Corporate hybrids: Relative value

The non-financial hybrid market enjoyed something of a renaissance in 2013, with conditions proving just right for issuers and investors alike. The technicals of the instrument have been the main concern for investors in the past; however, valuation has become more and more important. Elisa Belgacem, quantitative strategist at Crédit Agricole CIB, presents here elements of relative valuation within the euro hybrid universe.

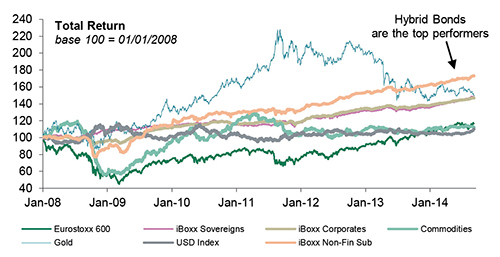

Hybrids vs other asset classes since 2008

The environment for investing in hybrids has been favourable since 2009, and this is reflected in hybrid total returns versus other asset classes over the same period (please note we have included only investment grade sectors in the fixed income space).

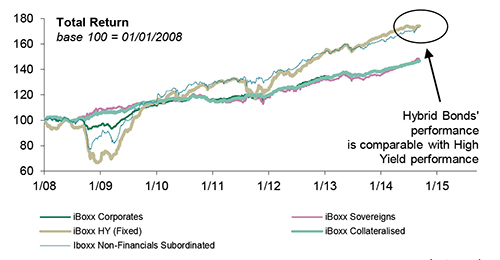

Hybrids vs other credit classes since 2008

Within the credit market, and since 2008, the performance of hybrid bonds has been comparable to the high yield market. This year, the performance of high yield is lagging slightly, due to the large number of new issues to be absorbed and two cases of early redemption — ArcelorMittal in US dollars and Telecom Italia in euros.

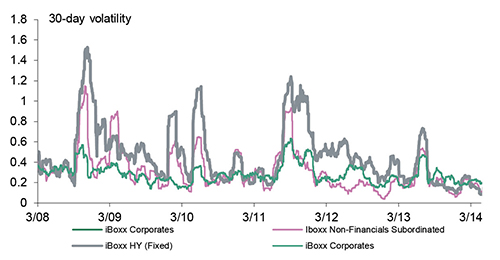

Hybrids are not as volatile as high yield

Even if the hybrids of today greatly differ from those issued before the crisis, the hybrid asset class in general appears to have been less volatile than high yield since 2008.

This lower volatility reflects the lower probability of default of the hybrids compared with high yield. The probability of default of a hybrid bond is linked to its issuer, which is rated two notches higher than the hybrid issue.

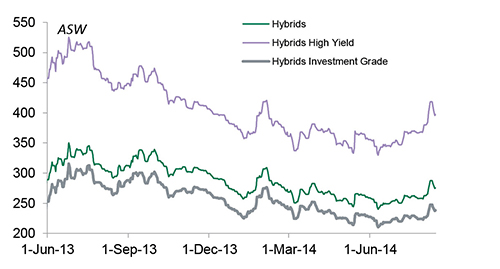

Evolution of hybrid spreads: investment grade vs speculative grade

Overall we have seen investment grade hybrids slightly outperforming in 2014 as their market value weighted average spread tightened by circa 5% while speculative grade hybrids tighten by 3%.

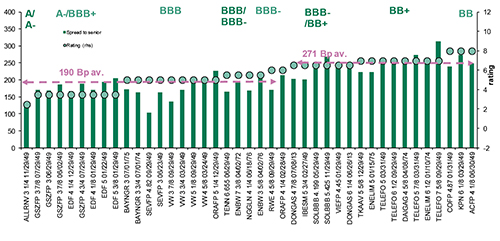

Hybrid premium over senior curve by rating

The spread over senior is the most common valuation measure used by the market. It has the advantage of being correlated to the credit quality of the issuer, in contrast to the senior or CDS multiple, which tends to be higher for the highest rated names as senior levels as well as CDS are currently very low.

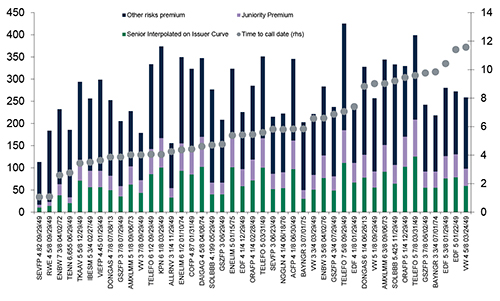

Premium Breakdown – Hybrid spreads, breakdown by risk type (asw bp lhs, years to call rhs)

A more sophisticated way of finding value within hybrid bonds is to isolate the part of the hybrid spread that compensates for hybrid-specific risks, i.e. coupon deferral risk, extension risk and early redemption risk. We deconstruct the hybrid spread into three components: the senior component, the juniority premium and the residual (blue bar on the chart) compensation for hybrid specific risks.

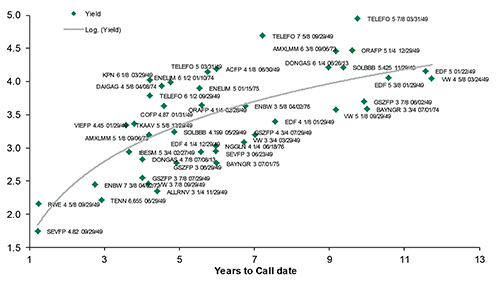

Hybrid euro universe yield vs years to call date

Spreads are well correlated with ratings, while yields are well correlated with time to maturity. “Spread or yield?” remains the question in this market. We tend to think that the investment grade part of the curve responds to spread logic while the speculative grade hybrid universe would rather be driven by the yield.

Source: Crédit Agricole CIB