Corporate hybrids: Coming of age

The corporate hybrid market has grown up since the crisis, attracting a broader range of credits. Here, Jonathan Blondeau, DCM, capital structuring & liability management at Crédit Agricole CIB, explores its evolution. In this special feature we also take a look at the state of the market today and hear from two leading proponents of the instrument: Bayer and EDF.

In biology, “hybrid” is used to define the offspring of two animals or plants of different breeds, varieties or species, and in general, as a result of combining two things that are different by nature. For corporate hybrid bonds, it is about mixing debt with equity content by extending it, adding coupons with no obligation to pay — like deductible dividends — and making it somehow loss absorbing. Corporate hybrid bonds are issued because they offer tax, accounting and rating benefits. Finding the right balance between the different drivers and structuring features (interest rates, rating agency methodologies, accounting constraints, etc.) took some time before a stable and liquid market could emerge. This is now the case, in a reassuringly more standardised but somehow less creative way.

Born from the free union of debt and equity

Unlike banks or insurance companies, corporates are not constrained by regulations with regard to the issuance of hybrid debt. They therefore needed a solid rationale to issue what could at first be seen as expensive debt rather than cheap equity. However, the main benefits are pretty clear:

- Accounting: with a perpetual maturity, hybrid bonds can be accounted for as equity if coupons are deferrable.

- Rating: rating agencies can grant equity content to hybrid bonds and take it into consideration in the calculation of the credit metrics of the company.

- Tax: even if from an accounting and rating perspective hybrid debt is considered as equity in full or in part, coupons are generally tax-deductible.

- Hybrid bondholders have no voting rights and it is therefore a non-dilutive instrument.

As a consequence, hybrids have been considered by corporates in many situations in order to protect ratings or senior debt covenants, to finance M&A activity or investments, or to fund pension deficits.

Rating agencies: the fairy godmothers?

The first generation of non-financial hybrids emerged in 2003. After Moody’s defined its rules for hybrid equity treatment in 2005-2007, closely followed by Standard & Poor’s, supply became steady (albeit much lower than current volumes).

Rating agencies have always been a key driver for the hybrid market. The importance of the rating of any hybrid security is twofold as it determines its “equity content” and its notching down from the issuer’s rating. Obviously the deeper the notching down, the higher the equity content, and vice versa.

The release of the Moody’s “Toolkit” in 2005 clarified how to structure hybrid securities to gain the optimal mix of equity credit from the rating agency by detailing the main features that were required:

- Permanence: very long maturity or perpetuity

- Financial flexibility: no ongoing payments, with the ability to defer or cancel coupon payments

- Subordination: loss absorption

S&P soon followed with its Hybrid Capital Handbook and Fitch with its Corporate Methodology (see timeline). Rating agencies thus clarified the criteria for getting equity credit for hybrids and set the basis for the unregulated corporate sector.

But potential changes to their methodologies and the related risk of loss of equity content have also been a matter of concern for rated issuers. If rating agencies have paved the way for this market, their various methodology changes may have limited its development, discouraging eligible issuers to join the market.

The mix of criteria have dictated the structures that have been issued since and which are the most common today. Like any hybrid animal, its appearance is perfectly explainable by its environmental constraints, but by no means simple or familiar at first glance (see illustrative term sheet below).

The most recent changes have led to the end of high equity content from S&P and of any equity content granted to non-investment grade companies by Moody’s: these two changes have both limited the range of possible structures and the number of issuers who could access this market (see box).

Rating agencies have thus greatly helped the process of natural selection in this market, leading to an even increased standardisation, which may be detrimental to some issuers (and structurers!) but offers greater clarity to investors. This may be considered as the descent with modification from which a viable asset class can arise.

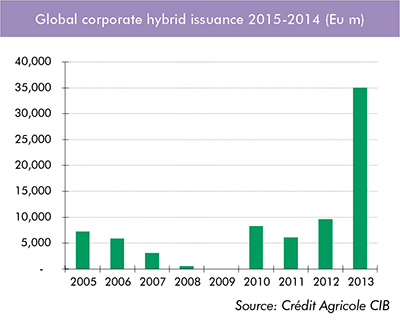

From childhood to adulthood, through bumpy teenage years

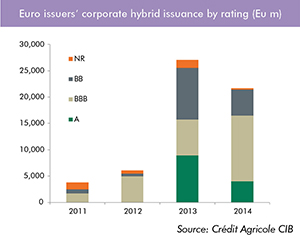

Supply of corporate hybrid bonds ceased completely with the advent of the crisis, from the end of 2007 until 2010, when the market resumed. An unprecedented period of growth for the corporate hybrid capital markets then started after Veolia Environnement, and more importantly EDF (see Q&A) came to the market. Issuance soared from Eu7bn in 2012 to almost Eu27bn in 2013, and has already reached Eu22bn since the beginning of the year. This boost has been mostly driven by the low interest rate development and clarifications from the rating agencies.

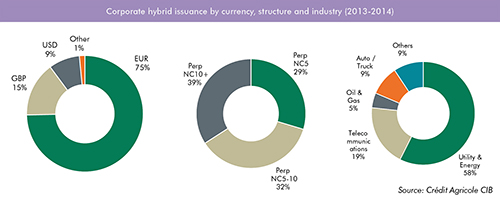

For European issuers, the market has been dominated by euro issuance, followed by sterling and US dollars. After 2013, the breakdown of implicit (before call first date) maturities also started to evolve and increased quite significantly compared with the previous perpetual non-call five structures.

An extended family: from core to peripheral and from utilities to more diverse issuers

After the halt in 2008-2009, supply returned in 2010 from utilities from core countries (RWE, Alliander, SSE, Suez Environnement, EnBW, Dong). Progressively, the market reopened to new countries (Austria, Italy, Spain) and more diverse sectors (telecoms, retail, automotive, hotels).

Unrated issuers like Voestalpine, Eurofins or Trafigura have chosen to access the market to strengthen their balance sheets at attractive levels.

A growing number of admirers: the investor base broadens

The asset class has grown thanks to the support of traditional fixed income investors who usually buy senior but are attracted by higher yield in the hybrid sector. Most of them have started to consider it as a suitable investment, particularly if the hybrid is issued by a well-established issuer whose credit story is better known and understood by this kind of investors than a high yield name. Nowadays, the spread to senior ranges from 150bp for a single-A category name to up to 250bp for a low triple-B. Corporate hybrids’ performance can of course prove more volatile, but in a low interest rate world their yield remains very attractive.

An increasing share of hybrids has been incorporated into bond indices, increasing their acceptance and visibility.

The next generation?

The corporate hybrid market has strengthened and will probably in the future be more resilient that it has proved in the past.

We expect refinancing of some of the first generation of hybrids to fuel the market over the next two years, as some of these bonds were issued with intend-based replacement language. These old structures may be worth replacing by cheaper and more efficient new structures.

M&A may also be a strong driver. As experienced by Bayer (see Q&A) or Telefónica, the issuance of hybrids helps mitigate the negative impact of an acquisition on credit metrics.

Last, but not least, we now expect the market to open more broadly to smaller issuers, rated or not, with very specific needs, and perhaps more tailor-made structures.

Click thumbnail below for illustrative new-style corporate hybrid term sheet

Focus: Changes to methodologies & early redemptions

First generation hybrid structures were often less transparent, which made their early redemption harder to anticipate. Here are a few examples.

Alliander lost its equity credit due to an upgrade, because the upgrade made its replacement clause null and void, and the replacement clause was the determinant in the granting of equity credit by Standard & Poor’s. As the price of the early redemption option was below market levels, Alliander decided to launch an Exchange Offer to existing holders at 102.5 instead of 101. As of today, the exchanged bond is trading around 105.

Changes to rating agencies’ hybrid methodologies have been the cause of a number of early redemption calls, either at the time the methodology changed or later as a consequence of it.

Nordic utility Dong lost maximal equity content because of a change to S&P’s methodology and could have called its hybrid at 101 because of a change-of-methodology clause, but proposed an exchange price of 104 Instead of 101. Before this transaction, the bond was trading at 112, but the exchanged bond is now trading around 116 thanks to a 6.25% coupon.

Telecom Italia and ArcelorMittal both issued hybrids before Moody’s withdrew the possibility of equity credit for speculative grade issuers in July 2013. In November 2012, ArcelorMittal was downgraded by Moody’s, so when the methodology changed in July 2013 it automatically lost the equity credit at Moody’s and became eligible for an early redemption option. On 21 January 2014, ArcelorMittal finally decided to call the bond at 101.

Telecom Italia’s hybrid lost its equity credit when the issuer was downgraded in November 2013, and Telecom Italia decided to recall its hybrid on 29 January 2014.

Due to the complexity of the hybrid structures, these call had not been fully anticipated by investors.

Click thumbnail below for timeline of the evolution of corporate hybrid rating agency methodologies