A tool to satisfy capital requirements

As the details of the Solvency II are fleshed out, Hervé Ekué, partner, Allen & Overy LLP, Paris, offers an overview of Tier 1 issuances under the insurance industry framework.

In July 2007, the European Commission proposed a ground-breaking revision of EU insurance law designed to improve consumer protection, modernise supervision, deepen market integration and increase the international competitiveness of European insurers (and reinsurers). Under the new system, known as Solvency II (Directive 2009/138/EC dated 25 November 2009) and which will enter into force on 1 January 2016, insurers (or reinsurers) would be required to take account of all types of risk to which they are exposed and to manage those risks more effectively.

The aim of EU solvency rules is to ensure that insurance undertakings are financially sound and can withstand adverse events, in order to protect policyholders and the stability of the financial system as a whole. The pre-Solvency II EU solvency system was over 30 years old and financial markets had developed dramatically in the 2000s, leading to a large discrepancy between the reality of the insurance business today and its regulation. Also, many Member States had introduced their own additional rules at national level, leading to a range of different regulatory requirements across the EU, which ultimately was seen by many commentators as undermining the Single Market and especially hindering insurance groups. Solvency II replaces this patchwork of different rules, with a view to ensuring a level playing field and a uniform level of consumer protection and introducing more sophisticated solvency requirements for insurers in order to guarantee that they have sufficient capital to withstand adverse events.

From 1 January 2016, insurers will also be required to focus on the active identification, measurement and management of risks, and to consider any future developments, such as new business plans or the possibility of catastrophic events, that might affect their financial standing. Solvency II is a risk-based system, meaning that capital requirements are set based on the underlying risks of the company.

The three pillar approach

“Solvency II is not just about capital. It is a change of behaviour” — Thomas Steffen, former chairman of CEIOPS

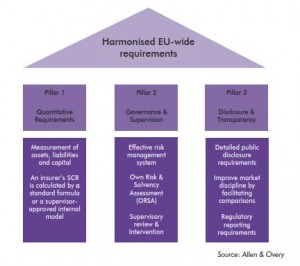

Solvency II is based on a three-pillar approach, as illustrated in the accompanying diagram.

Often called “Basel for insurers”, Solvency II is somewhat similar to the banking regulations of Basel II.

From January 2016, regarding Pillar 1, insurers will have to classify their own fund items into three tiers.

Regarding Pillar 2, insurers will have to undertake an Own Risk & Solvency Assessment (ORSA) and assess their capital needs in light of this assessment. Tier 1 assets play a crucial role in the ORSA.

Pillar 3 focuses on disclosure, reporting and transparency requirements around these risks and capital requirements, notably Tier 1 issuances.

Why issue Tier 1 instruments?

Capital requirements

Capital requirements are put on top of the technical provisions in order to cover unexpected losses with a given confidence of 99.5% over a one-year time horizon. To this end, a supervisory ladder of intervention is embedded in the system via the setting of two layers of capital:

(i) the Solvency Capital Requirement (SCR) which has been determined as the economic capital to be held by insurance and reinsurance undertakings in order to ensure that ruin occurs no more often than once in every 200 cases;

(ii) the Minimum Solvency Capital Requirement (MCR), which triggers ultimate supervisory action.

The own funds of the company obviously therefore play a key role. The Directive provides that own funds comprise the sum of “basic own funds” and “ancillary own funds”. Basic own funds which include in particular subordinated liabilities shall be classified into three tiers (referred to as Tier 1, Tier 2 and Tier 3 items, respectively) depending on various elements, including:

(i) sufficient duration;

(ii) absence of incentives to redeem;

(iii) absence of mandatory servicing costs;

(iv) absence of encumbrances; and

(v) specific features (please see “Key features of Tier 1 items” below).

As far as compliance with the SCR is concerned, the eligibility of Tier 2 and Tier 3 items are subject to a double quantitative limit such that (i) the proportion of Tier 1 items must be higher than one-third of the total amount of eligible own funds and (ii) the eligible amount of Tier 3 items must be less than one-third of the total amount of eligible own funds. Quantitative limits also exist in relation to the MCR such that, as a minimum, the proportion of Tier 1 items in the eligible basic own funds must be higher than one-half of the total amount of eligible basic own funds. As a result of these rules, the majority of the eligible amount of own funds to cover the MCR and SCR should be composed of Tier 1 items.

According to findings published in June 2013 by the European Insurance & Occupational Pensions Authority (EIOPA), the average coverage rate of the SCR stood at 77% based on the 2011 financial statements, which could also be understood as revealing a collective capital shortfall of Eu90bn euros.

Impact of the Stress Test carried out by EIOPA

The 2014 Stress Test published by EIOPA on 28 November 2014 is the second such exercise to be carried out by EIOPA and represents a significant step forward in terms of technical specifications and methodology. EIOPA reported that in aggregate terms:

(i) the overall surplus (i.e. own funds minus SCR) for the sample was reported as Eu234.7bn, which represents a Eu637bn excess of assets over liabilities in absolute figures and a ratio of assets over liabilities of 110.1% (please note that the core sample includes 29 members of the so-called “Top-30” group).

(ii) the capitalisation levels of the sample of undertakings are solid, especially looking at the largest European insurers. There is, however, a significant minority of undertakings that do not meet the requirements of Solvency II in the baseline case.

In short:

(i) In total, 86% of the Core Module participants (96% of the Top 30 subsample) reported a SCR ratio of 100% or better at year end 2013. More than 25% of the core module participants have a very strong starting position (SCR ratio > 200%).

(ii) The 14% of participants that did not reach the 100% threshold represent only 3% of total sample assets. For the Top 30 participants, only one falls below the 100% SCR ratio in the baseline scenario.

(iii) Quite importantly, a need for immediate restructuring of the composition of own funds was seen by 66% of participants. It was felt that this restructuring would be attained through an increase of capital, a change of the investment portfolio, and other measures including subordinated debt capital raising and/or asset sales.

Key features of Tier 1 items

Based on the Level 1 and Level 2 texts of Solvency II that are now available — after completion by Directive 204/51/EU dated 16 April 2014, the Omnibus II Directive — Tier 1 own funds should be made up of own fund items of a high quality and which fully absorb losses to enable an insurance company to continue as a going concern. The key features of Tier 1 items look very much like a long list of items that are to a certain extent unconnected and includes the following:

(1) the item must be a lowest ranking debt instruments such that it ranks after Tier 2 and Tier 3 items and after the claims of all policy holders and non-subordinated creditors;

(2) the item does not include features that may cause the insolvency or which may accelerate the process of the company becoming insolvent;

(3) the item is immediately available to absorb losses and possesses one of the loss absorbency mechanisms (such as write-down of the nominal amount) in case of non-compliance with the SCR;

(4) the item absorbs losses at least once there is non-compliance with the SCR;

(5) the item is undated and the first call date does not occur before year five from the date of issuance;

(6) redemption between year five and year 10 after the date of issuance is only allowed where the SCR is exceeded by an appropriate margin;

(7) the instrument is only repayable at the option of the issuer (i.e. no event of default and no investor put in any circumstance);

(8) any redemption is subject to the prior approval of the insurance regulator;

(9) the terms and conditions do not include any incentives to redeem the instrument that increases the likelihood that the insurer will redeem the instrument where it has the option to do so;

(10) the terms and conditions provide for the suspension of redemption of the instrument or payment of interest where there is non-compliance with the SCR or redemption or interest payment would lead to such non-compliance and more generally payment of interest is always at the full discretion of the issuer on a non-cumulative basis (meaning that interest not paid on a given date is cancelled without this triggering any event of default or right of claim including in insolvency).

Not surprisingly, the devil is in the detail and, for instance, an area of particular focus will be the analysis of the provisions aiming at clarifying the concept of full flexibility over the payment of interest. Indeed the relevant provisions specify that full flexibility in this context means among others that distributions are paid “out of distributable items”. This criterion requires careful consideration when combined with certain other features.

More generally, it remains to be seen how these criteria will be applied in the terms and conditions of the Tier 1 instruments and the views of the regulators on these terms and conditions.

Solvency II: Next steps

EIOPA will issue a set of general, overarching recommendations addressing the follow-up actions set out in its June 2013 report. The key steps are summarised in the diagram below.

Click thumbnail below for Solvency II timeline