Banco Popular: Ahead of the game

Having been a pioneer of Additional Tier 1, Banco Popular Español has lived the ups and downs of the asset class since its birth in 2013. Here, Francisco Sancha, CFO at Banco Popular, shares his views on the market’s latest growing pains and related regulatory developments, and explains the Spanish bank’s capital position and strategy.

Popular has been involved in the AT1 market since its early days. What are your thoughts on how the asset class has developed?

Investors have analysed this product in depth. Initially investors’ attention was focused on how this instrument absorbed losses (write-off, conversion) and what the distance to trigger was.

Then, loss-absorption interaction between instruments with different trigger levels emerged as an issue. The complexity of having different local regulators establishing higher triggers than the CRD IV 5.125% requirement (Sweden, UK, etc) added up. On this point, Banco Popular has pioneered with the only AT1 7% trigger issuance so far in Spain.

Lately, the focus has shifted to the probability of having any sort of restriction on distributions, which is a natural evolution as the loss absorption risks become less of a concern.

With a very weak market backdrop and significant uncertainty evident to all, the performance of AT1 has shown the ongoing need for further consolidation in the asset class.

What do you see as the challenges of the instrument going forward?

From our dialogue with new investors, I would say the most recurring concern is the sluggish development of a deeper and diversified investor base. Of course, this would require a better understanding of the instrument — backed by consistent regulation — and the improvement of liquidity conditions for the noteholders. I am positive that as we see strong appetite, we will see new investors getting involved in a more stable market position.

Investors are conscious of the improvement of the banking industry in the last few years, as almost every entity has increased its capital ratios. This will continue going forward, as issuers are targeting higher funding plans reinforcing their ratios and fulfilling Total Capital buckets in the phase-in of the CRR and MREL/TLAC requirements. We will certainly continue working in that direction.

How would you describe Popular’s capital position today?

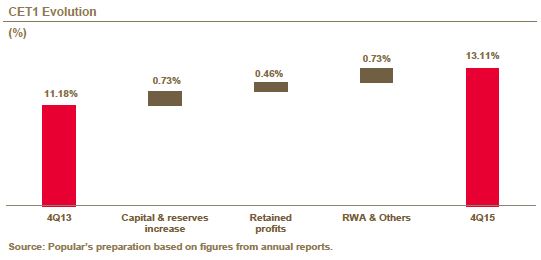

Popular has been making great progress in steadily building up its capital position. In the last two years, it has been able to generate close to 200bp of capital in a challenging environment thanks to its business model and strong franchise. In fact it has seen one of the highest capital generation progressions, at least in Spain.

I would highlight the bank’s remarkable capacity to maintain a very strong and stable top line throughout the crisis, building on its profitable business mix, which is focused on SMEs and professionals, and where it is able to grow and gain market share.

As a result, the bank now enjoys a CET1 phased-in ratio of 13.11% and Total Capital of 13.83%. Both are deemed very satisfactory to meet current as well as forthcoming regulation.

You have recently disclosed a 10.25% CET1 phased-in SREP requirement. How do you value this in comparison with your present capital position?

I think the outcome is extremely positive. The SREP requirement communicated by the ECB was quite clear; Popular has been required to meet a minimum CET1 phased-in of 10.25% for 2016, which compares very well with our CET1 of 13.11% as of year-end, so we currently hold a robust headroom to MDA of 286bp. It’s a strong starting point for our capital strategy, giving Popular total discretion for the payment of distributions.

The EBA opinion published in December on the interaction of Pillar 1, Pillar 2, the Combined Buffer Requirement and MDA restrictions has been interpreted by some investors and analysts so that AT1 and Tier 2 deficits will withdraw from the CET1 capital available to meet the SREP number. What is your view?

In my opinion, there is still work to be done to align the different regulatory developments in a credible way. In this regard, Competent Authorities are developing different work-streams in response to investors’ calls for clarity, which is key to allow entities to continue building up their capital buckets in anticipation.

Nonetheless, the requirement communicated by the ECB is clear and give us a sizeable headroom to MDA, as noted earlier.

You have said that Popular has been very proactive in building up its capital stack — could you explain why?

The bank is committed to deploying a strong and sound capital base, and we started from the very bottom of the capital stack, growing CET1 at a quick pace as shown earlier, and filling up the AT1 bucket requirement promptly.

In this respect, Popular has been well ahead of schedule in the build-up of its buckets, which is in our view a competitive advantage. It launched the first euro AT1 transaction in the EU and was also the first Spanish bank to fully top up the AT1 bucket. It launched the first high-trigger AT1 structure in Spain with a view to obtaining the maximum regulatory recognition on its quest to improve the quality and quantity of the capital base.

What can you tell us about your capital plans?

Our aim is to keep on building CET1 capital on the back of organic growth and RWA model calibration and, as we already filled up the AT1 bucket, we will move to continue growing the Tier 2 bucket, which stands at 73bp at the end of 2015. We would probably do a Tier 2 transaction in 2016, but without urgency, when the markets would be receptive.

What would you see as your target capital ratios?

In terms of Total Capital, Popular reported a year-end ratio of 13.83%; meaning 183bp improvement during the year — which is a quite remarkable performance. Taking into account our recurrent organic growth and the proactive fulfillment of our Tier 2 bucket, we have a strong growth potential that would take us well above the 14% mark at the end of 2016, with the aim to be always well ahead of the minimum requirement given that this is a moving target.

Your 8.25% callable perpetual debt reached a trading level as wide as 11.5% YTM. Is there any message you want to pass on to investors?

Yes, as I said before, recent hybrid capital market turmoil has to do, among other reasons, with concerns on coupon payments restrictions.

In connection with this, I would recall that fundamentals on Popular remain strong and emphasize that we have no restrictions on distributions whatsoever. As a matter of fact, we have published a statement on our website to confirm the first AT1 2016 calendar payment had been done, and we have paid a dividend on 25 January. Headroom to MDA is a healthy 286bp and our ADIs are over Eu3.8bn, not forgetting that we enjoy a profitable business model that will allow us to keep on building both capital and reserves buffers.

Markets have been very volatile during the development of the AT1 market. As you have filled your AT1 bucket, would you give any suggestions to banks with AT1 issuance plans?

As the AT1 market developed, investors became more and more sophisticated and demanding of what banks had to face in terms of enhancing communication and marketing activities, while wanting to see progress on their ability to build the quantity and quality of their capital base.

Since mid-January, volatility in the AT1 market has been especially harsh due to several factors. Uncertainties on the regulatory front continue to be the main driver, but we recently observed the lack of liquidity as another relevant factor further increasing volatility. In this regard, we would suggest banks intensify communication and interaction with investors, whilst trying to enlarge the investor base.

What are your views on the Spanish approach to MREL/TLAC and senior subordinated/Tier 3 issuance? Should there be a European solution?

The Spanish approach is another feasible solution to address eligibility in the bail-in ratios, though it is not free of uncertainties as to how that could impact the cost of funding and may not be feasible until legacy Tier 2 are gone. In any case, it is not the only approach, as you noted. The Germans, French and Italians have their own, each with different nuances.

In my view, and looking to the efforts already undertaken by the EU in order to eliminate fragmentation and secure financial stability (such us the creation of the bail-in tool, the Single Supervisory Mechanism, or the Single Resolution Fund) it makes sense to reach a harmonized approach, which would also help pave the way towards a level playing field.

Are there any other regulatory developments that are of particular concern to Popular?

As I said, Popular has been working well ahead of requirements and will continue to do so. Given our current capital position and a proven track record on building the capital stack, we are in a very comfortable position to face this challenging era. Nonetheless, we have to be well aware of any future developments such as the implementation of IFRS9, expected TLAC and MREL convergence, and any potential changes to RWA calibrations, among others.

This Q&A is from the forthcoming issue of Bank+Insurance Hybrid Capital magazine