman (pictured), said that the Opinion provided clarity and consistency in the mechanisms for the trigger and calculation for MDA across the EU.

“Consistency in supervisory outcomes is a cornerstone of the Single Market,” he said. “Clarity about the implications of supervisory decisions is similarly vital for banks undertaking capital planning and for investors in banks.”

Source: EBA, BIHC

The fallout from the EBA’s declaration was compounded by the lack of transparency around Pillar 2 requirements and their application, which have typically not been disclosed, meaning that AT1 bondholders were unable to calculate the likelihood of restrictions being triggered – although the Opinion also included a call for greater transparency on this front. This was seen as particularly acute within the Single Supervisory Mechanism (SSM) area, where only a few issuers had at the time disclosed Pillar 2 requirements.

“It is imperative that the appropriate degree of disclosure of the institutions’ own funds requirements is reached,” said the EBA.

The European Central Bank, the authority in charge of bank supervision within the SSM, on 6 January confirmed the EBA’s approach. At the same time it left investors in the dark as to several important parameters, raising questions such as:

- How should investors understand the SREP CET1 numbers communicated by banks? I.e. the Pillar 1 CET1 minimum of 4.5% is included, but what else? Investors were forced to second guess that the SREP CET1 number consisted of (i) the Pillar 1 CET1 minimum, (ii) the Capital Conservation Buffer, and (iii) the SREP Pillar 1 CET1 add-on.

- Is the imposed Pillar 2 add-on under the SREP 2015 exercise only referring to CET1 capital or does it also entail add-ons for AT1 and Tier 2 capital?

- And are AT1 and Tier 2 deficits under Pillar 1 additive on top of the SREP requirement? On a phased-in or on a fully-loaded basis?

The EBA nevertheless in its Opinion also recommended to the European Commission that it review the automatic limitation on distributions via the MDA, “notably insofar as it relates to AT1 instruments, in all circumstances when no profits are made in any given year”.

Combined with macroeconomic headwinds and somewhat weak bank profits, the AT1 market entered a period of crisis in January until mid-February (see separate article).

The ECB then — possibly prompted by the dramatic market impact — publicly addressed the issue twice. On 19 February it published its SSM SREP Methodology Booklet, which clarified that the Capital Conservation Buffer sits within the overall SREP requirement, that the 2015 SREP exercise resulted in requirements only relative to CET1, and that AT1 and Tier 2 Pillar 1 deficits were not taken into account. Then, in a not widely publicised conference call on 25 February, the ECB expressed that it may take into account AT1 and Tier 2 deficits under Pillar 1 in the 2016 SREP exercise (valid for 2017), and it also said that it is currently considering whether to express Pillar 2 add-ons across all capital tiers or only via CET1.

Amid this fraught situation, the European Parliament on 10 March added its voice to growing calls for the issue to be addressed, in a resolution regarding increasing capital requirements, criticising the ECB Supervisory Board and solutions that are “too rigid and affect negatively the AT1 bond market and hence financial stability”, and seeking a review of the MDA mechanism. Jonathan Hill, Commissioner for financial stability, financial services and Capital Markets Union, responded directly to the Parliament by announcing that the Commission would undertake such a review.

“Together with the EBA recommendations on the subject and the SSM’s own recently-published observations, we may expect some relaxation around automatic AT1 coupon cancellations upon buffer breach,” said Doncho Donchev, capital solutions, debt capital markets, at Crédit Agricole CIB, “and potentially a move towards the UK Pillar 2 system, currently the most advanced and transparent within the EU, with Pillar 2 expression across all capital tiers and a split of Pillar 2 into a ‘hard’ component, sitting below all buffers, and a ‘soft’ component, sitting on top of the buffers for e.g. adverse stress test scenarios and initially not binding for MDA restrictions.”